Sheesh, I sure am glad I put that caveat in there yesterday, because all those nice high topped hammers I saw yesterday did nothing but crash off my dome all day long today. Let’s face it, I’m starting to get a little tired of this pullback (down over 9% this month!), m’self, and even more so given the relative reasonableness of today’s market on the specifically non-Jacksonian financial sector today. Talk about a victory for the bloody Redcoats!

That said, I haven’t stopped picking up shares in various stocks that I consider bargains at these prices. I’m just flabbergasted at how low ((SSRI)) and ((PAAS)) and ((SLW)) have gotten. I bot more SSRI yesterday, and got another 2k of SLW today (at $8.26 on the gap fill), so I guess tomorrow is PAAS’s day?

For those of you who have been accumulating slowly here, bravo. The Jacksonian Portfolio is defintely a Spartan marathon and not a dash to the corner deli for a pack of Kools and a pint of Sunny Delight. This “bucking bull” volatility is going to be here for the duration, so we’re going to have to “get in shape” by taking some cash off the table from time to time, like I did with ((TC)) the other day.

As you may recall, that 1/3 TC sale and the liquidation of the original TSO position left me with some $14,607 in cash from the original portfolio. I finally decided to put the bulk of that to work with an initial $10k position in ((TCK)), as we’ve contemplated. It didn’t hurt that TCK was having a good day, let me tell you. Now I have $4.6 k left in cash, and soon I’ll begin incorporating the cash component into the overall returns as well. It doesn’t make any sense to take profits and then not incorporate that into the total return of the portfolio.

As well, I’ve decided to be a bit more “illustrative” in this account by dealing with hedging in a different way than I do in my personal account. As it’s too complex (and annoying) to incorporate the short calls I usually use to hedge my portfolio, I will more simply sell portions (or all) of the Jacksonians in order to accrue cash in the portfolio and take risk off the table. I think that will probably be easier for you all to follow as well. Your comments are welcome.

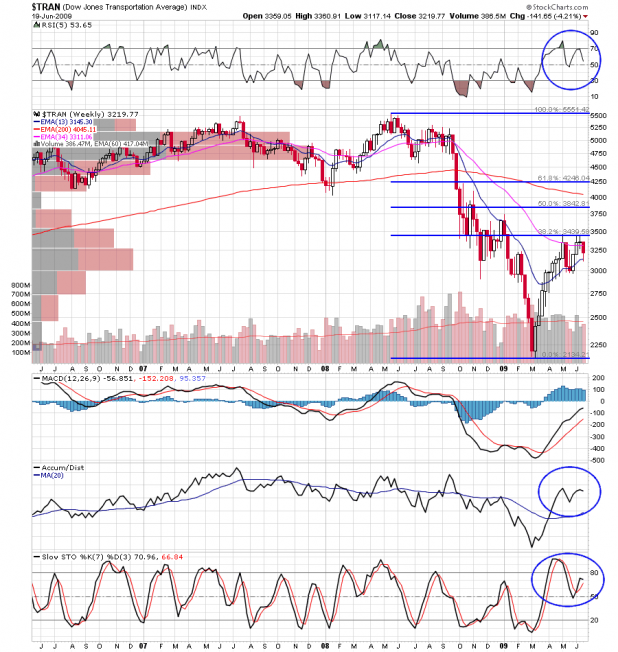

I haven’t much in the way of commentary on the Jacksons today other than my notes below. I will say that we continue to be brutally oversold, and we are due for a cycle low here in the precious metals any day now. I continue to believe you will be rewarded for your perseverance here.

Because I felt bad about all these bloody Jacksons (save TCK) I figured I’d dig up one “present” for tomorrow… a non-Jacksonian I did the fibs on tonight is [[MTL]] — Mechel OAO. Coking coal, steel, molybdenum, it’s got it all. I like it because it touched beautifully off the23.6% intermediate term fibonacci line today and it looks like it’s ready to go again. The other one I like for tomorrow we’ve already discussed… PPT favorite [[SPAR]]. Best to you all.

| Name |

17-Jun |

18-Jun |

% Change |

|

Comments |

| ANDE |

$ 28.88 |

$ 28.18 |

-2.42% |

|

Will sell half on a break of $28. Gap fill at $26.60 |

| EGO |

8.65 |

7.97 |

-7.86% |

|

Trend line @ 7.78. Bearish engulfing says we get it. |

| GDX |

38.23 |

37.20 |

-2.69% |

|

Failed hammer, back to support. |

| GLD |

92.35 |

91.60 |

-0.81% |

|

POG $934, within yest range |

| IAG |

9.65 |

9.10 |

-5.70% |

|

Sell 1/2 on break of support @ 8.75 |

| MON |

81.08 |

82.30 |

1.50% |

|

Cramer beat it up tonight, a net positive. |

| NRP |

22.13 |

21.95 |

-0.81% |

|

5 red days in a row? C’mon already! |

| PAAS |

20.39 |

18.59 |

-8.83% |

|

Uptrend line at 17.95. Pssin me off. |

| RGLD |

43.73 |

41.98 |

-4.00% |

|

Hammer doji on trendline, EOD buying |

| SLV |

14.12 |

13.97 |

-1.06% |

|

POSilver @14.24, inside day |

| SLW |

8.80 |

8.30 |

-5.68% |

|

Filled that last gap at $8.27, bot 2k more $8.26 |

| SSRI |

19.22 |

18.13 |

-5.67% |

|

Do not like this action one bit. |

| TBT |

54.17 |

55.76 |

2.94% |

|

Gap @ 54.21. Could come back once more. |

| TC |

10.50 |

10.50 |

0.00% |

|

Perfect doji day. |

| TCK |

15.31 |

16.28 |

6.34% |

|

Nice first day on the job. |

| AVG (daily) |

|

-2.32% |

|

|

| AVG (monthly) |

|

-8.32% |

|

|

| AVG (inception) |

|

13.91% |

|

|

| Cash ( 000’s) |

|

|

$ 4.61 |

|

|

Comments »