In the last post I discussed how I used a system and position sizing simulator to look at the ENDING equity of thousands of traders trading a theoretical system. I mentioned I would be showing sample equity curves at a given amount of risk by pulling up a random trader. It’s a lot easier on the spreadsheet to get a better sense as you can just press the F9 key to recalculate the random iterations and thus instantly bring up an entirely new random equity curve with all the same settings. You can go through several examples in a short amount of time. It is a bit more time consuming to create new JPEG images of each of them and then post them here so I will only be showing a few.

To further illustrate the type of “risk” you are taking by a particular strategy I provide just one random “trader’s” equity curve of each of them. Understand that results may not be entirely typical but pay attention to the % drawdowns to get a broad sense of the type of risk you may look at and endure.

Please note: The actual expectations of the system you use will drastically impact the type of volatility you see with every 1% change in risk. These sample equity curves are only made with the trading system with an expectation of a 20% chance of each of a 50% loss, 50% gain, no change, 100% loss and 150% gain.

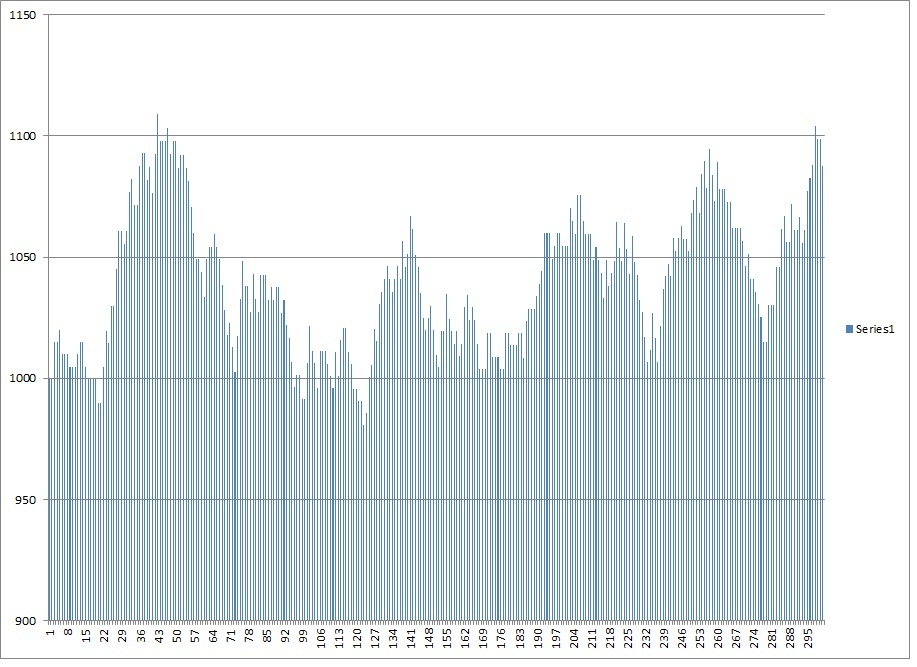

1% risk

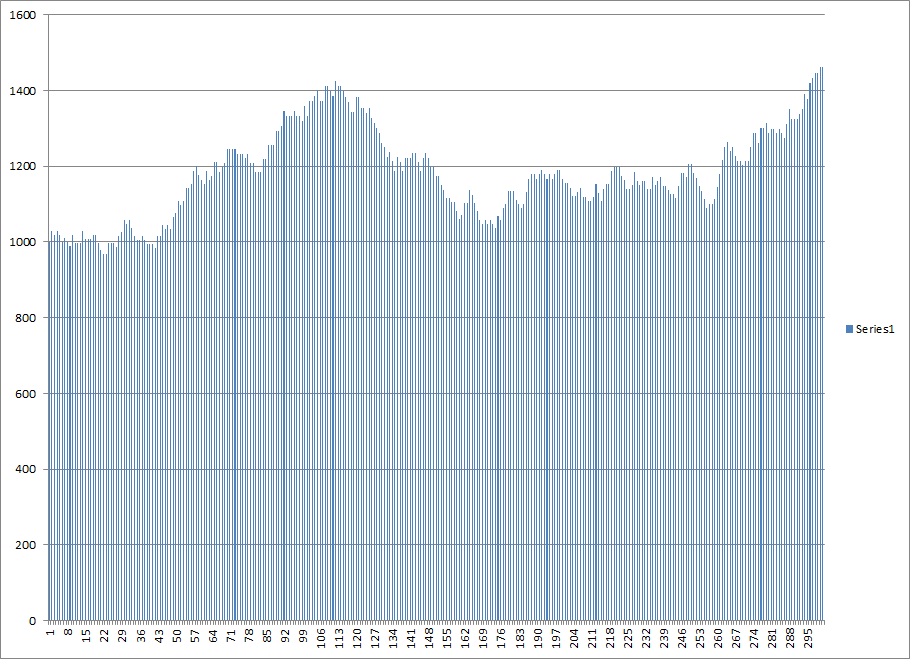

2% risk

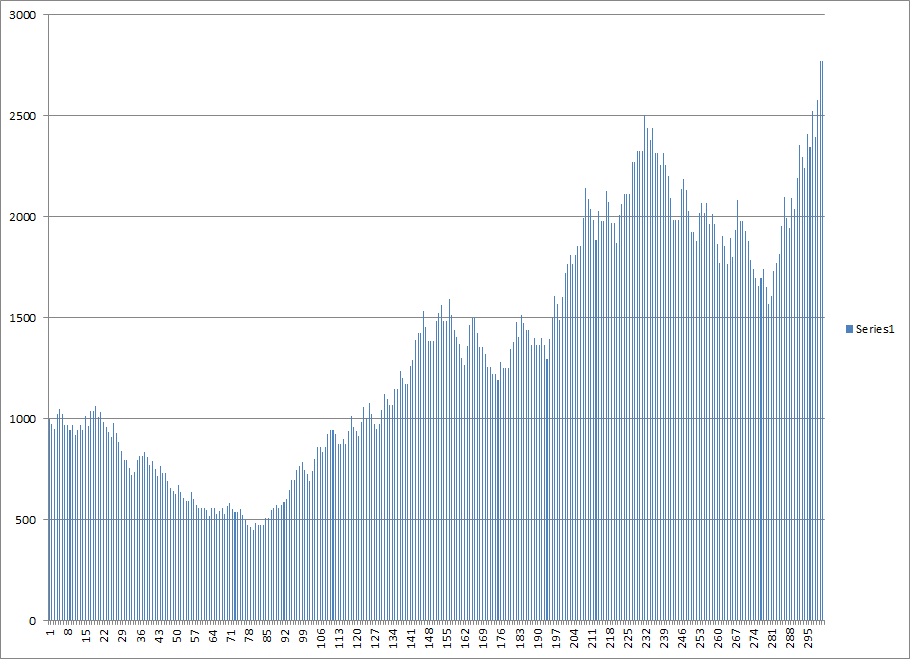

5% risk

As you increase risk, the results become more polarized and more extreme, so I will provide a few examples for those at the supposed “optimal” risk percentage of 14% risk

The phenomenal results of a few skew the results of the rest. The drawdowns are insane as you see 70% and 80% drawdowns.

Can you stand 80 trades of being down steadily as your account drives lower to HALF of what it started with? Most people can not and would capitulate so even putting 5% of your capital into this “system” becomes problematic. Granted multiple bets with a lower correlation that adds up to 5% or even more may be actually “lower risk” than 5%. Granted, you can potentially use strategies that actually profit from market overall volatility such as allocation models and rebalancing and modern portfolio theory and hedging and pairs trades and such, you can put in some income and weight a lot of your portfolio with stock that have more of a slow and steady drift upwards that 70% of the time actually provides more stability and increased liquidity that can comba the negative effects of account volatility. Granted, a MORE profitable system can allow you to risk quite a bit more without the same drawdown expectations…. But even so, we are talking about a winning system where even at 1/3rd of what some quants would suggest to be “optimal” over a finite amount of time the returns are very likely to be terrible over a significant period of time.

Can you see why long term capital management went bust now as they did not test their assumptions while taking only a small sliver of time in the past by which to evaluate their “expected risk”?

I could get into how uncertain the world is and how your estimated “edge” within a system is also not a certainty which is still an assumption that this model must make to provide results, but at least can be recalculated with different sets of expectations. But I hope that this post has been educational enough for you to make at a minimum slight, productive adjustments to your way of thinking, if nothing else.

Don’t blow up like LTCM… Test all of even your most basic assumptions… Evaluate your risk in as many ways as you can. Understand risk and how to manage it. Control your destiny rather than being a victim of your own emotional compulsions to sell at the worst point of time and capitulate just before your system takes off because your system is too volatile. Understand the dynamic nature of reality and how increasingly large leverage and risk may be increasingly more volatile while also being more vulnerable to small changes in the conditions by which you based your assumptions. Understand the need to be well capitalized and that fees aren’t factored in and more negatively impact the volatile systems that have an increased probability of drawing down significantly from the starting point. Constantly seek to let the facts guide your conclusions, and seek productive improvement on the way you look at things. Then risk can serve you, rather than you “getting Serrrrrrved” by risk.

Comments »