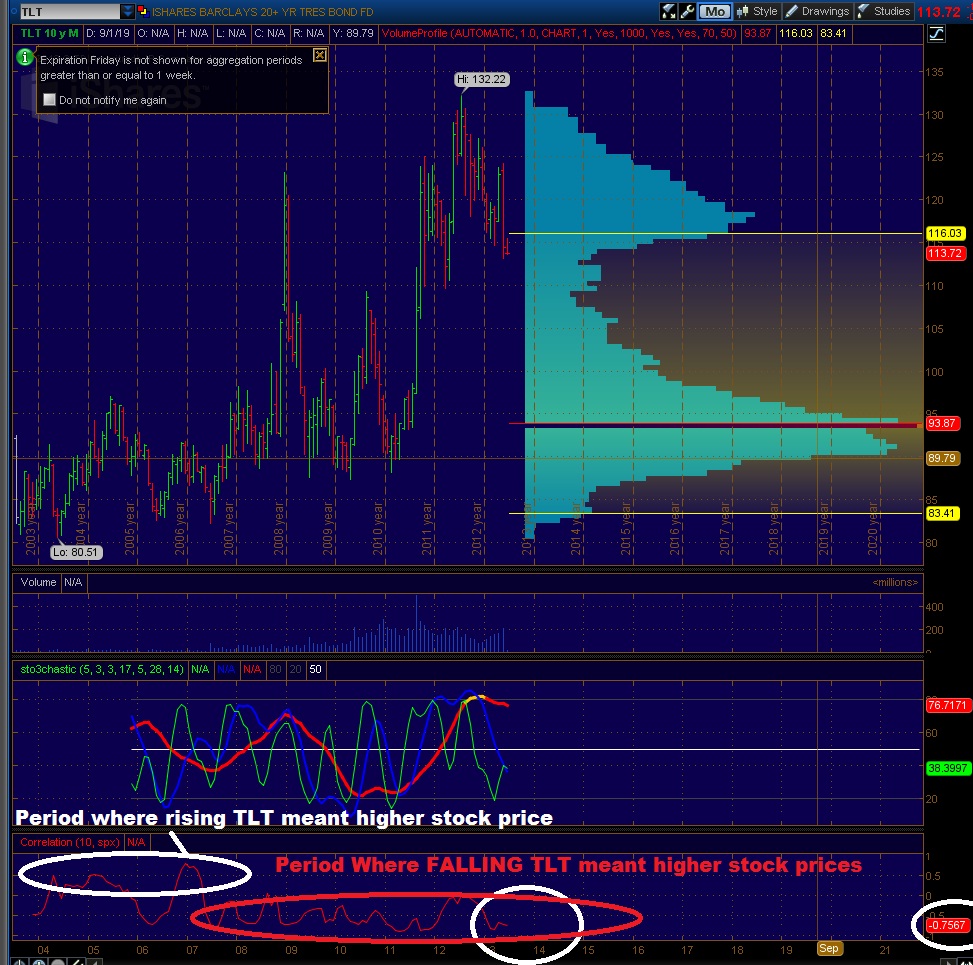

I get a little tired of the myth that rising interest rates is bearish. Sure, periods of time it can be, but eventually the cash flooding out of treasuries goes somewhere. Also, rising interest rates mean there is a BID for CASH, so people are willing to start BORROWING. If people don’t want to borrow, interest rates don’t magically start going up. The interest rates go up on demand to bring cash up front and borrow.. Hence, this should be bullish if anything. Granted, the market behaves based off of ideas that were formed hundreds of years ago in economic textbooks. Sometimes falling bonds and rising yield has been bearish for stocks, but the long long term correlation and current trend seems to say rising yield is correlated with rising stock prices.

TLT going up means falling yield, rising bond prices. TLT going down means Rising yield falling bond prices.

Sometimes you have to shut your economic textbooks, and look at reality.

If you enjoy the content at iBankCoin, please follow us on Twitter

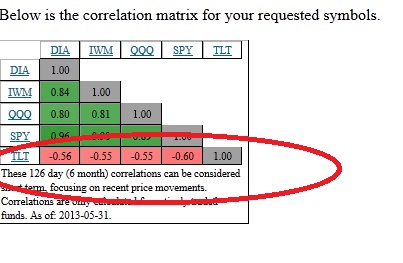

FYI, over the last 3 years on average according to http://www.sectorspdr.com/correlation/

The correlation is actually positive but every other time frame it’s negative.

http://lwcm.com/research/stock-bond-correlations-are-upside-down

Sick post.

thanks.