“When a man looks into the abyss he finds his character… And it’s his character which prevents him from falling into the abyss” -Gordon Gecko

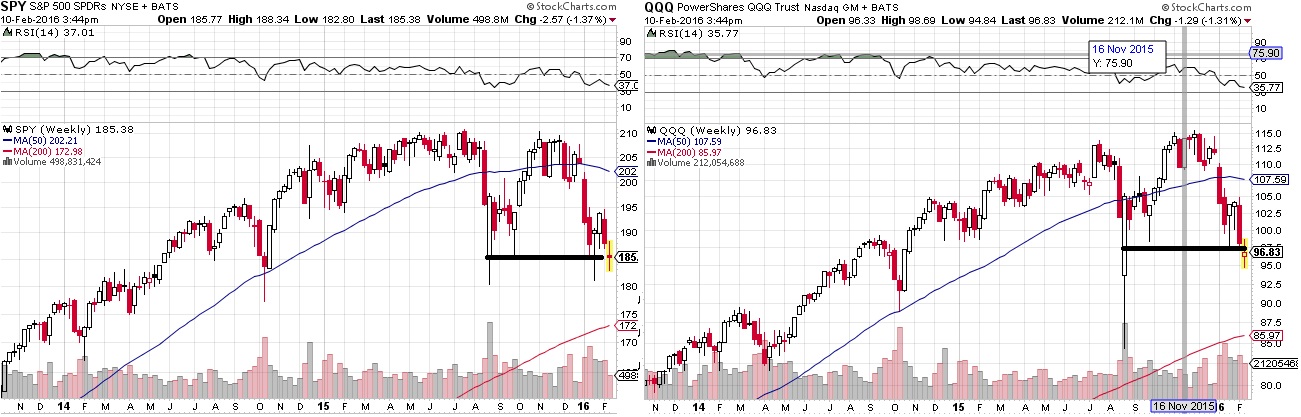

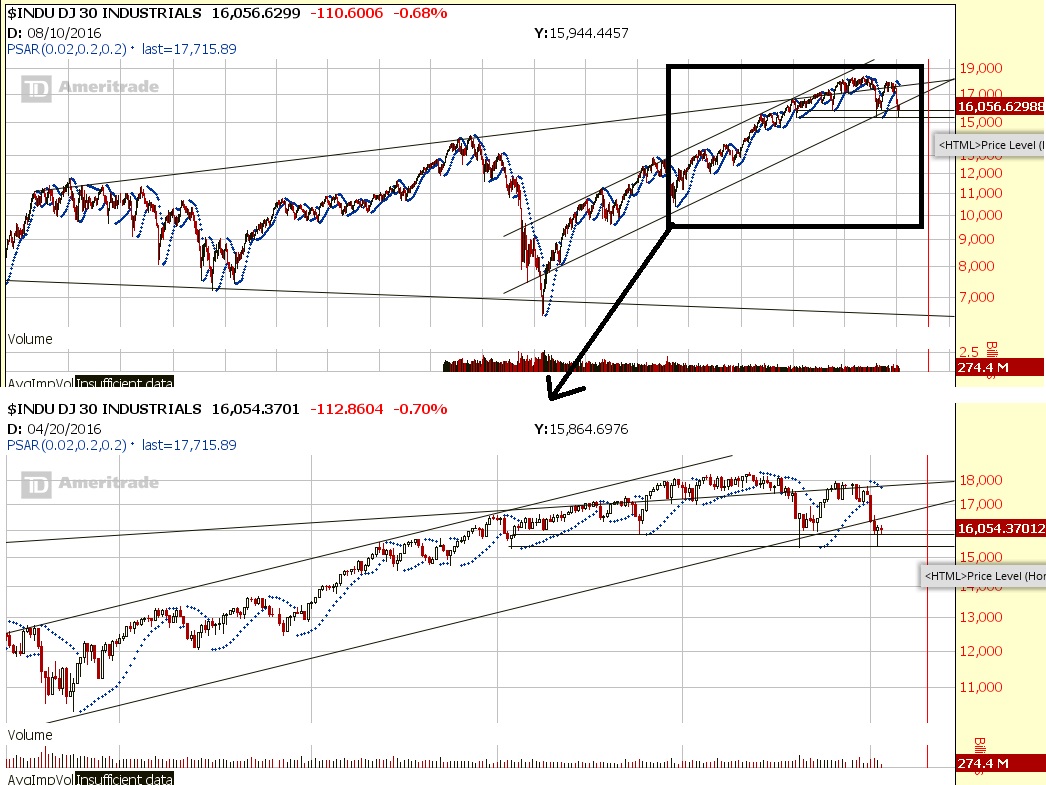

Right now the markets are overlooking an abyss. I’m sure many have noticed. And perhaps it’s fueled pessimism. The question is whether or not we will fall into the abyss. If/when there’s evidence we won’t, there may be a good bullish entry in development.

Victor Sperandeo In his book Trader Vic discussed 2B bottom and topping pattern. There’s good stuff on it here. (insert 2B or not 2B joke here)

There’s always a debate on whether or not to use intraday signals, or to wait until the session closes, and whether or not to use daily or weekly signals.

Since I’m limited in time, I will stick to the more significant signals which tend to provide a bit higher confidence in their success, but provide fewer opportunities to take a trade.

Right now we have a week that potentially will close below significant levels (depending on which prior “low” you consider relevant, and which market you are looking at.) If it does, one way to plan a trade is to use this week’s high as the trigger (a close above it), and this week’s low as the stop.

You’d then typically target the recent high.

This signal is nothing magical, and I want to make sure you understand the psychology behind it.

The strategy works because of a few keys. The psychology is such that you can trigger a chase, following the market getting too one sided. In this case we are looking at the bullish signal, so the market gets too bearish, a breakdown signal occurs, and then we move above the session high during that signal. The tendency of the market to trend from extremes is combined with manageable entries. Basically, recent session high/low can often act as support and resistance providing a manageable entry and manageable exits. The prior low is also a significant psychological barrier which can trap a lot of people short, and the move above that session’s high can trigger some chasing to cover as the short term traders covering or getting long can trigger some of the longer term technical traders who bet on a top and witness it move beyond their pain tolerance levels to the upside, causing a bit of a short squeeze.

Volume profiles can also be used to better understand the psychological breaking points, and you can modify an exit contingent upon what the volume profile looks like to fine tune the trade to the psychology of a stock or broad market…

Right now this signal is unconfirmed, but I have noticed enough pessimism for this to be a decent signal, and the volume profile supports it being a manageable entry with better likelihood of a move due to less price history in the areas above the entry and below the stop.

AN ALTERNATIVE way to trade it is to get short at some point between here and the signal and use the “buy entry” as a stop. The volume profile also suggests a fast move to the downside is possible. That supports the importance of the stop below if you buy a move above, but also allows for the reverse signal… Taking a bearish position while using the upside volume profile risk and “buy signal” to close out a bearish position. You would and target a downside move to fill the thin profile below.

How can both bearish and Bullish be right? Ultimately, only one trade will win, but the reason either trade can be profitable is the risk and reward is such that the probability of success doesn’t need to be 50% to win. As long as the psychological litmus of the volume profile and tendcy of the markets to move to and from extremes exist, this trade carries with it an edge on either side.

Broad Market Signal vs Portfolio Management

I’m using the broad markets for the signal as more of an idea of how to shift portfolio allocations and position sizes. If the market is in buy signal, perhaps increase position sizes or increase risk allocation (number of positions long). If it’s a sell signal, perhaps decrease position sizes or reduce risk allocation. Or perhaps if you’re aggressive shift from net long to net short depending on the anticipated market direction.

Since there’s fast zones above and even faster below, you could also strategically hedge using the broad markets in either direction so you aren’t overexposed to one side.

Note: This is being posted 2/11, but images are from 2/10.

If you enjoy the content at iBankCoin, please follow us on Twitter