I’ve been busy due to family issues that have came up.

I just finished the formulas for short, medium, and long term. I still have to do the busy work of making changes so that the medium and long term formulas will apply for every single stock. Some formulas need to remain “locked in” so it’s always accessing one specific cell from the formula tab. Other formulas need to change to correspond to a completely different stock and set of data.

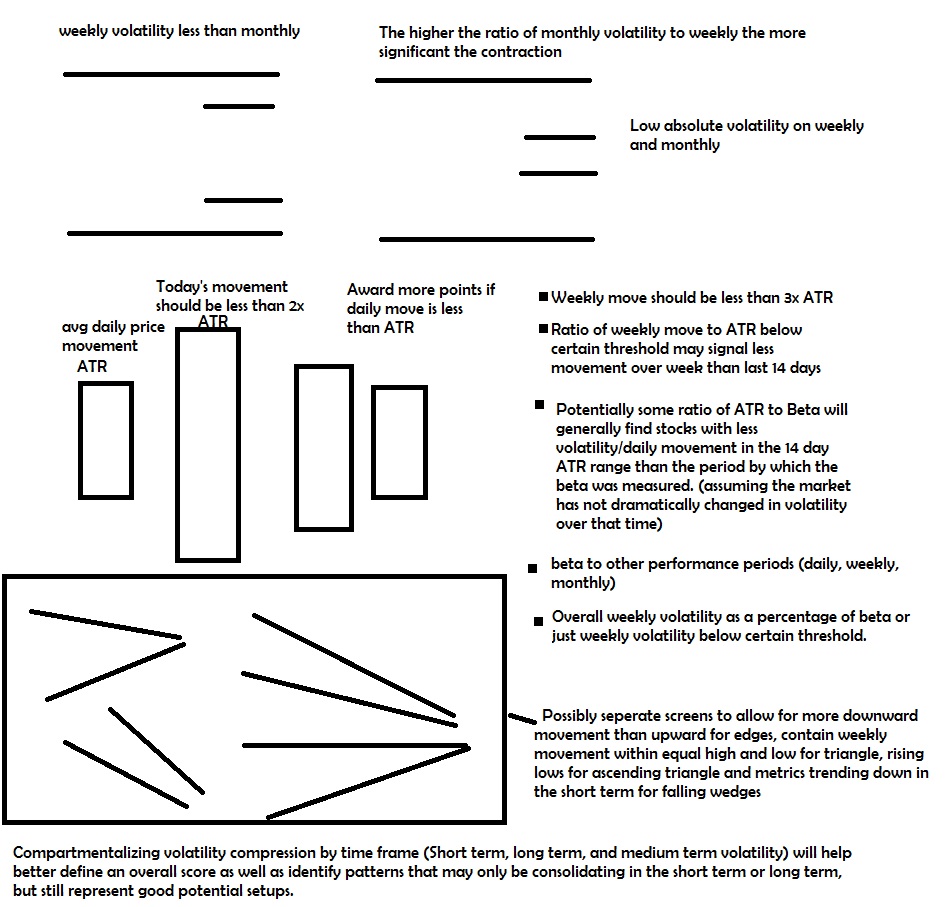

The Long Term Consolidation rank will use quarterly and monthly performance and compare one another. It will also look at the overall range of quarterly and the overall range of monthly. It will also look at total monthly volatility as well as monthly change in price and look at the change/beta.

The consolidation score on it’s various levels has a formula tab that makes it easy to change the formulas and know exactly what you are changing. This makes it possible to tailor these formulas to the individual.

Eventually I also will allow a more complex layer of formulas that actually adjusts the individual stock’s score based upon the strength of the score of the industry that it’s in. If many stocks in the same industry are setting up, these stocks will get a little bit of a boost.

The next step may take some time before I am able to find the time to set it all up, but it involves setting up risk factors, comparing the risk factor of individual stocks to their industry. I may adjust the risk score as well as the overall score based upon relative strength and industry cycles, and I may even apply an input for “market phase” which would then apply a bonus to stocks that are “up next”.

All of this is time consuming though and I want to get a functional tool available, so the first one probably won’t be very complete, but will be complete enough to come up with a list of stocks that are filled with most of the names that are consolidating.

The sort of end point if I am able to free up more time to work on it would be a stock market simulator based upon projections and setting up subjective probabilities of certain performance results. Then I could set up a simulation that would only take a minute to run a few thousand possible outcomes over several iterations.

In other words, what happens if we draw several random numbers for each stock, then based upon the probabilities, convert that number to performance, then recalculate the scores and probabilities of certain outcomes of all stocks based upon how those performances change a stock’s score? …Then what if we interpret the next random number based upon these new probabilities, and repeat the process for to represent weeks or months of performance? …Then what if the simulation would record the final result and run this entire series of simulations thousands of times for a particular spot? This is what the simulation would determine.

The coiled up stocks will tend to move more, the stocks in industries making breakouts will also tend to breakout, the stocks all setting up together will have a higher probability of breaking out and having more significant amounts of capital leading to larger moves. As certain moves develop, it will influence the development of other setups because of the tendency to influence group scores.

The point of all of this will be to project probabilities of a few outcomes for a particular option trade, converting that set of expectations to a risk adjusted growth rate of your portfolio, and compare the top performing trades to determine the best risk adjusted decisions individually.

It should also be possible based upon the tendency of trades to either correlate together or have opposite correlations to possibly try to construct a more optimal portfolio that accounts for the edge and correlation related to a stock’s performance rather than broad theory that starts with assumption that the market is random.

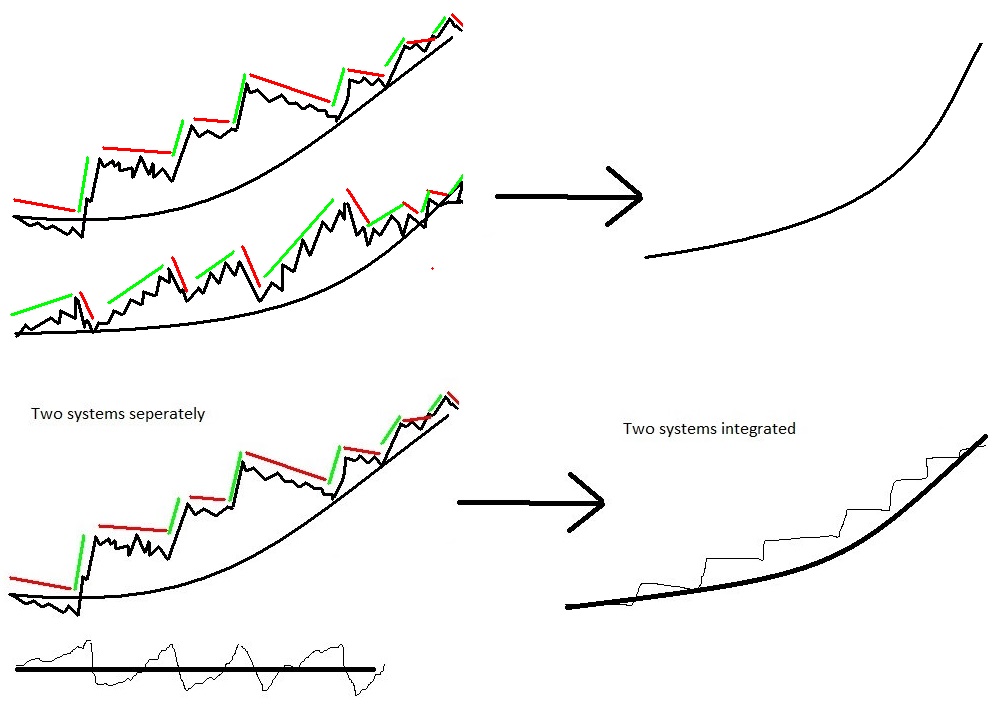

In other words, rather than simulating expected outcome of an individual stock, you can set up a mock portfolio with a particular weighting and look at the probability of the TOTAL performance. Since certain stocks from the same industry may expect to outperform but when they don’t there is a greater chance that neither will, having a portfolio consisting of all of the best stocks may not have the best return on risk. By adjusting the total portfolio as well as the weightings and finding stocks with inverse correlations but positive return on risks, you should be able to normalize your downside without costing you. Below is an illustration of how with the perfect balance of positive expectation and negative correlation adding a trade with a lower expectation can actually be more constructive to risk and reward than one and produce a much better return on risk than either trade independently.

I wish I had the time to really set this up well in a few weeks to a month, but unfortunately it will take longer than that. There’s plenty of theory out there about reducing correlation through efficient market hypothesis and appropriate diversification, but that is assuming an efficient mostly random market. There is a greater edge to be had if you can successfully handicap the market, but that doesn’t entirely eliminate the benefits of appropriate weightings and mitigation of risk through reducing portfolio correlations.

If you enjoy the content at iBankCoin, please follow us on Twitter