The leadership we do have at least is finally bullish after a few days of what may be just temporary risk aversion.

However, there is a greater concern…

That concern is that individual stock bets have failed to pick a direction. These conditions, should they continue, is very dangerous for short dated option trading strategies, but may just be pre-earnings uncertainty. Nevertheless, until things turn around in the short term, it is a “stock market” rather than a market of stocks.

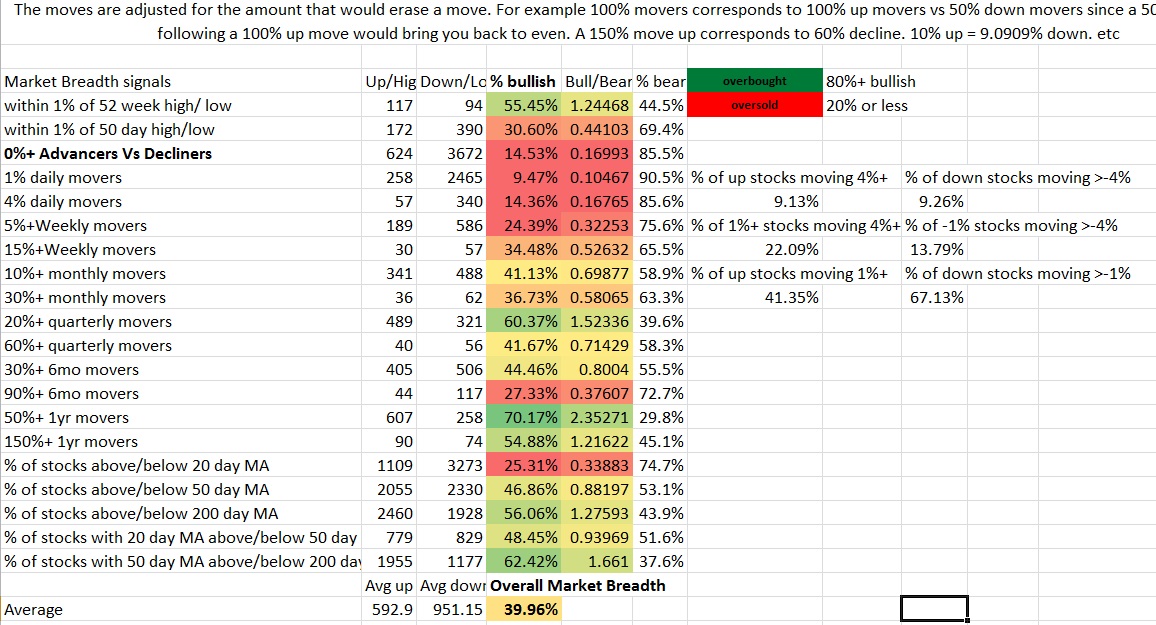

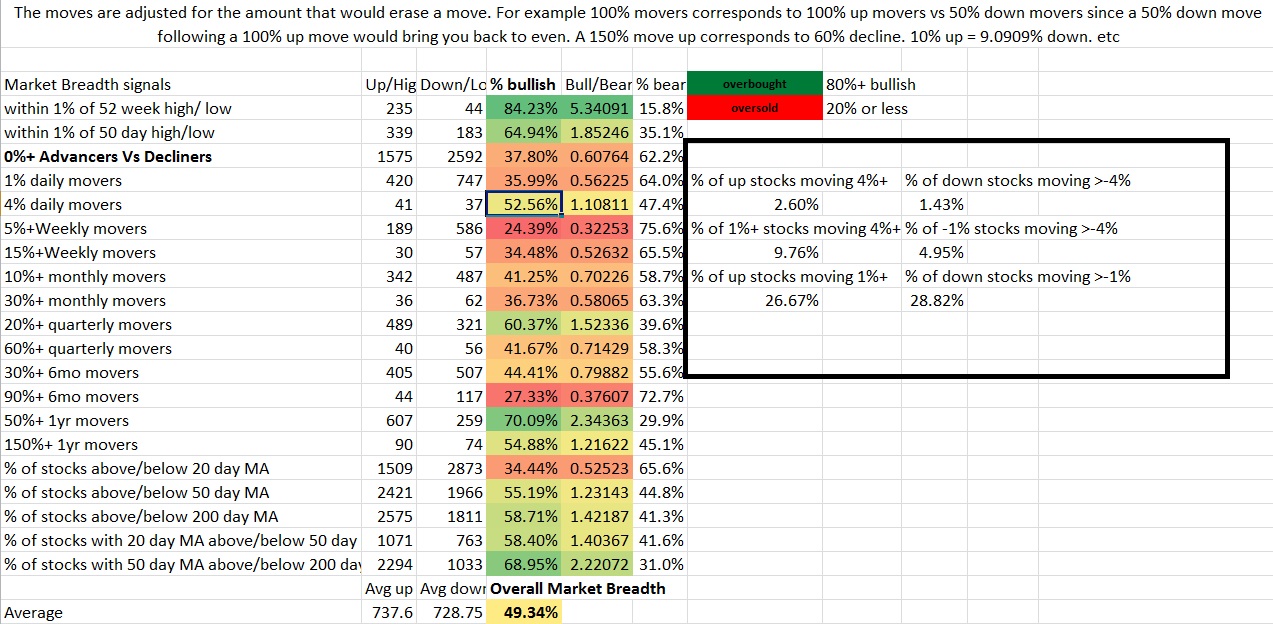

I haven’t been following breadth for very long and I only recently started looking at the % of stocks that are up making significant moves, but nevertheless, I have seen readings where over 10% of all stocks that are up have made +4% moves. I thought 5% was low, but a reading under 3% right now is pretty rough, especially considering with such low VIX we should see some individual leadership. As I have not tracked breadth in this much depth for very long I cannot be substantially confident in my interpretation, but I suspect the divergence between a VIX suggesting a “market of stocks” while breadth has increasingly suggested an increasing shift into a “stock market” means we are on the verge of some kind of turning point where in hindsight this signal will seem obvious.

The russel diverging from S&P and dow, and the breadth suggesting investors are hesitant to aggressively accumulate or sell any particular theme could simply confirm the gameplan of “aversion” that OA has mapped out. Alternatively, if the glass is half empty, instead you might see this as an early indication and precursor to volatility increasing, the smart money reducing positions ahead of it and selling into any strength while there simply aren’t a lot of people that have caught on and joined in selling yet, and the “calm before the storm” type of logic. Last time the “market of stocks” got put into question it only took a week or two until it turned back around and remained a “market of stocks” before then selling off sharply in a slightly more correlated way than desired and remaining there (bloop, bloop) as Janet Yellen decided to give grandma stock advice, warning the kids to avoid playing with firecracker stocks.

Translating this ambiguous view into a gameplan is actually much easier than one might think. One should always have their own way of deciding “what” to buy, but equally important is how to position size, what time frames to look at, and how defensive of a strategy to use. Regardless of the viewpoint of “the market” going forward, the mere suggestion that the “market of stocks” is being put into question yet again suggests following a more concentrated approach (fewer names with normal or slightly above normal position size for about equal or less total capital at risk in options) going forward. The lack of clear leadership suggests that if I must buy options, more time is advised. So remaining a bit more patient with some extra cash, not leaping into the riskier names just yet, giving more time for setups to develop and sticking with what you do well looks like a good gamplan going forward from my point of view. Perhaps a more defensive strategy of cutting losses a bit more quickly to not get stuck in stuff that takes too long to develop, and counting your blessings if you have a gain in a stock run over 4% in your anticipated direction rather than expecting it to defy the even longer than usual odds. If you cannot trade that way and want to stick to stock picking and letting winners run more so than worrying about salvaging premium, just gear down for awhile and make sure you have enough capital ready to position more aggressively again once we get some leadership and more positive signs.

asinine disclaimer:I’m not certified as a broker or financial planner so this isn’t “advice” legally speaking, just “entertainment” and education.

breadth end of day is interesting. More time in the day leads to greater chance of larger moves and with very few positive stocks, it’s not all that surprising that market would dive into the few runners:

If you enjoy the content at iBankCoin, please follow us on Twitter