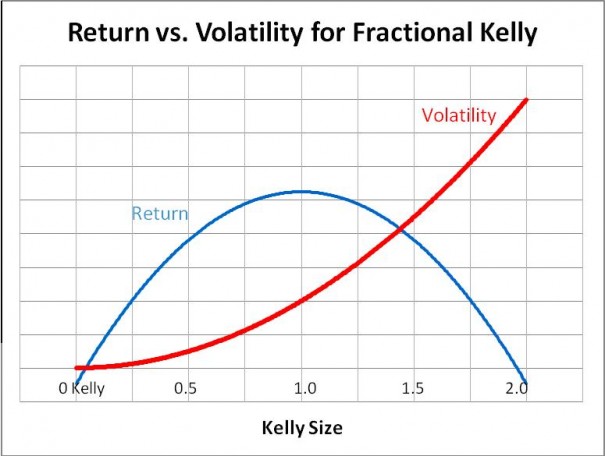

If you have an edge in the market, or are using an “exploitative” strategy, position sizing is supremely valuable. If not, you should position defensively (use an “equilibrium” strategy) to avoid being “exploited” yourself. As you increase position size and overall risk (with an edge) your geometric return functions like this (over an unlimited time period):

If we were to continue beyond double the amount that maximizes your geometric return, it would begin to look like this:

This is based upon a formula called the Kelly criterion. There are Kelly criterion spreadsheets available like this one. The exact percentage in which you reach the apex of returns depends upon your edge and odds. 50% of the “optimal” risk produces 75% of the results with 1/2 the volatility. Because of uncertainty over your edge, it statistically is better to err on the side of caution, not to mention better for reasons of psychologically, emotionally, and due to a “less than infinite” duration of one’s trading career, and “utility theory” among other things. Let me be clear… It is far more important to protect what you have while producing a positive return than maximizing the return. As such the exact application of this is perhaps not so important as recognizing that increasing the risk does not proportionally increase the geometric return.

Without fees involved, one single independently correlated position size at the apex of those charts produces a lower return than two independently correlated position sizes at HALF the apex.

We can pretty accurately conclude that uncertainty, randomness (or more accurately “chaos”) and portfolio volatility are usually the enemy of those who look to place wagers and handicap markets with a particular edge.

Illustrated numerically, it occurs because of this concept of the result of a loss not being equal to a gain:

loss gain | needed to get back to even

1.00% | 1.01%

2.00% | 2.04%

3.00% | 3.09%

5.00% | 5.26%

10.00% | 11.11%

20.00% | 25.00%

30.00% | 42.86%

40.00% | 66.67%

50.00% | 100.00%

60.00% | 150.00%

70.00% | 233.33%

80.00% | 400.00%

90.00% | 900.00%

95.00% | 1900.00%

99.00% | 9900.00%

The largest obstacle to overcome with this style of trading is that volatility will more often become your enemy. A conservative approach can still handle most expected volatility, but factor in your “black swan” and “10-sigma events”, and even a conservative strategy can be hit hard and fast by volatility to the point that it can destroy many otherwise profitable strategies. A robust approach that may do only a little better than break even in all environments, yet protect itself from the deadliest rare “black swans” in the long run may prove much better than the aggressive highly profitable approach. Fortunately their is a happy medium that may provide the best of both worlds.

If you have an edge, I believe a portfolio should still have a significant portion designed around mitigating the risks of volatility. The solution to volatility can be to try to adjust strategy based upon the “market type” you are in, but that can often be either retroactive (backward looking), and late to the party, or anticipatory and potentially inaccurate a high percentage of the time. As a result their are still substantial risks of not being able to significantly mitigate the risks of volatility ruining or greatly reducing a strategy’s profitability. In technical terms you might have a “balanced exploitative strategy”, that only slightly deviates from an “equilibrium strategy”.

Quick Primer on Game Theory – “Nash Equilibrium Theory” and “Exploitative Theory”

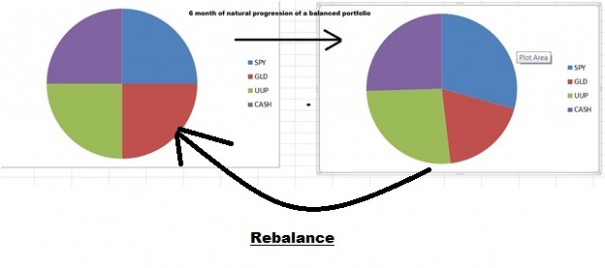

1)Imagine an alternate universe where there were only 2 investments “stock market” and “dollars” and no leverage where the “stock market” never goes to zero (although individual pieces might). If market were random or if the actual “edge” or expected direction were completely unknown, the “equilibrium solution” to play the market and produce gain based upon others mistake (who transfer capital from stock and cash unevenly causing changes in prices) without directly exploiting them would be 50% cash and 50% stock.

Example: Stocks are worth $1000 and you have $1000 in cash. Stocks double to $2000. You sell 1/4th of your stock position so that you now have $1500 cash, $1500 stock (50% each). Stocks decline by half. You now have $750 stock, $1500 cash $2250 total vs $2000 you started with. $250 more value than you started with or a 12.5% gain due to volatility after stocks “normalized” or “reverted to the mean”. The “equilibrium” strategy seeks not to handicap the market, but let others try to do so while over a very long period of time profit from volatility.

An “exploitative” strategy under the same “universe” is when you decide you have an edge and that the market has neglected “stocks” so you might buy somewhere between 50% and 100% stock (100% would be maximally exploitative, (and an “unbalanced” strategy) where as 50% would not be exploitative). The more “exploitative” you are, the more vulnerable to long term portfolio volatility, uncertainty, and “chaos” (I feel this is a much more accurate term than “randomness”). It’s important to realize that the farther the market is from “equilibrium”, the more an equilibrium strategy will gain. However, the proper exploitative strategy under the same circumstances will gain even more than equilibrium strategies if assumptions are correct in such situations. I will prove this with a brief example: If you had to choose heads or tails with a double sided coin (2 heads) with 3:1 payout (payout is far from equilibrium), calling 50% heads and 50% tails might still gain more than a 2:1 or 1.5:1 payout, but calling heads every time would be MORE profitable. However, if someone was able to switch to a double tailed coin or a regular coin at one point without you knowing, the more aggressively you bet your assumption and position for those assumptions, the more vulnerable to decline and even risk of ruin you are if your assumptions are proven wrong.

2)In the real world capital can migrate to and from multiple asset classes, credit can contract and expand, domestic capital flows can be very different than global ones and potentially move against the grain of global capital flow. Asset classes have components and sub components and so on all of which can receive capital inflows (rally) in the face of a broader capital outflow (gold going up or sideways as commodities go down. Rather than concentrate on a specific equilibrium solution, it’s more practical to just look at a simple one as part of a “core” strategy. One such as this:

If you want the technical jargon you can read about “modern portfolio theory” which basically attempts to maximize expected return for a given level of risk using the “efficient frontier” and using “beta” to define risk. To me “beta” is a backwards (retroactive) looking view on price volatility relative to the backwards looking view on the market’s price volatility. The assumption of an efficient market is also a “suboptimal” conclusion in my view. I am not interested in an overly technical portfolio that requires frequent management. Instead I am only looking to exploit the inefficiencies of the market one one hand, manage the risks to do so effectively, while mitigating risks via defending against chaos via a portion of capital that is in some pseudo-equilibrium solution that basically looks to establish a “baseline”

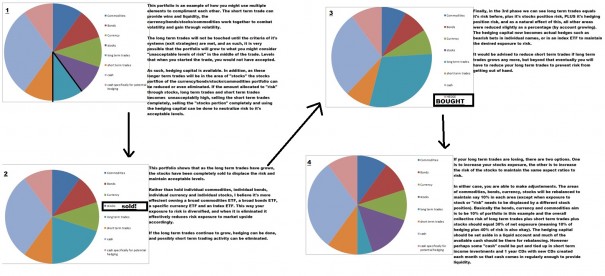

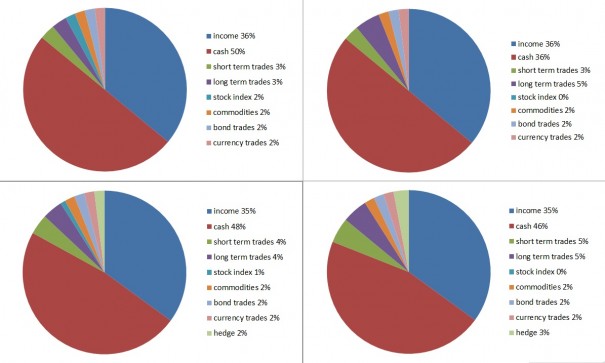

My portfolio composition will actually function more like this: (click on the image to see full size photo)

This is how the same concept could look and function with mostly leverage:

Depending on how low the correlation of each trades, you may be able to add a lot more individual short and long term trades as the natural “baseline” of risk, but it still must be monitored and have certain rules and “limits” in order to keep the exposure and risk in check at all times.

You might reduce cash and add in “long term income” based risk in your capital that could be anything from buying a 12 month cash CD every single month (so that every month you have a CD from a year ago pay out and become liquid), individual stocks that pay dividends, ETFs in any number of many categories that pay dividends and so on. The income will drip feed into the cash account, and because of a growing cash reserve that can be used to rebalance, their is less of a priority to have as much excess cash, provided the income is fairly robust. (A broad S&P ETF probably isn’t at risk to see its dividend get cut).

A basket of various income ETFs such as PFF,CORP,TLT,SPY,HYG,EWSS and SHY as a substitute for a large portion of that cash along with a 12 month CD purchased every month is an effective way to create liquidity without having so much capital tied up in 0 interest yielding cash on the side, yet without having an overly large amount of risk associated with it.

The philosophy is still about having an allocation based portfolio that can manage large swings in volatile capital flows, manage portfolio through large periods of expansion and contraction (inflation/deflation) and any number of unforeseen variables. This management of volatility in combination with individual positions and hedges provides a more stable portfolio overall, but still allows you to do plenty of “core” trading” in the short and long term.

The actual allocation should be dependent upon: your skill in each of the areas you allocate towards, your overall skill, your current market outlook/bias, risk tolerance and a few other variables. I’m not going to go any further in depth than that for now, but I hope this post is able to allow one to rethink their strategy and whether or not their strategy is properly prepared for different periods of volatility while still providing yourself with the flexibility to adapt.

You do NOT have to be a “game theorist” to invest and trade, but it is important that you understand that there is a basic “baseline”. Also, it is useful to know how one might adjust when approaching a market that is not at equilibrium and how to avoid significant risks that are detrimental to your long term returns. We will cover more on making adjustments to a basic balanced philosophy that I have presented.

If you enjoy the content at iBankCoin, please follow us on Twitter