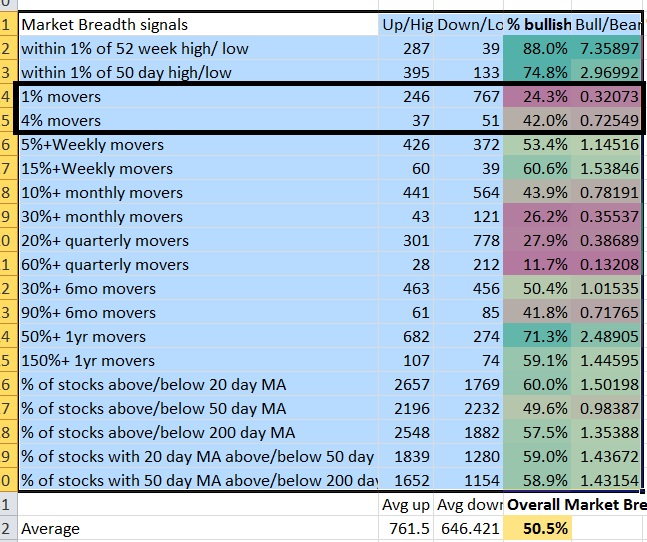

This morning people were flipping out. They saw a lot of red across a lot of stocks. Many normal breadth indicators would point to a large percentage of stocks down overall today. But there is a silver lining. A large percentage, even if not a majority of stocks making large moves are going up. This means not everyone is selling. Leadership may be emerging in areas and the buyers aren’t shying away from today’s tape. The longer term perspective of the underlying businesses and/or economy are good, in other words (or at least not as bad as advertised). Another way of saying it, is today’s sell off is largely noise. Certainly, it may be possible, and even likely that at some point the negativity will spill over to even the leading stocks and people want to position so that they can avoid the margin clerks. However, put into context of the initial underlying signal and you may find that to be a good buying point. Conversely, it also is perfectly reasonable for the leading stocks to take the majority as the most beaten down stocks rebound and the entire market goes with it. At any rate, you might either abstain from selling or reducing, or look to buy names that are red now, and possibly consider buying the current 4% movers if they dip and retest their daily breakouts on F.E.A.R. (false evidence appearing real).

Some additional notes. Although we are still near highs and more stocks are near highs than lows, the longer term breadth has not yet shown leadership and only is seen on a daily and weekly basis. Keep in mind that the moves to the downside are adjusted to cancel out the upside move. In other words, a 60% increase is equal to a 37.5% decrease because if a stock increased by 60% it would only take a 37.5% decline to erase the move. Nevertheless this could be interpreted to corroborate sentiment. Alternatively, it could also be used to identify leadership (or lack thereof). Sentiment is more about either identifying extreme oversold levels and/or waiting for a signal that it may be shifting. Leadership is more about waiting until you have some positive momentum in the underlying economy and market developing. With that being said, quarterly data has been oversold for quite some time signaling that there is not “complacency” like the vix may have suggested, but nevertheless, if new leadership does not emerge soon, there is concern that we may see more significant declines from the rest of the market.

You could also use this as a lagging measurement of your odds of hitting a big winner vs a big loser on whatever timeframe. Since it is only on a lagging basis, you can really only use it as a benchmark vs your own performance, unless you have some sort of indication that the momentum/trend is just starting and should continue. If you didn’t snag any big winners on stocks you held the last 3 months, that may not mean that your system, strategy, or abilities have “broke”, just the conditions the market has gone through.

Bottomline:Nothing super actionable, but enough information is provided to develop a gameplan such as buying weakness and waiting for a retest on leading movers… or if you’d prefer to remain prudent, abstaining from any selling and remaining patient until the longer term conditions begin to turn around a bit.

—-

update:Breadth has deteriorated on 4% movers. I did not see a reading of the 4% movers get over 50% which would have actually indicated accumulation overall in leaders. Instead it was just a positive divergence with moderate leadership deterioration that was still much less than the rest of the market, and an early sign that once the fear is out that there could easily be a lot of buying. It’s not uncommon for even the leaders to flush before we begin a stronger rotation into the market, but the early chasing action signals the tape isn’t all that weak and/or complacent as it might look. Correlation still down and volatility low, it is a market of stocks and although tody there may be some mild pressure, I interpret the signals as more likely than not to be short lived.

6/4:Today started off very similar, only this time the 4% movers were above 50% and it pulled up the 1% movers. Looks like yesterday was a precursor to the initial signal. At any rate, so far it appears that interpreting the selling pressure as mostly “noise” was correct. The fear did spill over but today it looks as if things are turning around and leadership again is emerging. Today it is a bit less likely to spill into late day selling because not only are there more bullish movers than bearish movers over 4%, but the bullishness on strong movers is stronger than moderate movers. That translates into leadership pulling the market higher as opposed to still a large amount of chasers showing that the sell off may be short lived.

If you enjoy the content at iBankCoin, please follow us on Twitter