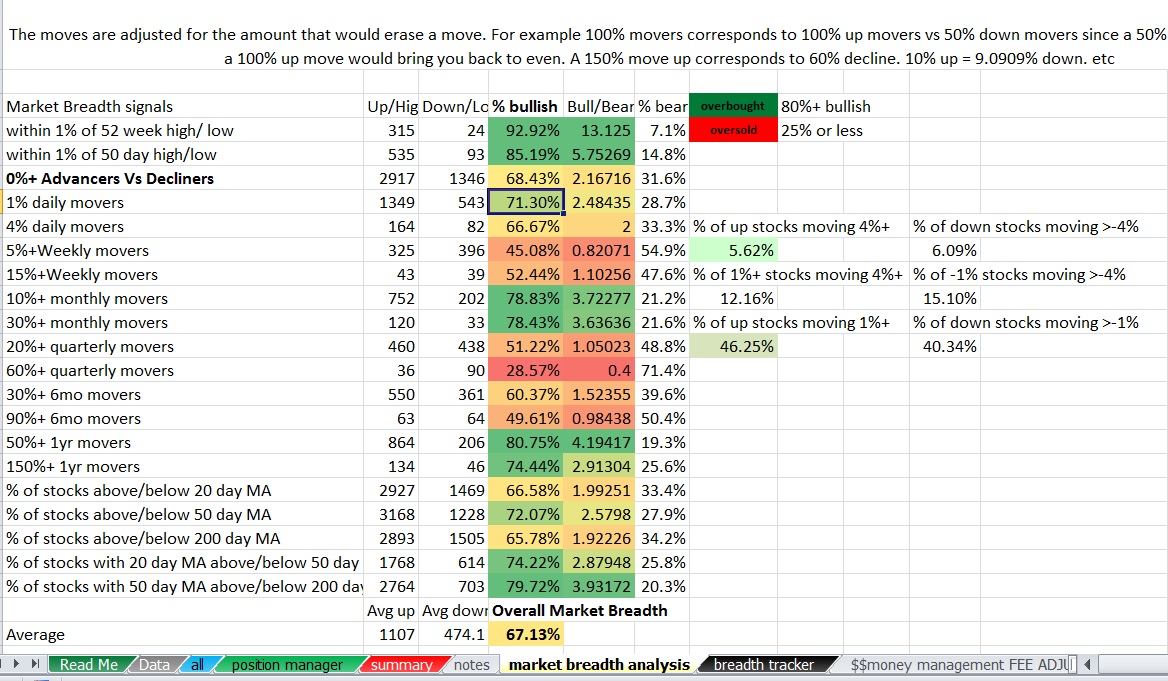

Before the market was weak into 6/24 close the 4% movers were non existent, the correlated selloff could be displayed even if it was an only one day move and the vix remained around 12 it still potentially could be cause for concern going forward. On 6/24 85% or so of stocks were down to close out the day. Today 6/25 the 0 and 1% movers were moving and the 4% were but not by greater than the 1 and 0%. This could just be a return to a stock market rally rather than a market of stocks and the start of more correlated moves. But it is very early to say. An alternative, more optimistic view is that the leaders first made a strong move and lead and now are only moving in line with the rest of the market and the appetite towards risk is just approaching the accumulation more cautiously. I know, everyone hates people that hedge their predictions, so I will give another metric to look at. % of all up movers that moved 4%. When there was lots of leadership and the pickings were easy, about 10% of all stocks that were up were up 4% or more. Now we are down to 5.6% today. That’s still not terrible, but it requires a bit more skill to be a stock picker in this environment.

If I had to guess, I would say the reason we are still seeing some chop like this is because there is a lot of charts in the “aversion” and “denial” and “anxiety” for a smaller amount still not heading into their aversion points. This has the market a little bit on edge on both sides, and will display itself with a bit more chop and a little bit less leadership until we break right through. So in the next week or two, I would put these numbers in the context of continuing to display “aversion” (hence why you see a lot of weakness and lack of leadership to the upside for stocks over the last 3 months), for a bit longer in the longer term, while we will see some leadership emerge over the coming weeks months ahead but in the meantime, because of the volatility associated with these states, even as the VIX is down and on average volatility is low, there is still a lot of small jittery rotation back and forth as market may struggle to find leaders that stick until we enter more “returning confidence”. When you put the numbers into that context, the entire story adds up.

I’m still not going to go without mentioning that today as of the close the bearish moves caught on and stuck a bit better than the bullish ones GIVEN that they WERE down even though over 60% of all stocks were up. That may not be too alarming as it can be explained by the logic “if a stock can’t rally in this environment with all stocks up, I better sell it”, and without context around it to support cautiousness other than the move yesterday (6/24/14) signalling across the board selling

Either way, the environment suggests that it no longer is the type of market where you can be gung-ho long with much larger than usual positions that you let ride until expiration, and instead you should go back to the normal risk and normal management (or perhaps slightly larger position size with the VIX where it is if you can manage it more carefully)

If you enjoy the content at iBankCoin, please follow us on Twitter