I plan to buy a house soon, and like many people, I would care for low interest rates. If Interest rates go even lower, it is a win because not only does that mean cheaper borrowing costs, but that also may mean that there is a rotation away from assets into bonds as well as a NEED to ease rates and the conditions from which the need develops means cheaper prices. (in theory, but perhaps not in my particular area). That “win” is not necessary, in order for me to be able to afford a house. Through finding the right deal and saving I can afford the type of house I am interested in. It is a question of having the stars align and being able to close on the deal in the right neighborhood for the right price with the right features to the house,etc. But if interest rates skyrocket it may be problematic. My borrowing power will decline and the availability of the types of houses I am looking at may decline. In my view, this is a perfect scenario to hedge.

Since a house is affordable based upon current interest rates and it is a matter of me finding the right house in the right area at a reasonable price, it may make sense to hedge. I want to avoid the possibility that interest rates will require me to save more money for a larger down payment or keep less per month, or resort to frugality, so hedging makes sense.

Since higher prices in TLT (treasury bonds) corresponds to LOWER yield and lower interest rates, In order to protect myself from a decline, I would want to profit from lower prices in TLT and higher yield and interest rates.

With the implied volatility in the TLT historically so low, we want to BUY premium.

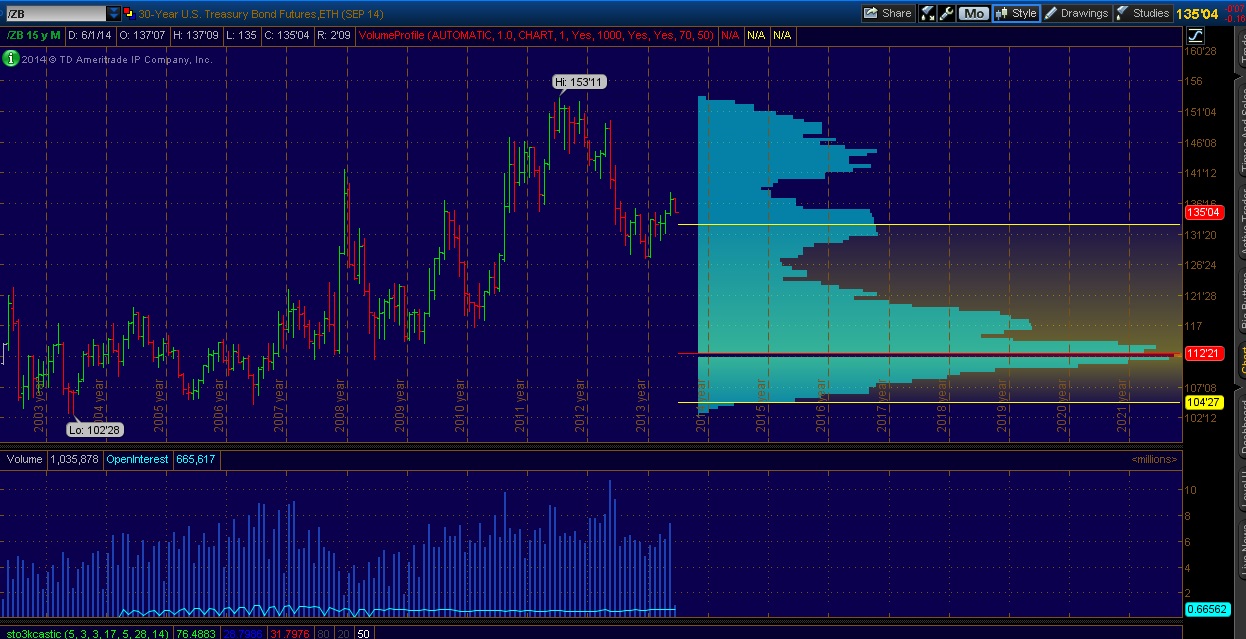

Time frame? We have to take into account both the actual chart AND the time one anticipates taking before no longer needing a hedge (buying a house). In the short term, the bond futures on just over a 10 year chart shows the following volume profile.

Timing? The actual timing of the entry is important, but remember, we are currently completely unhedged from a very large cash purchase and about to borrow a lot of money relative to the account size since much of the capital has gone towards saving of the down payment. So what I’m going to do is buy a small TMV position now (3x treasury bear), and consider getting some Jan 2016 puts on the TLT further strength to retest the initial breakdown that I had mentioned may happen.

In theory you could work out what rise of interest rate would impact your affordability and ensure you have a large enough position to offset that and use options and such to try to match your gains to offset your loss as best as possible, but I’m not going to get that carried away. The key thing is that I give myself SOME flexibility so I can be patient on buying a house without having to rush into a decision prematurely without doing my due diligence and so I can make a calm emotionless decision as much as it is to worry about the exact dollar amount.

Protecting Your Home Equity through Hedging

Let’s say I’ve bought my house, lived in it for a couple years and the market has skyrocketed along with the value of my house. I don’t want to sell, but I am concerned about the housing market crashing. NOW how might I hedge? Now I want to actually take out as much equity as I can from the house and I might actually want to put it into TLT. I would have to sell at a rate or collect from dividends and covered calls at a rate at which would allow me to collect the cash needed to make the payment on the refinance mortgage. If the market crashes and Interest rates go lower or even negative, my loan becomes a gift at home equity levels that were at bubble levels, and I’ve locked in interest rates BEFORE they declined in attempts to ease the economy. This will compensate for the lost equity in the house. If more people are aware of hedging and can use it to fit their needs, then the “next 2008” will be less likely to domino into a contagion as homeowners won’t be forced out, foreclosures won’t cause a contagion of forced liquidation of real estate and job losses will be not as steep. Unfortunately I think many people are living paycheck to paycheck unhedged (and the increased taxes and austerity certainly haven’t helped) and they are VERY susceptible to an economic downcycle. Until people learn to hedge, each decline will just cause more volatility and fear, more pressure to leverage the system further. And each up cycle will be filled with panic buying as people are forced to buy while the house is still affordable, or else be forced to wait for the next downcycle.

Say you bought residential real estate ETFs when the cost was low and you weren’t in a position to buy a house and while the borrowing cost is affordable you also hedged vs interest rate increase; then even when market is near extremes near the top, you can still afford to buy. If you become concerned that you bought too late in the cycle, you might still be able to buy some puts and profit from a decline to offset your risks since your profits from hedging plus additional savings will provide you with more capital which you can use to now hedge a decline.

The time to commit excess capital into savings and hedging and investment is before you need to. That way, when problems come up, they aren’t really the problems they would have been. Maybe you want to be long natural gas and gasoline and heating oil futures contracts or options on futures contracts as well to hedge your costs so that if gas prices increase, you still have added capital to draw from from the investment. You don’t have to get too carried away as investment in companies at the right time with some attention paid to your own day to day financial needs and risks, will allow you to make money. However, ultimately taking away the possibility of bankruptcy no matter what life throws at you (within reason) through hedging, may, in many situations be a great form of insurance, and allow you to be more aggressive with the rest of your money and potentially at times with your life path (such as buying a house late in the cycle or quiting your job earlier to take a shot at a business opportunity knowing you have investment in things that will protect against rising food costs, gas prices, and savings that will last you long enough. )

If you want to quit your job and “take a shot” at whatever, you need to buy yourself a specific amount of TIME. Convert your money into “time” and through hedging you can most likely keep that time no matter what prices do. Simply count how much “TIME” worth of expenses you have. Count all the costs you will incur per month. Food, oil, heating, etc. Then multiply the current cost by the number of months you need. You need a minimum of that dollar amount to buy yourself that many months. Say you need at least 12 months. $2000 per month times 12 months is $24000. Now you need to convert that amount of capital or more into hedges. Each item over 12 months in this case will contribute to a specific dollar amount of cost. That is the target amount for which you use to hedge. Say food takes up $10,000 of that $24,000. $10,000 should go into buying food and hedging by putting capital into a basket of stocks and ETFs that profit from food or agriculture, or give you exposure to the food items and agriculture themselves. If you deploy that capital into things that will rise along with food prices, and in non-perishable food yourself, then an increase in food prices won’t disturb the amount of time (months or years worth of savings) that you have deployed towards your food.

Of course, that hedging capital is in addition to whatever OTHER costs you might incur such as the startup capital for trying to build a business in that time or whatever. You also need to consider the lifestyle you will have to live if the plan doesn’t pan out and you can’t get the same quality of job you had before and plan for some contingencies. I would carry at least 6 months of additional expenses worth of capital in CASH for needs that pop up, and at least another 6 months extra in hedges than you intend on using for additional time in which you are trying to find another job if things don’t pan out, or the job you were told you could always come back to isn’t there, but that is just me. Your needs and risk tolerance may be different, and so this article isn’t for everyone, but just a primer on how you might get started hedging. The average joe paycheck to paycheck should actually cut back first on expenses first, pay off debt second, save up cash third, hedge forth, and THEN go back to living their reckless rockstar lifestyle as they were, if they must. At least that way they will have a cushion that will give them an edge as costs increase and their paycheck doesn’t.

If you enjoy the content at iBankCoin, please follow us on Twitter