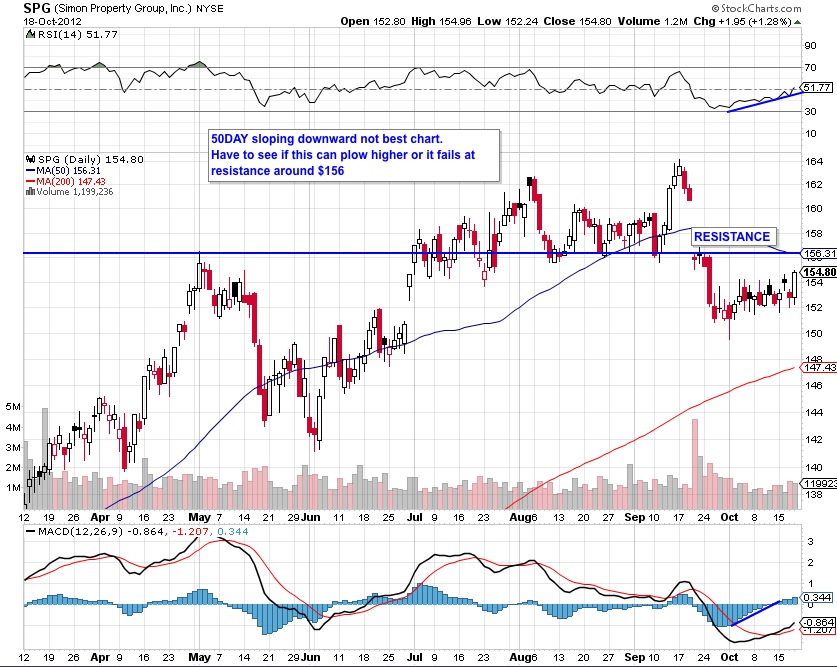

Few days ago I logged into my work 401k to see how my major holding in FARCX (real estate fund) was doing. I knew the hit would be decent considering I had just looked at SPG chart earlier in the day. While staring at the FARCX chart on my phone during a train ride back home it looked like it was bottoming out short term. I kept that in mind, and I’ve been watching the chart last few days. The real test to prove if it’s “for real” happens soon with SPG coming into strong resistance at $156. Not only is there prior supply there looking to break even, but you have a sloping 50day moving average converging at this same spot. SPG holds a 8.83% weighting in the IYR ETF and as a market leader in this sector you don’t want to see it fail here. If you go take a look at what the major components of IYR ETF is you get the following:

We all know tech fucking blows right now and it’s been nothing but a pain trade yet the market is still up. Taking a look at those components in this ETF some of the charts are showing better price action with increased volume (great!).

PSA (SLOPPY CHART, BUT COULD BE START OF SMALL BOUNCE)

SPG (REAL TEST OF STRENGTH AT $156 COMING UP)