A Golden Opportunity?

Unless you were under some kind of rock for the past year, you well know that gold has been rising to new highs. Many so called gold experts are shaking their heads wondering why gold hasn’t stop rising when they said it would $100 ago! So instead of trying to call the top, why not ride gold all the way to $1000? I have to admit, I do think all the metal stocks are destined for some major correction, but everytime that correction doesn’t happen more and more people jump in sending stocks higher. With that in mind, I’m looking for a buy on the dips scenario- we just missed one this past Thursday.

There are a few ways to play Gold. There’s the dependable gold ETF streetTracks Gold (GLD):

There’s “the world’s lowest cost gold producer and one of my favorites, Gold Corp (GG), which is reaching new highs while paying some dividends. Look at that volume!…

For those of you who don’t care about risks, there’s the highly speculative stock that trades over the counter, like Western Goldfield (WDGF) where all their eggs are in one gold mine named Mesquite located in California…

But for now, I’m going for a company that has a lot of upside but not as much risk as WDGF. The company I’m talking about is Eldorado Gold Corp (EGO). Don’t you just love that ticker? So why go for EGO? Because they are well positioned to grow and they are well diversified in different parts of the world. A brief look at their website will show you that EGO has mines in Brazil, China, and Turkey. How much are these mines worth? Here’s a breakdown of their reserves:

Brazil (Sao Bento) 95,000 oz

Turkey (Kisladag) 5,846,100

China (Tanjinshan) 1,115,000

At a gold price of $633 per ounce, that makes EGO’s reserves worth $4,466,448,000. Wow! These guys are well well well positioned for growth! In fact, of all the gold companies out there, EGO has the highest rate of growth for a 5-year period. I ran a screen through Yahoo Finance which can be found here. But that’s the gold in the ground. We next must ask how much gold is EGO mining? The company forecasted for 2006 is 231,500 oz, which equates to revenue of $146,539,500. What?!! Last year’s EGO’s revenue was only $35 million. That’s an incredible jump! It’s so huge, I probably will have to dig deeper to find out why. But there is one huge catalyst that could explain all this. EGO, today announced operations underway in their mines in Turkey and China. How else can I put this? Well, for those of you who have experience with investing in pharmaceuitcal companies, you know that all it takes is a few blockbuster drugs to put them on the map. I think the mine in China, Tanjinshan and in Turkey, Kisladag, are “blockbuster mines.” It’s been a while now for EGO to produce positive income (they have a horrible net profit margin), but I think we can forgive them for finally nailing huge mines such as Kisladag- remember, we only like to see companies sacrifice current income for future growth. Hey! EGO has got major growth! I also forgot to mention, EGO has zero debt. Here’s a quick technical analysis on EGO, which has had a nice run so far:

Right now the stock is testing resistance at $5.69. It’s nice to see that the old resistance at $3.73 has now become the new support- a key bullish indicator. Currently the stock has been consolidating within this range, but what I’m looking for this coming week is how the market will react to the latest updates on their mines… this could be good enough news for a breakout to $6 zone.

BottomLines:

I like EGO for their growth potential, and their global presence in red hot countries like Brazil and China. If everything goes well as the company so optimitically plans, then the company should turn a profit for 2006. As long as gold continues its run to $1000, we can expect EGO to be positioned for a whole lotta profits.

———————————————————–

Has Anyone Noticed the Rise In Copper?

Earlier I wrote about Gold, which is no doubt stealing the show. But what about base metals? If you visit the authority on metals- precious, or base, at www.kitco.com you will see that almost all metals are rising. Some metals, like copper and zinc have already rose more than 30% in price in the past two months! Why isn’t anyone talking about it? Well, I think everyone has been fixed on the glimmer of gold. Go to this site and see for yourself the crazy crazy CRAZY rise of copper. What is going on here? Remember, copper is used in all kinds of applications- from construction (ie, China is the biggest consumer), to technology.

Hey, What About Uranium?

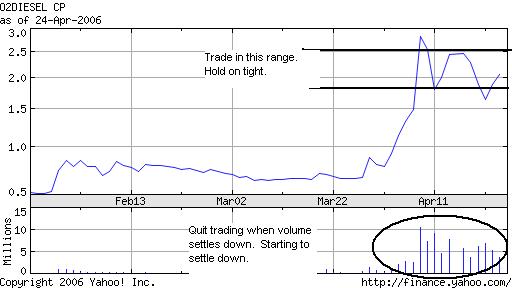

If you are investing in companies like Fronteer Development Group, be sure to keep a close eye on the spot prices of uranium. Again, you can find it at http://www.kitcom.com . But for now, feast your eyes on this remarkable chart which tells us uranium = demand. Truly, you don’t see this everyday…

Comments »