I am outside of Borders right now, and I have some pretty good free wireless! Anyway, the month of May started off quite interesting. If you noticed the day charts for major indices, there was a significant sell off in the final hour of trading- not exactly a good sign for tomorrow. Also, many other high volume stocks saw a similar sell off too. This end of the day melt down occurred on news that the market was “misinterpretted Bernanke’s comments on the end of rate hikes.” Clearly, Bernanke is not doing the greatest job. But at least we can profit from all this uncertainty through investing in hedge items like gold and silver!

If you haven’t noticed, our China pick BBC took a major major hit today… just yesterday I mentioned that our Chinese stocks were under pressure (see yesterday’s post). The drop was hard and fast, which gave us an important lesson- protect your capital. One of the best ways to do that is to set stop-losses. Usually I keep a mental 5% stop loss, but a better strategy would have to set a trailing 5% stop loss or a permanent 7%-8% stop loss. Mathematically, a 7-8% stop loss is the optimal point.

Marketwatch/Articles I’m Reading

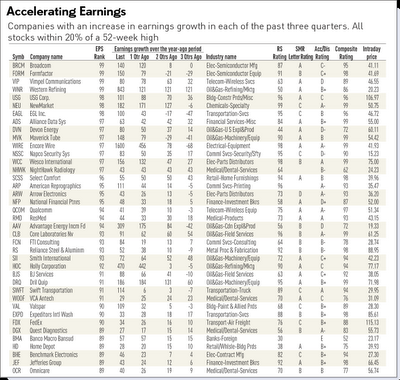

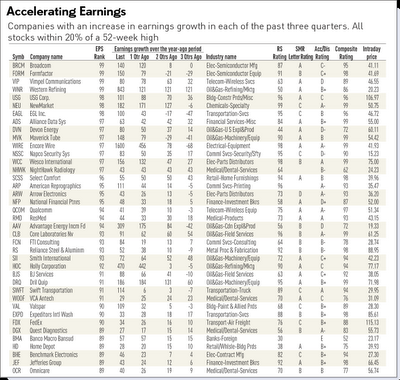

IBD’s Accelerating Earnings Stock Screen

Check this screen out by IBD! There are a lot of good stocks in the screen. I really like screens because they cut your work in half or perhaps even by ninety percent. Think of this screen as finding a gold mine- now all we have to do is dig around to find the gold! If you find one, let me know.

Hmmmmmmmmmmmmmm. It’s very tiny isn’t it. Grrrr! That’s what I don’t like about this blog. I’ll post it on another website tonight.

REVISITING CARBON FIBER

Back by popular demand, I will be posting a small write-up on carbon fiber tonight. Ron and I plugged in Zoltek (ZOLT) into a future stock price calculator derived from earnings and P/E. The calculator priced ZOLT at over $300 in 5-years!! Huh? That’s a 1000% gain. Ha!

Changes To My Site

I have a few charts with technical analysis, but I will post them on the other webiste, My Trader Notes. Link is on the toolbar to your right. I’ll do that tonight once I finish studying some accounting. I have 3 momentum picks, and 1 bulletin board stock that is ready to take off.

Comments »