At some point in the year, you will come across a stock and say to yourself, “How the f#$% did this thing move up 100%? How come I was not aware?” Probably because you do not know how to screen for such names or are too lazy. Sorry but this requires some heavy lifting or work.

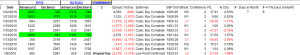

Each Saturday, I review the list of stocks up year to date. At the rate we are going, it is going from a 1-2 hour exercise to a 30 minute jaunt.

What I noticed this week is that most of the names I found up year to date were either restaurant stocks or retailers. Very few tech or healthcare names and no financial names. The lack of diversity is telling. So what tickers were of interest to me?

They are as follows: NDLS, M, ZUMZ, WING, FRGI, SAVE, ABX, TWX, KONA, SSW, CPB, DLTH and VCO. Why these names? Because I know the current story on all of them and just need to drill down more.

This gives me plenty to opin on over the rest of the week. From these names I will figure out names that have heavy short interest where the shorts are “dumb short sellers”. Then I will analyze earnings and revenues to see which of these names actually has an ability to grow. Last, I will analyze who owns these stocks and is recommending them to investor.

Basically C-A-N S-L-I-M for those who follow IBD or William O’Neil.

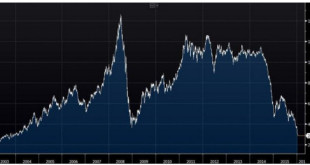

P.S. I am not of the camp the world is ending after today. Rather we are going to be extremely volatile for much longer than most think possible. More on this as we see this week play out.

Comments »