This is a new column that will appear each weekend. It is called “The Week That Was”. For the past several years, I have been writing “The Week Ahead” (TWA) so this is a natural addition to TWA. The goal of this column is to give a different twist on what just happened.

The past week was a shortened trading week as markets were closed around the world for Good Friday. In the U.S., the bond market closed on Thursday at 2:00 p.m. This helped the U.S. stock indexes climb higher in the last two hours.

However, for the week stock indexes were lower across the board for the first time in six weeks. For the S&P 500, it fell -0.67%. The Russell 2000 fell -1.73%. Each week I track the spread between stocks with a strong technical rank and those with a poor technical rank was rather wide. Stocks with strong relative strength lost on average -2.22% and those with a weak relative strength lost -1.63%. The conclusion is that investors and traders were locking in gains, playing defense.

Intraday action was weak for the first time in six weeks. Our confidence score on the intraday action was 33%. The range is typically between .10 and .90. Also, the advance decline 10 day moving average for the week dropped from 652 to 403. While positive, this is notable deterioration since March 4th when the peak for this current cycle was hit at 1,490.

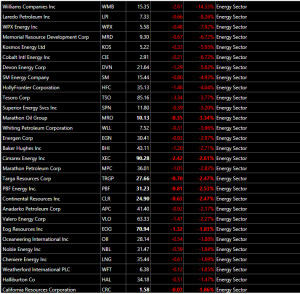

The only sector to put in a strong week was healthcare as it rose 1.4%. The worst sector was basic materials that included energy and materials. It fell by -3.5%. For the month there are no sectors in the red.

As such, the big worry for this week is whether profit taking continues with four days left in the quarter. When stocks move lower, typically treasury bonds moved higher and that happened in the week that was. Corporate bonds had a solid week rising 0.27%. High yield bonds fell by -1.17%.

A week ago Wednesday the U.S. Dollar (UUP) fell the day the Federal Reserve Open Market Committee (FOMC) announced its latest interest rate intentions. UUP then bottomed on Thursday and has been rising since. If the dollar strengthens, then that will become an issue for stocks. Watch this move closely.

Emerging markets (EEM) fell by -1.97% last week. Meanwhile Europe (EFA) fell by -2.00%. China (FXI) also had a poor week dropping -2.79%. On Thursday night, China will release its latest Manufacturing PMI data.

Conclusion: Last week was worse than what the headlines would lead you to believe. Caution is advised as we head into the last week of the quarter.

Comments »