The rally that began on Tuesday, June 28th is quite simply the most hated rally I have seen in my 30 years on Wall Street. Why?

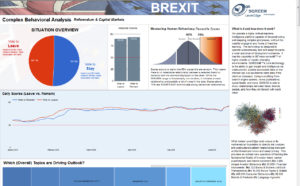

Quite simply all the “smart money” moved to the sidelines in front of the Brexit vote. Merrill Lynch reported that cash in accounts was 5.7% at the beginning of July, the highest level since November 2001.

Hedge funds cut exposure into the Brexit. Then when the vote failed, they sat froze. They did not short on Friday and Monday (June 24th and 27th). We know this with the latest short interest data just released tonight. NYSE fell -0.38% and NASDAQ rose 0.73%.

They did not get long for the rest of that week, June 28th to July 1 and now are playing catchup. They have to chase if they do not want redemptions for missing a 15% or 20% year.

Let’s move on from the hedgies to the illuminati. Alan Greenspan should have been playing shuffleboard at the old folk’s home instead of proclaiming this would be a worse outcome than the 1987 stock market crash. Seriously why is he not fishing the Keys? Ditto other Federal Reserve and Central Bank experts who proclaimed the world was going to end. At this point, they need to “shut the fuck up and be put to sleep.”

Who thought that the British would have a new Prime Minister less than two weeks after the Brexit vote? The answer is no one!!!! The British Pound might be the buy of the century now as they cut the umbilical cord from the European Union which at this point is nothing more than the European Disunion. The United States could learn much from their political process. Short and sweet is what people want.

Back to the hedgies. They are trying to get their talking heads to talk down the market so they can get invested. Carter Worth(less) comes on CNBC day after day to say this is madness. No madness is him getting it wrong all year long. There are others.

Just tonight I read Scott Redler of T3 said a 75 point move on the S&P 500 is too much. Really? The funny thing is I respect this guy but cannot for the life of me understand what is going on here now with his thought process.

Since the fourth quarter of 2012 average up move is 139 points or 7.67% and we are up 151.60 or 7.58%. That is the average move. Since the fourth quarter we have seen four moves above 10% lest we forget (11.37%, 11.59%, 12.12% and 14.94%) Instead we are in blast off or as I like to call it Buzz Lightyear territory, “to infinity and beyond” (thanks Fred Meissner for the term).

The S&P 500 and the Dow Jones Industrial Average have broken to all time new highs and the tertiary indexes have to join the party. Oh, maybe they don’t if the bears are right. Then again the bears are not having a good year and have lost control.

Symbology is everywhere. The other day a Spanish matador was gored to death by a bull!!! What could be more appropriate as we make new highs.

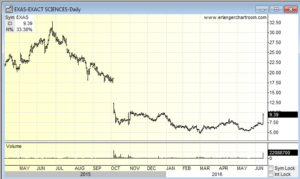

The long short boys are getting hurt here because they buy relative value and as such are buying crappy charts. Meanwhile, they are shorting valuation extremes that have good charts. We see how this will end. Can you say Ackman months!!

There is carnage everywhere and we still have Mark Carney speaking before the week is out. Beware Thursday and a rate cut from the BOE just to say the hedgies, “do not fuck with the us!” If Carney gets it wrong, then he gets a do-over in Canada on Friday when he speak a day later. Me thinks he learned this from Super Mario and Grandmonster Yellen who love to call this audible.

The answer to all this is pretty simple get long and enjoy the ride. Many cannot do this mentally but if you are long then stay long and enjoy the ride. If you are not long, then it is time to dip a toe in the pool.

That is enough for now. More later.

P.S. On Monday, June 27th in this blog, “The best advice I can give here is be careful on shorts and start to make lists of names you want to buy on the long side”. No one is perfect and we get calls wrong, thankfully much less than most (just read what we have written since Day 1 here) but this is not a time to be paying attention to those that continue to get it wrong. The Fly has done a good job this year and his bond call is epic. I remind you to listen to those that get it right like The Fly. Eschew those that blow call after call. Life is too short unless you are an Eagles or Cowboys fan and love the pain.

Comments »