Now with Charlie Munger out of the way, pray tell — why the fuck did you not buy Bitcoin? You’ve bought everything in the world BUT Bitcoin and it’s the one asset which proved to be both defensive and a risk on asset. This asset I speak of, mostly likely used for International money laundering, is +127% for 2023. What else has achieved such heights?

The oil markets are in fucking ruins. Biotech is an absolute clown show. The banks nearly shit themselves earlier in the year and if it weren’t for bailouts — we’d have no banking system right now.

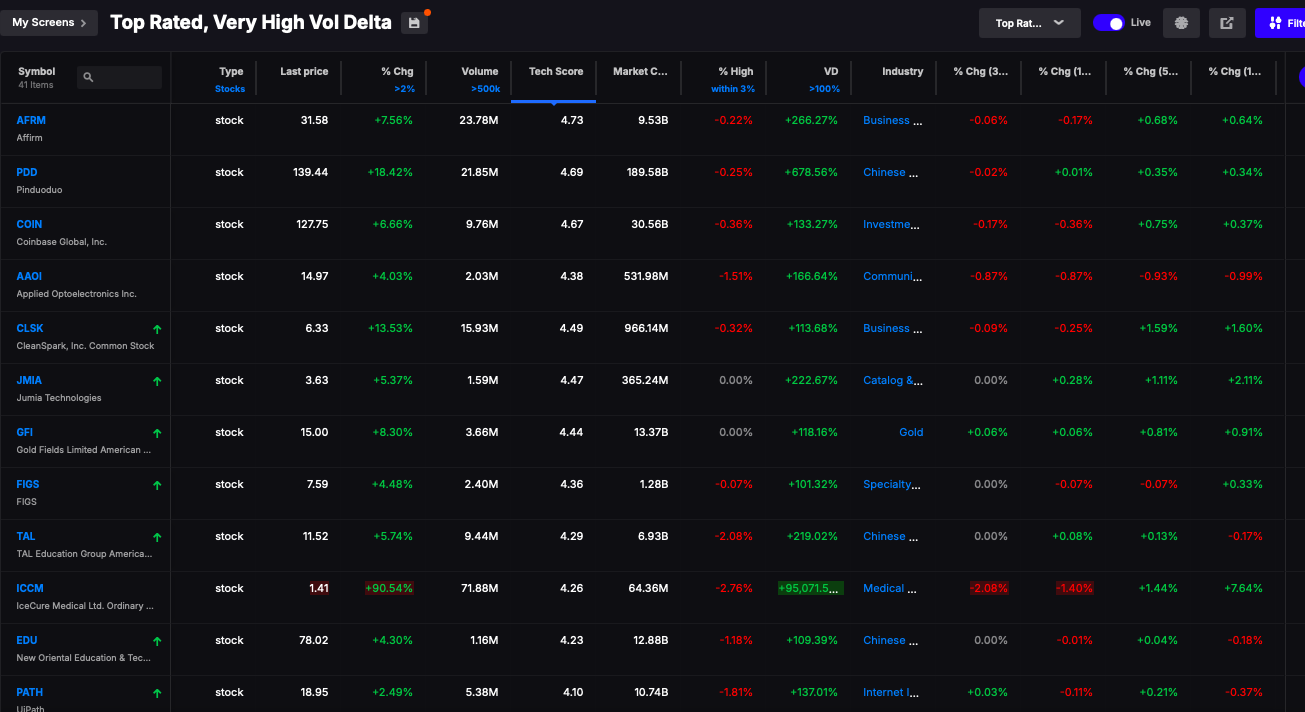

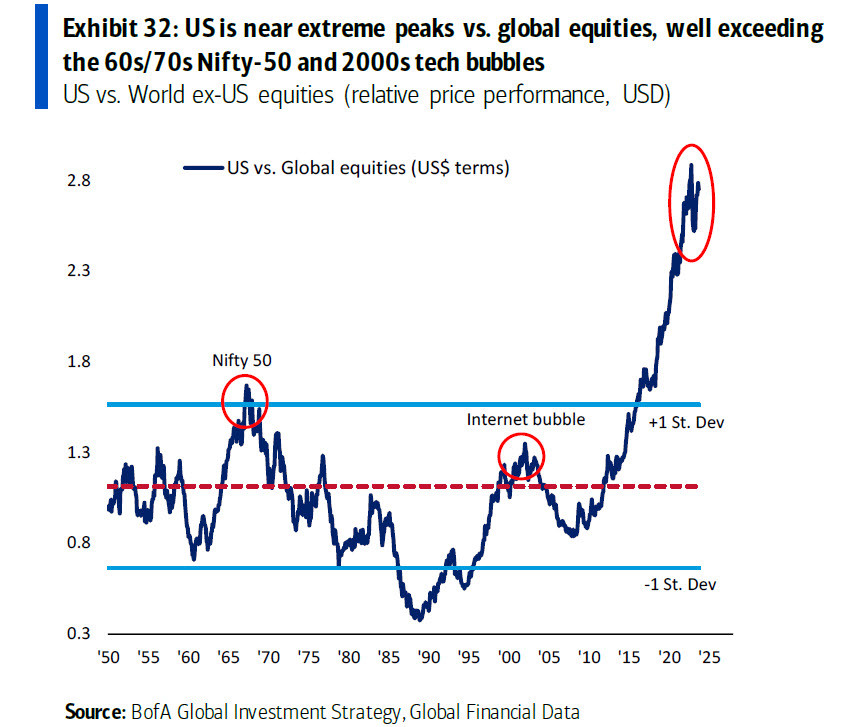

As far as I can tell, the only real outperformers this year was $BTC and large cap tech. But how comfortable do you feel with $AAPL into the teeth of a recession?

On the other hand, how comfortable do you feel about said recession going global causing central banks to further debase their currencies, causing CAPITAL FLIGHT in China — providing fresh buyers for $BTC?

At this point, you should give up on the notion that just Bitcoin is a scam. Sir – if you haven’t been paying attention — everything is a scam. It’s all relative and relatively speaking — Bitcoin is less of a scam than say the 2020 earnings for Pfizer and Zoom.

Comments »