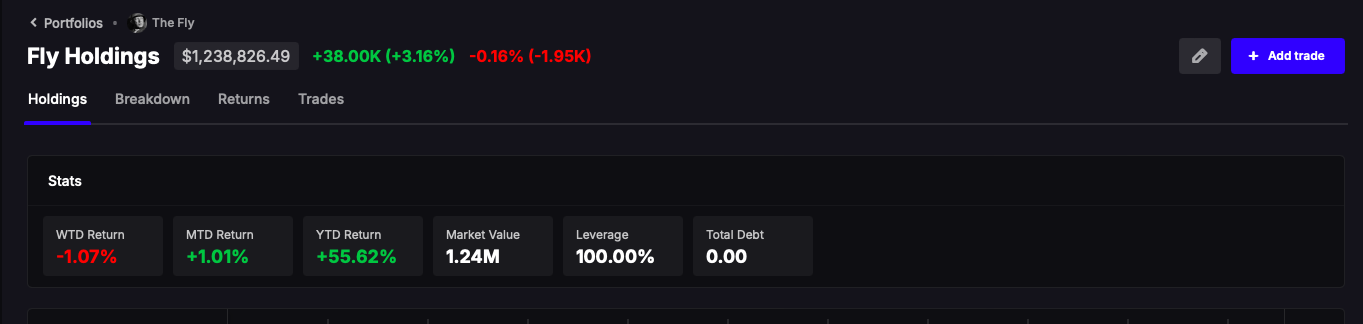

On one hand I sort of feel as if the gains for the year have been had, and enjoyed. On the other, I want more. I am cognizant of the fact that my desires don’t necessarily gibe with the future outcomes — but the trends has been higher and all bids are being bought.

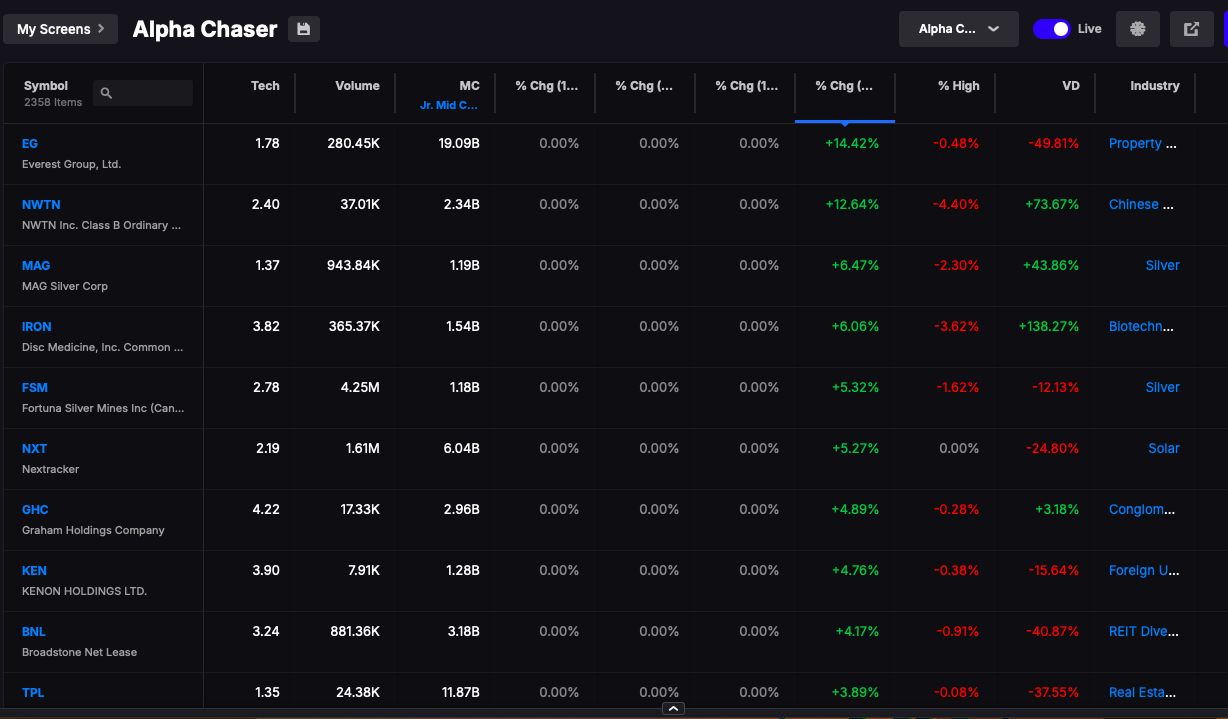

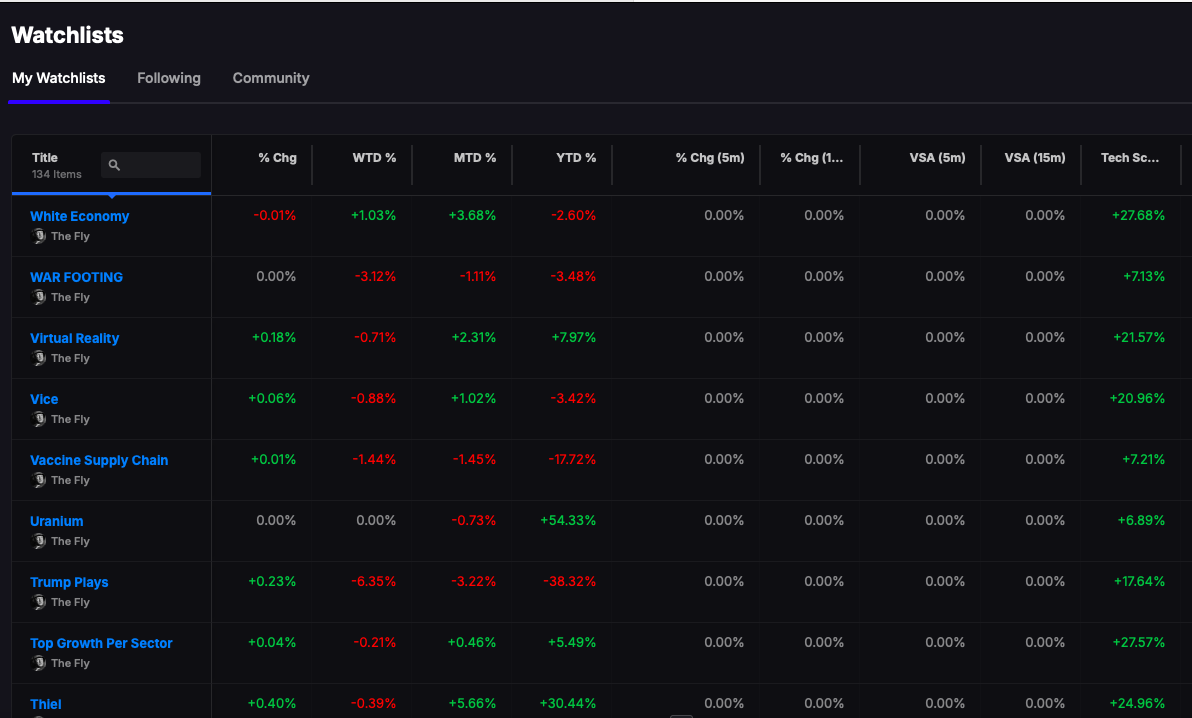

In the past week or so the breadth has narrowed, making it difficult to trade indiscriminately. The small caps have lagged and the truly degenerate stocks have been dismantled. This is the reason why I’m -1.4% for December. I’m not too worried about my performance, since the month is young and I feel good about my handle on this particular tape.

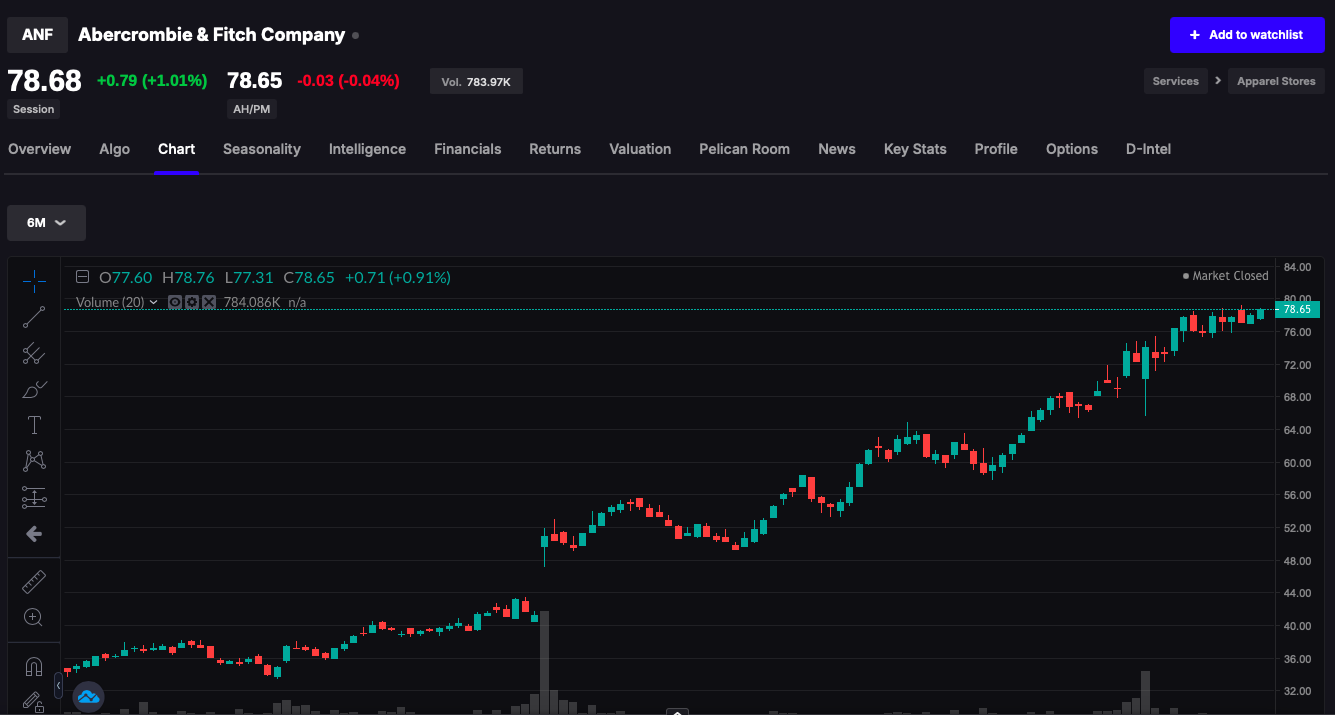

I closed the session down 14bps, heavily leveraged long without hedges at 115% of equity. I have soured on basic materials and now favor healthcare, risk averse, and select tech names. I do like certain retail oriented names, such as SBH and GOOS. We are of course in the middle of the Christmas shopping season and things appear to be doing just fine, unfortunately.

The tape is slow and methodical and many people are choosing to trade less — in preparation of the holiday down time. The year has been good — but not easy. I look forward to tackling the puzzle of the market in 2024 and beyond but before I do, damn it, I want to make another 5% from here.

Comments »