How apropos for the fiends in Davos, spending millions to be seen at the decadent splendour of the world economic forum, to have a real life crisis to discuss–and donkeypunch each other– over glasses of hot chocolate. As their helicopters descend upon the mountain resort, Dow futures drop by 300–making their shallow lives a bit more tangible.

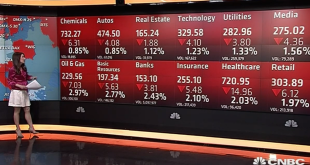

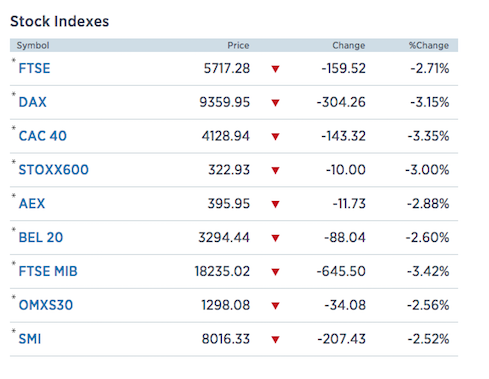

Here are some of the pre-market movers.

SDRL -11.8%, CHK -9.1%, VALE -8.6%, DDD -7.1%, BBL -6.8%, SUNE -6.5%, DVN -6.3%, BHP -6.2%, DOC -5.7%, FTNT -5.5%, SYMC -5.3%, MT -5.1%, AMD -5.1%, PBR -5%, DB -4.6%, HSBC -4.6%, IBM -4.6%, FCX -4.5%, MU -4.4%, IBKR -4.4%, RDS.A -4.4%, APC -4.3%, STO -4.2%, CS -3.9%, JOY -3.7%, BAC -3.7%, SLB -3.5%, TWTR -3.5%, C -3.4%, TOT -3.4%, AEG -3.4%, SSS -3%, BIDU -2.9%, BABA -2.9%, BCS -2.9%, JPM -2.7%, ING -2.7%, LYB -2.7%, RACE -2.6%

Look, I can’t recall a market this stressed since the dot com collapse, when we’d simply gawk at the screens in utter amazement and make fun of the prices of the S&P for delving into the colonial era years. We’d be so distraught over the capital destruction, the only logical course of action would be to get drunk during lunch and pretend we were all participating in a group nightmare–like from the movie Nightmare on Elm Street. The country was just getting over 9/11 and everyone was insecure about the future.

But what about today?

We have Fed governors more concerned with inflation than the trillions of dollars being lost in capital markets, not including the hundreds of billions that will be lost by basic resource bond holders. How can they be so stupid? Perhaps it’s by design. The real morons are the economists who come on the teevee and explain to us how QE failed and how “normalization” of rates is an absolute necessity.

The only necessity demanded of Janet Yellen’s Federal Reserve is to read the data and use some common sense when it comes to stoking the fires with incendiary comments– at a time when markets are in crisis.

Just like in 2008, the Federal Reserve is going to cause an economic crisis and then have all of us bowing to their greatness when they bail us out again.

Comments »