It’s official. SVB has been placed into government receivorship. All f this occurred, 100%, due to inflation and Fed rate hikes. Without the hikes, SVB would not have incurred billions in losses from their fucking treasury bond purchases.

This is what happened. Their cash reserves placed in treasuries tanked as rates climbed. In an attempt to extricate themselves out of the situation, they began moving from long dated to short dated and as a result realized massive losses.

This is not an issue unique at SVB. All banks have massive losses on their books, as a direct result of Fed hikes. The fact that most of SVB’S assets were uninsured is an entirely different story. But the fact remains: higher rates is causing things to break. Look at Schwab. That stock is tanking due to ‘cash sorting’ concerns aka customers transferring cash out in search for higher yield. This, coupled with stocks cratering, is a modern day bank run.

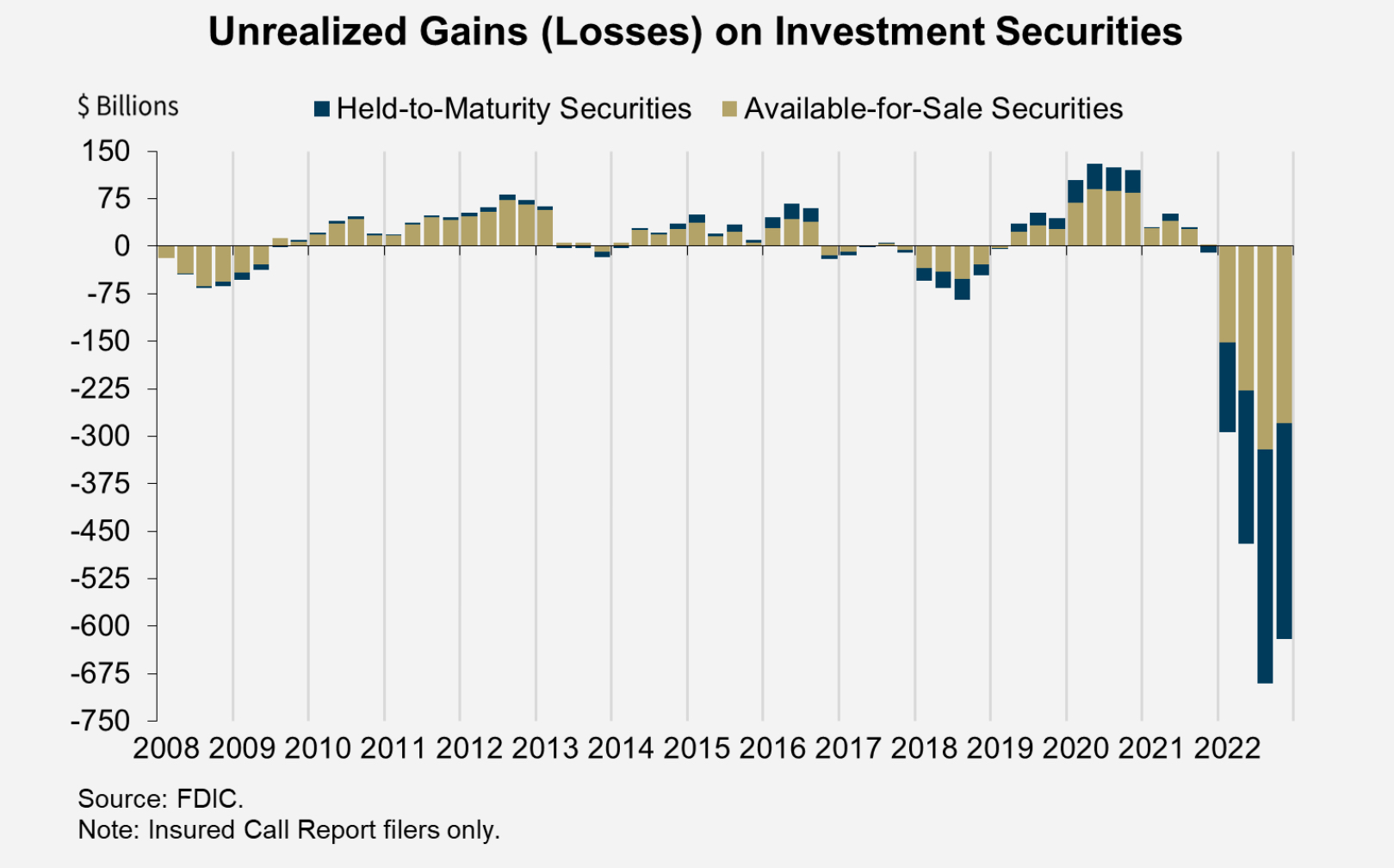

Banks are sitting on $300b in unrealized losses in treasuries. That number will skyrocket as the Fed hikes. We all knew this would happen and the Fed most certainly intended for this to occur, or at a minimum knew it would causes failures. What the government is likely to do is create some sort of scheme that will enable banks to hide their losses on treasuries held. This way we can pretend and just keep doing the same old shit — sending money to Ukraine, funding wars, and doing whatever the fuck we want in spite of the rather inconvenient annoyances like bank failures.

If you enjoy the content at iBankCoin, please follow us on Twitter

Here is the “Health” Rating on Silicon Valley Bank (Hint: it is an A).

https://www.depositaccounts.com/banks/silicon-valley-bank.html#health

Hilarious, SIVB ranked in Top 20 in Forbes list of Best banks, claiming 0.05% in non-performing assets

https://www.forbes.com/companies/svb-financial-group/?list=americas-best-banks&sh=53d6b9e2b0e2