Assessing the landscape of the market — the novice sees nothing but value — based upon a false perception from historically absurd valuations. The notion of a “new dichotomy” has been negated and we are quickly seeing things revert back to historical norms. Inside Stocklabs we track valuations and can tell you with absolute certainty — should the US economy head into recession there is substantial downside left in tech stocks.

The first line in the sand that comes to mind is the COVID 2020 lows, now 45% lower from present values.

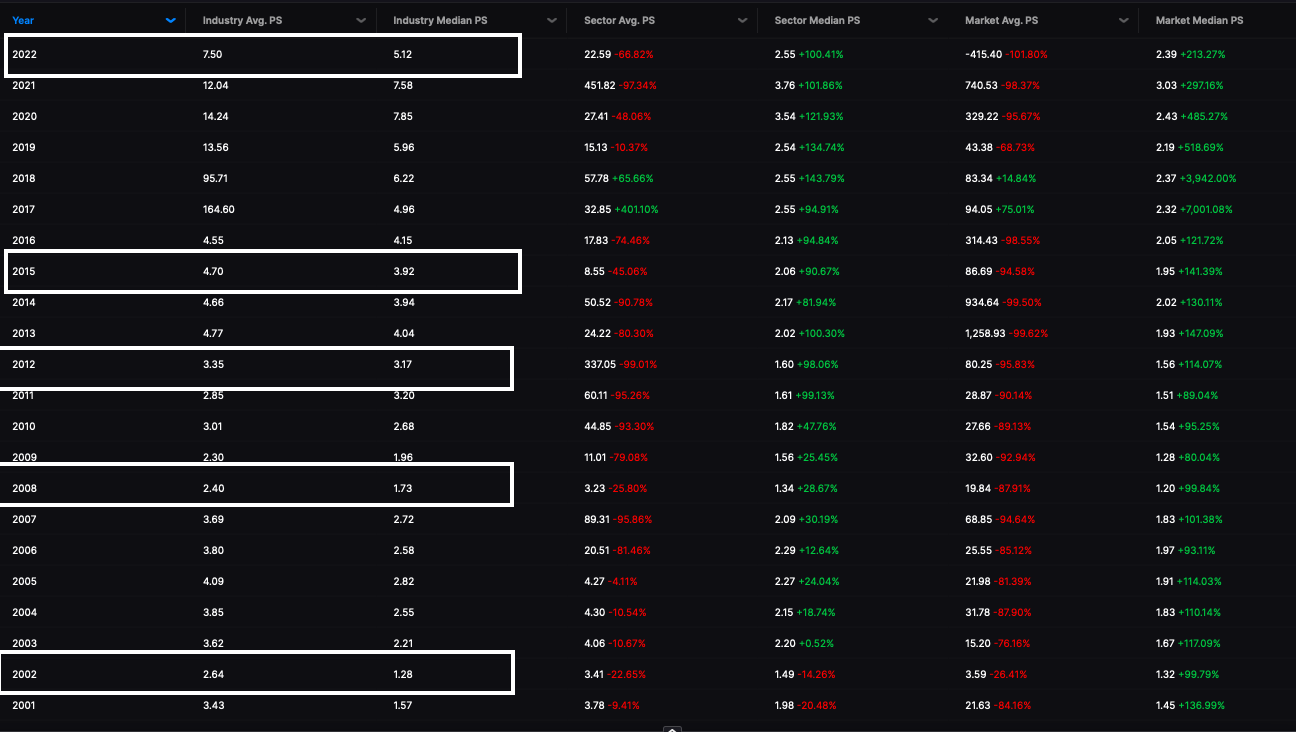

On a more substantive analysis, here is a table of the Application Software industry and their price to sales ratios over time. I highlighted the years where the tech sector was under pressure for comparison.

At a median price to sales of 5x, where is the value? The last time the NASDAQ fell this much was April 2002 when valuations were 1.3x sales. Granted, we haven’t seen revenues revised lower yet and once they do get revised lower the dynamics of valuation will look even worse. At 5x, we are assuming that revenues will continue to grow at 20%+ like they have for the past decade. Should we begin to get DOWNWARD revisions, we will also begin to see SHARPLY lower share prices.

I do not tell you this to scare you, but only to alert you to the fact that we are not in value territory yet and things can get much worse before they get better. I am in the camp that stocks should bounce from present levels, as we are extremely oversold and the mood of the market is decidedly bearish — which usually lends to a mean reversion bounce. However, longer term, shares of CRM, SHOP and your other favorite go to tech stocks will get CUT IN HALF AGAIN, providing the recession deepens and the war worsens.

If you enjoy the content at iBankCoin, please follow us on Twitter

Inflation will determine. The liquidity boom is verified dead but there will be bounces on what-have-you news. The die is cast even without covid and Ukraine and Pelosi and so forth.

Politicising war is repugnant, the headline and photo this morning was a step too far. Shame and no possibility of forgiveness.

Yep, and oil, gas and energy can run double from here, easyyyyyy peasyyy

Sadly, chances of the war worsening are guaranteed.

Thanks for the excellent analysis!

why are tech stocks and nasdaq he only thing hat matters? I personally don’t give a shit if they all go to zero. There are a lot of people crowded on one side of this boat.