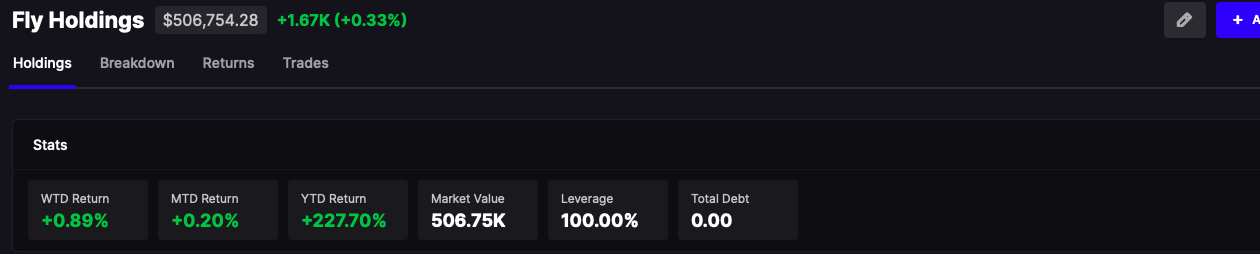

While you lost half your accounts this week, the evermore industrious and carefully plotting Fly made coin.

The purpose of this post is to boast, a celebration of my greatness. I am not here, nor have I ever been, to teach you anything. This is not a blog where you learn, but instead humble oneself at the feet of magnificence.

Ever since I was a small boy running around in the oil fields of Brooklyn, I dreamt of calamitous market turns lower. I recall when the market crashed in 1987, when I was just 11, being pleased by it. I was reading the newspaper and was delighted in the losses inflicted upon errant traders. It’s very simply, actually. If you lose money during a crash — you deserved it.

While some of us saw the little subtleties of decline before they happened, most did not. This is what makes a market and separates the great traders from the chaff. You being chaff should strive to be more like me — fastidious and hard working. Do not drink booze and visit the gym to lift weights 5 times per week and limit your consumption of carbs and fun. Life isn’t fun — but instead a never-ending toil by which we measure ourselves against others in an attempt to leave the world slightly better than before we had been born.

If you’re curious about what I think the market does next — FUCK OFF. I am not interested in sharing my innermost details of market timing. I will say, however, that the credit markets are stable and those seeking refuge inside SHITCOINS have been dispatched. We are not yet circling the wagons around our own grave, but instead flirting with the idea of getting in a very fast calash and driving it over the cliff unto the hard rocks below.

I was up 30bps for the session, +0.85% for the week — all trades furnished in RT inside Stocklabs.

If you enjoy the content at iBankCoin, please follow us on Twitter

I was working in my real job on 10/19/87 (crash day). Wild market swings started in mid-Aug.and picked up through September. I am starting to see these wild swings now. The futures (especially at 2 AM – having trouble sleeping at night cause I am getting old) are going a little nuts.The warning signs were there in 1987 and I stopped trading my Fidelity Sector funds (with hourly pricing) because I was getting nervous. The crash really started big time on the Friday before Black Monday and continued to Tuesday until about 10:30 or so when Prez Ronald Reagan and folks came up with the PPT (Plunge Protection Team) and started buying up the futures.

Gold looks interesting as everybody hates it and a couple of interesting developments ocurred this week. It was disclosed that both the Singapore central bank and the Irish central bank bought gold for the first time in decades. And they bought tons of the stuff for the first time since 2000 (when it bottomed at about $280/oz) and 2009 for the Irish.

The Fed is behind the curve and will be for a long time.

Stay nimble.

“The purpose of this post is to boast, a celebration of my greatness.”

Alexander the Great said something similar right before he perished at age 32 and faded into obscurity.

Your legacy is only as great as the good you accomplish before you are buried. That legacy is not measured in $$$ signs. Ask Steve Jobs who was known to ask “what good is it to be the richest man in the cemetery?”