I get a lot of emails asking me to describe position sizing, methodology and/or process by which I partake to trade well. There isn’t one way to trade. We all have our tools and instincts and methods, none are better than the next. The only thing that matters is the net result. I have found, through years of trial and error, the only way to permit my natural talents to shine is by preventing blow ups. I had been prone to blow ups because I like to take outsized risk. A long time ago, I stopped trading speculative stocks in an effort to prevent large drawdowns. But that was not the remedy for my disease. Position sizing was and is at the core of all trading errors. You can be the best trader in the world and get caught flat in a bad news release or black swan/unforeseen event and get washed out of the market.

This event will break your confidence and make you believe you’re not a good trader — because, after all, you blew up. But the only reason why you blew up had nothing to do with picking stocks. It was the sizing of those positions that was wrong.

I do not think people should trade with less than $50k in their account. You can get away with $25k, but nothing less than that. If you do not have $25k, build up your account over time and be patient. Reason being, pikers tend to minimize their account values as ‘nothing’ and gamble with it, in a foolish attempt to ‘turn nothing into something.’

My position sizes are always 5% with a maximum of 15% and the max is rarely taken — only during periods of high conviction. Losses are more or less stopped out at 10%, but more frequently much less than that. Each position should be considered every single day and if you would not want that position to be started today — it should be sold. I never trade with a bias, always malleable to the point that people think I’m crazy — long and short, sometimes both at the same time.

Lastly, and this is an important one, I never look at my account value and extrapolate cow-eyed plans for it — saying to myself ‘well if I can achieve these returns over the next 10 years, or 6 months, I will have X amount in my account.’ Fuck that. Most people fuck themselves by making plans with their money. They let gains or account sizes get to their heads and start to treat the money differently. If up big, you get cautious and trade like a pussy. If down big, you trade like an even bigger pussy. The size of the account should not affect your trading. You have rules and methods, stick to them.

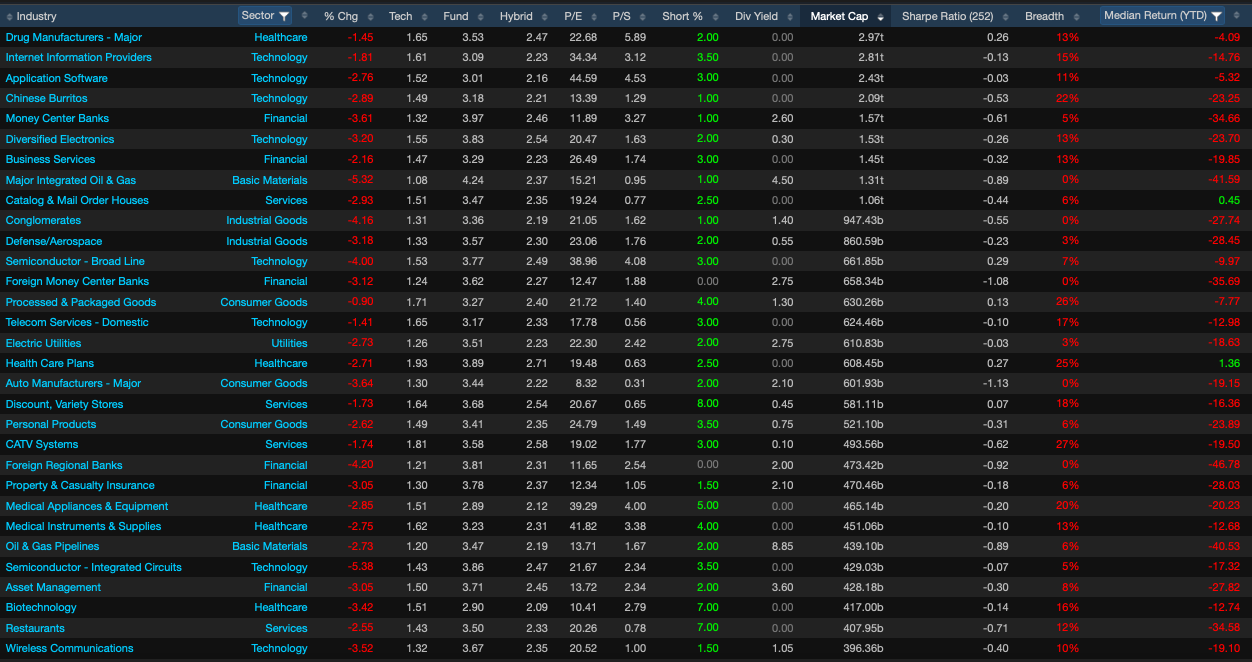

On the issue of where the market is going next. We’ve had some really big gains the past month — up 50% or more in many industries. But stark losses still exist and we’re only one major leg lower from feeling the pangs of this shut down again.

We’ve had a nice symmetrical lift off the lows and now we’ve broken lower. Can we regain the trend line or have we started a new leg lower and resumption of the bear? Stay tuned.

If you enjoy the content at iBankCoin, please follow us on Twitter

one of your best posts ever-

Not one of the best ever.. but I will say very very solid info. The position sizing was on my mind and it’s been discussed before. Really helpful and very true. If it wasn’t for position sizing, I’d be blown out years ago. And I really wanted to go all in. That is a gem alone that should be a takeaway for any trader of any level.

Agree. Always remember this. I’d like to know a little more about how Fly, or anyone handles their tax situations, regarding putting profits aside for the IRS. Any tactful ploys?

People trade out of boredom and ego, not profit.

Solid

Praise Lord Fly teaching a motherfucker how to fish

tl;dr …size matters

She said… XD

Shorter Fly: “My favorite drink is a White Russian made with freshly squeezed man milk”

Another reason to have at least 25K (more would be better-at least 30K) is in the event you end up reluctantly or intentionally become a pattern day trader per the SEC rules. Many times one starts out with a trade and during the day ask yourself,”What did I do. I want out.” If you do 4 or more of these of these within a 5 day business period you better have the account equity.

My own opinion is that you shouldn’t be trading anyway unless you have much more $$.

One needs to go to work, contribute 100% to a matching 401K and if you have leftover $$ just dollar cost average into core etfs (the type depending on your age) and make adjustments every once awhile being aware of the tax consequences.

Trading is not for most people.

Real talk, Mr. Fly. Robin Hood traders should perk their ears up.

Solid article with solid advice and personal experience.

good stuff fly

Great fucking post. I got the feels a little bit here.

I’m not a trader and have everything in gold. Companies left standing will cut out 401K matches with the market at best going up to 4000 and then into a 1930’s 1970’s dead cat dead end. The Fed’s balance sheet goes to 50-100 trillion to prevent foreigners from selling treasuries. Will they succeed?

so no long term portfolio? DRIPS? 100% day trading or multi day? not even swing trades?

No more prudent investing talk around these parts. Paranoia spread faster than the virus.

American people never trusted their government, now they do. And government workers are delighted; they are getting incentive payments on top of their paychecks. Lets calm prevail over the land. Amen.

People had a great distrust of vaccines, now they demand them

I am long airlines, let’s see if WB was priced in?

We’ll see how that works out tomorrow. Maybe a good long term play if you trust Uncle Sam will keep the industry out of BK. Boeing, airlines, car rentals, hotels etc all have a symbiotic relationship. WB has no confidence as an ongoing concern.

https://www.breitbart.com/economy/2020/05/03/crowds-gather-atlanta-mall-buy-air-jordans-after-lockdown-lifted/

Narcist spotted spending his stimulus check. Stay safe!

No thanks, not a Jordan fan. And I gave the money away.

Are you going to upload a new post soon? I just started writing a reply to another poster.

I remember someone (peaches?) asked me about how my scalps work a few days ago, and whether to use his scholarship to study engineering or something else. I didn’t have time to reply but I do now, so here are my thoughts:

The basis of most of my algos is similar to Kinlay’s stuff:

http://jonathankinlay.com/2018/09/the-mathematics-of-scalping/

Here’s a short bio of Kinlay:

https://www.wikiwand.com/en/Jonathan_Kinlay

So you should at least study for a math minor if you want to be able to understand how things are done. (I use much more actuarial and engineering math than Kinlay; he does more econometrics.)

As I’m typing this, we’re just about 2 hours into the overnight session (8:05PM). My algos have already produced more than $4000 of gains on roughly $10000 maximum drawdown–I frankly don’t think Kinlay’s products work nearly as well.

Here’s the trade log of all my automated trades in the last two hours:

https://primapad.com/05032020

3 hours in and brung in almost 6 stacks:

https://primapad.com/05032020upated

I understand that it’s possible, however unlikely, to reverse-engineer the algos with the trade log. So that’s all I’m showing publicly.

Brung? Is that some Georgia hillbilly bad grammar?

Narcists sunday- I done brung in my stimulus check to da Nike store

I prefer saying brung. Excuse my word choice.

Also, the log is in pdf so you sour grapes don’t get to edit it:

https://www.scribd.com/document/459722649/05032020-Updated

Vanguard trades for me. I don’t lift a finger.

No more screens, charts, sipping coffee at a desk, bananas and diet coke, not getting up to go to the bathroom, sandwich for lunch. What a joke.

Monthly analysis is good enough.

Agreed, I’m doing less and less of manual trading for the same reasons. Got more important things to do with the time.

Waking up at 6:30 in the morning for market open on the west coast. Checking overseas indices and futures after market close. It never ends. Time and sanity are also currencies.

Oil setting up to be sub-$30 through May 2021 now…

SPY rolls over at 300 and then the long slide down to 160 over the next 2 years with vicious short term term rallies.

Look at the SPY back in 2007 to the lows in March 2009. That was a ‘financial crisis’ . This is an everything crisis. The entire world is shut down over complete bullshit. Can’t pay your mortgage, car lease/payment or credit card for three months? No problem. We’ll tack that on to the end of your mortgage/lease/payment. Here’s $1200 per person courtesy of Uncle Sam and another $600 a month if you are unemployed.

Maybe a few acres in the country will be cheaper in a couple years.