Fed’s Bullard wanted a 50bps cut last week — due to “getting ahead of the curve”, the storm that is coming.

The US manufacturing sector “already appears in recession” and overall economic growth is expected to slow “in the near horizon,” St. Louis Federal Reserve Bank president James Bullard said on Friday, explaining why he dissented at a recent Fed meeting and wanted a deeper, half-percentage-point rate cut.

ZH:

Sure enough, as Goldman wrote in its FOMC post-mortem, “we took this as a fairly strong hint and now expect the Fed to resume trend growth of its balance sheet in November with permanent OMOs. It is possible that the FOMC will take that opportunity to also reach a final decision on possibly shortening the maturity composition of its purchases, which it discussed at its May meeting.”

And we’re off pic.twitter.com/fvtHiC7wOw

— zerohedge (@zerohedge) September 21, 2019

This is precisely what we said last Friday would be the Fed’s first line of defense, when we laid out what may happen after the dollar funding shortage arrives:

- repos, i.e. temporary ad hoc reserve adding open market operations,

- Treasury purchases, i.e. permanent open market operations, similar to outright UST QE only without a clear QE mandate (for now), and

- standing repo facility (SRF), i.e. a new facility that could “automatically” add reserves to the banking system when GC or fed funds reaches a threshold above IOER.

We are now at 1. If and when repo rates continue to rise even with the Fed’s repos in market, the Fed will have no choice but to launch either QE or start a standing repo facility.

For those who may have forgotten how repos work – which is to be expected in a world where all the excess funding was provided by QE – here is the explainer we provided last week:

1. Old school funding pressure lessons: repos & outrights

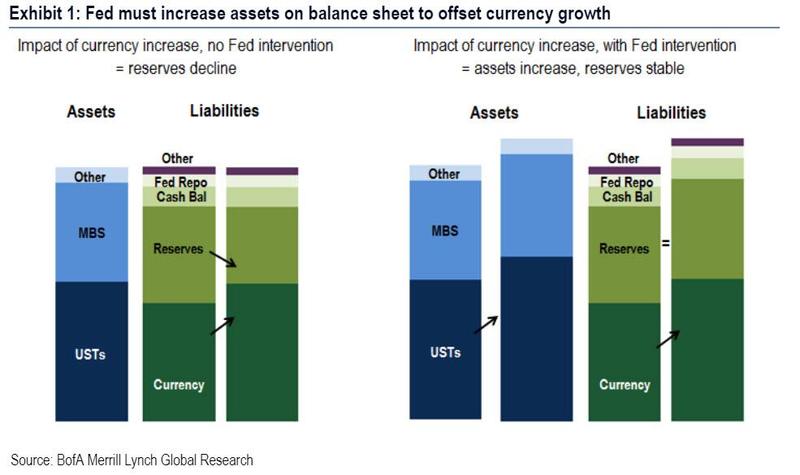

Pre-crisis the Fed relied on two types of open market operations to manage funding markets and their balance sheet: (1) temporary repo or reverse repo operations (2) outright UST purchases. Repo operations were used to “fine tune” the amount of reserves in the banking system to hit the fed funds target rate while outright UST purchases were used to offset currency in circulation growth. As a reminder, currency growth – of which we have seen a dramatic increase in recent years as the amount of $100 bills in circulation has soared – eats away at reserves in the banking system; this would pressure fed funds higher if the Fed did not growth their balance sheet to offset this (Exhibit 1).

-

Reserve adding operations: both repos and outright UST purchases have the same impact on the Fed’s balance sheet: on the asset side they increase SOMA holdings and on the liability side they increase reserves (Table 1). The only difference is that repos are relatively short-lived and unwind on an overnight or short-term basis; outright Treasury purchases have a permanent impact on the Fed’s balance sheet.

-

Reserve draining operations: pre-crisis the Fed only ever engaged in open market operations to drain reserves as a “fine tuning” fed funds management exercise. Prior to 2008 the Fed never engaged in any permanent open market operations to drain reserves (such as UST sales) since they only ever used this tool to offset currency growth.

Bottom line: Because of the pressure in the repo markets, the Fed are going to be forced to start buying bonds, ergo QE4. This might be feared at the onset, due to “MUH END OF WORLD”, but will soon be embraced as incredibly bullish for equities.

In short, buy stocks.

If you enjoy the content at iBankCoin, please follow us on Twitter

Buy silver.

We’re F’d.

You plagiarized Peter schiff.

Forget patience, QE 4 is coming: Peter Schiff

Tue, 17 March 2015

Fuck Schiff,

He has never been right.

React accordingly ignoring all preconceived notions and predictions.

(still trying to even approximate that goal so it is a motherhood statement of sorts)

i was making 2.2% in my money market. was already cut to 1.85% prior to the 2nd rate cut. Likely will now go down towards 1.5%. So the trend will favor a flow back into stocks.