For the past year, morons have been talking about yield curve inversion for fucked up time frames — but not to do with 2s and 10s aka the only yield spread that counts. Well here we are — INVERSION DAY — and faggots are out strong buying stocks with their cocks.

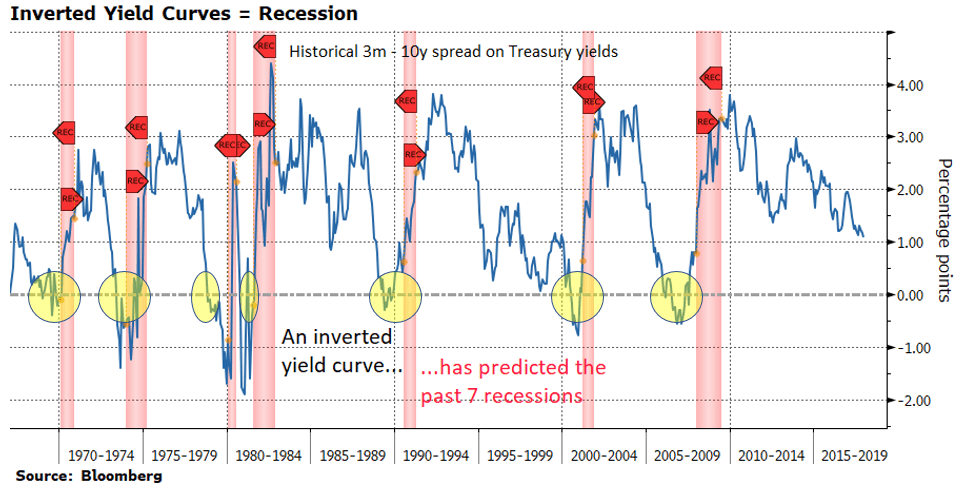

Bear in mind, INVERSION has predicted the last 7 recessions without flaw.

By my math, by next year this time you will be dying off the vine, thirsting for more QE dick. Today is a grande day for stocks — but it will not last!

If you enjoy the content at iBankCoin, please follow us on Twitter

Read this:

https://www.zerohedge.com/news/2019-08-13/recession-alert-ust-2s10s-yield-curve-inverts-first-time-12-years

“The fact that the Treasury yield curve has inverted at relatively low nominal yields, suggests that the interest rate channel is not producing the restrictive influences on the economy as it did during prior inversions and instead is actually providing a cushion (or stimulus) to the economy. ”

This means that the inversion is probably less significant as it was in the past. Before making a recession judgement, I would at least wait until Retail Sales come out Thursday morning (8:30am)

This time it’s different? How old are you?

then when I link you to your laughable ever changing forecasts , you answer in Capital Maiusculus Moron’ ” LIKE YOU KNEW LIKE YOU KNEW” uh ?