Big balled rally today. My gold stocks are getting lit the fuck up. Normally under such conditions, I’d consider getting rid of them. After all, this is a trading account, not a buy and hold. HOWEVER, I do believe lesser men sell gold here. I do believe that if you sell your gold here, on such a stupid fucking day, you deserve to die.

Also, I have just 1 inverse ETF on the books, everything else is long or in cash.

Regarding the cash, I allocated back into stocks about an hour ago — trades only given inside Exodus now — because electronics are apparently off the table when it comes to trade wars. Apparently, video game consoles are a matter of national security.

I bought an American name and several Chinese.

Do we hold these gains and build from here? Who fucking knows? But the timing of this bullshit news seems suspect AF, right when the 2s and 10s were going to invert — BAM! — out comes the USTR chicanery. My sense is you don’t bet against Trump’s stock market for an extended period of time. But he deserves a market calamity more than any President in the history of America.

That being said, shit looks good now.

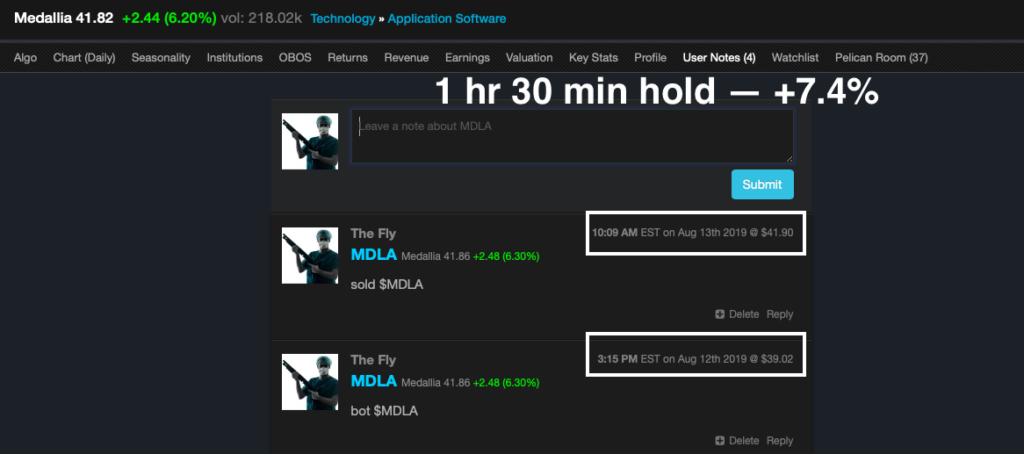

Yesterday’s overnight trade was MDLA — booked it for +7.4%.

If you enjoy the content at iBankCoin, please follow us on Twitter

Although the timing of this can’t be predicte, anyone that thought these tariffs would go into full effect without delay is an idiot. This is at least the 4th time items have been removed from the tariff list or tariffs have been altogether delayed.

However, keep your eye on the ball: are we closer to or farther from a Chinese Trade deal than we were yesterday, a week ago, a month ago, a year ago…

We have two egotistical dictators more eager for a win and saving face with their people than in any kind of economic accomplishment. Has either one showed anything but contempt for their middle and lower classes? Any sign of a bad deal will be highlighted by the US Press, which has a (undersatndable) dislike of both men, which means if one blinks, the world will know.

Politically, XI knows:

1) a continuing trade war will hurt Trump’s re-election chances

2) while some Democratic candidate (notably Sanders) have taken a hard line on uneven tarde policies, centrist Democrats such as Biden will abandon the war

It seems like China’s best move now is to wait while Trump weakens, at least until the Democratic nomination process nasrrows down. If a moderate wins the Democratic Nomination, then XI will not make a deal, instead watch the US economy go down along with Trump, and then make a corporate-friendly deal with the new Democrat President. If a progressive wins the nomination, then the decision becomes trickier for the Chinese

“tarde policies”

Indeed.

Also, although it gets annoyign when Fly constantly trumpets his victories while ignoring hi 180°s and losses, what peopel shoudl takeaway is that it is always good to hedge your bets. If all your positons move in the same direction, you are robably doing something wrong.

Remmeber Fly’s lessons:

1) Position size

2) Cutting losses and takign money off the table with winners

3) Hedging your positions

The prudent reason to sell or reduce a position is when the probability of further success falls out of favor, regardless of whether a recent move was positive or negative.

Simply selling winning assets to take money off the table is not optimal if the situation changes to favor greater future value in those assets.

As an additional thought exercise, imagine a hypothetical environment where dollars lose value and every asset loses dollar-denominated value. In such an environment, holding the asset that loses the least dollar-denominated value may well yield a gain in buying power.

Ultimately position size limits the worst case risk, not hedges subject to shifts in correlations, malfunctions, or implosions in the days of mayhem.

If you are giving advice, the first question to ask is: who’s your audience? Mine is the average investor, which is who the above post is targeted at.

So do you think that the average investor has the knowledge, experience, and expertise to quanitfy the “probability of further success” without bias towards fear or greed? Any investor that does, already knows when to sell or buy, and doesn’t need mine or your basic advice on this.

Also, you aren’t taking into account the fact that the data changes everyday. Most people can’t keep up with that, so a solid analysis can turn into a losign position before they can react to it.

Risk management is key.

BTW, for “hedges”, I’m simply talking nabout investments that have a low or preferably negative correlation.

Thanks Dr Fly for telling me I am a Big man with Big Balls really appreciate the support!

I always broadcast my losers you son of a bitch.