This isn’t a joke people. Laugh and masturbate all you want over a rigged market dominated by explicit central bank schemes, but this is the game changer. The collapse of Deutsche Bank is underway and it’s having a profound effect on other banks too, like Commerzbank and Soc Gen, just to name a few. I can’t even sleep right now.

Bloomberg's @MooreMichaelJ explains why there's concern about Deutsche Bank https://t.co/tC3RidtcI0 pic.twitter.com/KueEt1xwAH

— Bloomberg TV (@BloombergTV) September 30, 2016

Shares of Deutsche are collapsing, now off by 9%.

Germany’s second largest bank, Commerzbank, is collapsing — down 7%.

Soc Gen is off by 5%. You get the picture.

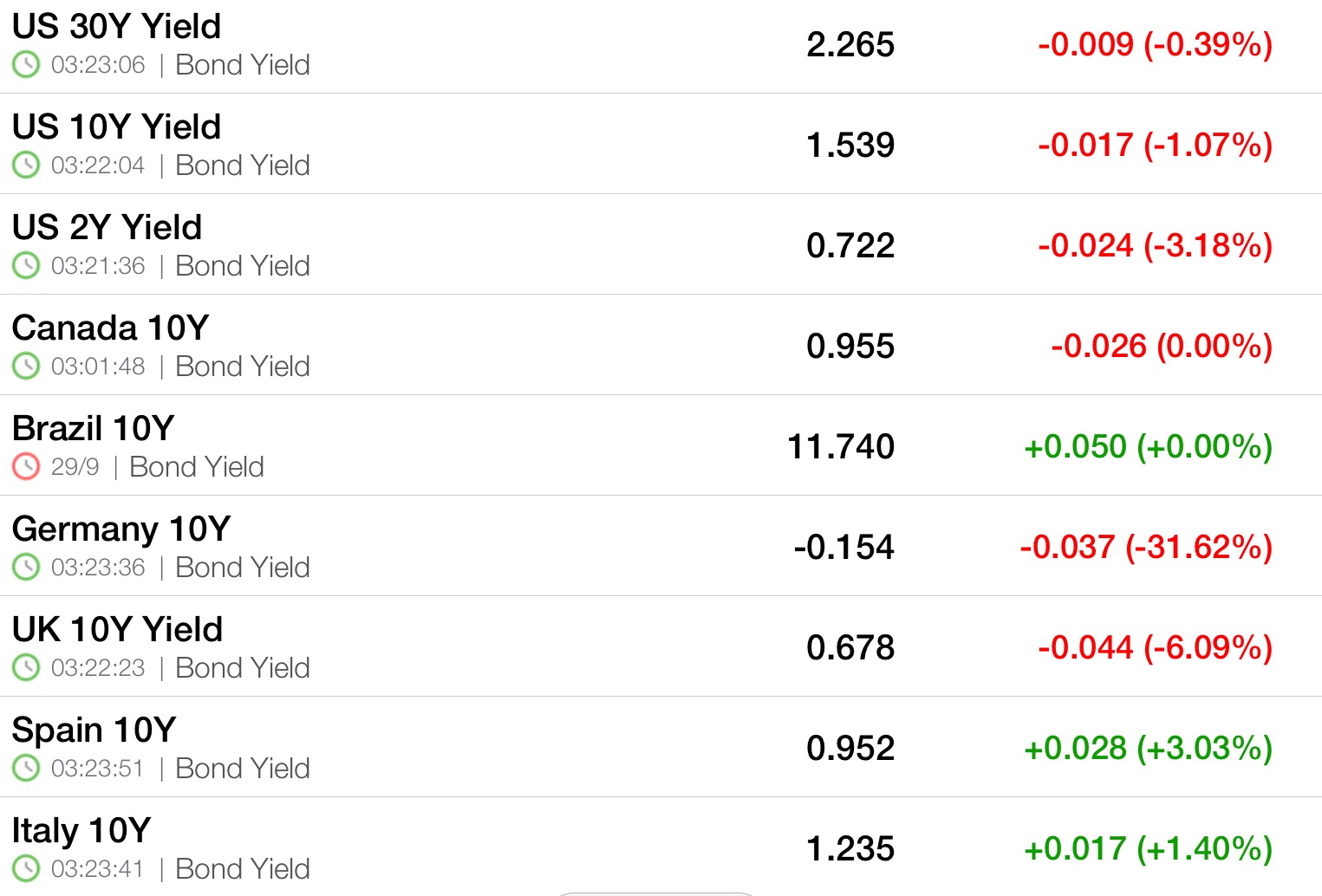

German and American yields are dropping like a stone, while peripheral Europe rise. This is a huge issue that will become front page news if it should continue.

Futures are down over 100 and Europe is down more than 2%.

If you enjoy the content at iBankCoin, please follow us on Twitter

Hi,

Question from a newbie.

If DB and other German banks collapsing, why would German Bonds be Bid (especially considering they are negative down to 15 years)? Surely the economic and political fallout from such an event would result in re-pricing of German risk.

Not to mention if the contagion hits rest of EU and there is serious risk of EU falling apart, first thing Germans would do if they had their own Central Bank back would be to stop the culture of negative rates and QE.

Thank you

Flight to safety. Plain and simple.

Thanks Fly,

But flight to safety in an instrument which may be re-priced on the downside?

I can understand flight to safety to US or UK bonds, but am finding it tough to get my head around fleeing to bonds in a country whose banking system is perhaps about to implode. Politically the fallout from German Govt having to save Db would be dire (they would then have to allow Italians, Greeks, and any other EU nation to be able to do same).

Apologies in advance if I am being too convoluted.

I think this below sums up my confusion, rise in sovereign risk should not equal a rise in the debt of that nation.

http://www.zerohedge.com/news/2016-09-27/deutsche-bank-fears-spark-buying-panic-bunds-despite-rising-germany-sovereign-risk

Or are we in an era where many traders long stopped thinking for themselves ie. Risk Off = Buy bunds with zero thought.

Shall stop thinking too much and just watch.

Thanks Fly.

Madness when large banks are teetering on survival, believe me, you will seek out the safest place you can to keep your money. (and even if you decide to bury it in your backyard there are all kinds of risk with that too) The thing with banks is technically when you hand over your money to them it then becomes their money! They give you a promise to give it back.

Where were you in 2008?

Cryan is cryin’.

Peso – Thanks for the reply.

I do understand what you are saying but again, why buy something that could well be re-priced downwards causing you even more loss when there are other options out there?

Lets say you decide to get in to the “safety” of 10yr German bonds. Should Germans banks implode, even if the Govt bails them out, is there then not a massive risk to possible German downgrade and fact that Germany may have to cut back on spending or issue even more debt. The political chaos that would ensue and the possibility of EU chaos. Why chase bonds in a region that is imploding? Why not UK or US bonds which are at least positive yielding.

Having said all this, i see the Euro has been stable through out all of this so perhaps until we start to see also falling hard, we should remain calm.

Perceived safety of money can turn in to a rabbit hole if you really think about it, but let’s just start with Germany’s credit rating is AAA versus USA’s AA+ (not to say rating services are the ultimate experts on credit quality). Doesn’t higher yield infer higher risk. Germany has about 2 trillion euros of debt, USA has 19 trillion dollars!

True, good points.

But US has an “independent” Central Bank which can print and provide assistance. as they did with TARP. Germany does not have this at it’s disposal. Whatever Germany does (or whatever the ECB may do to help Germany) it then has to make available to Italy, Greece, Cyprus et al. The political ramifications are more far reaching.

Should this banking crisis implode, I do expect a, “Oh crap – German bonds are massively over valued” moment.

Thanks again.

TINA, currency implodes, equity eviscerated but sovereign debt backed by German army.

TINA? Bratwurst + sauerkraut + beer. BBQ can be fueled with negative bond paper.

oh shit

futures down -0.2%

Bred it was going to be a game changer too. We will be at all-time highs again within two weeks.

Brexit, God dam iPhone.

Damn… Fuck it I give up.

It’s 2008 all over again….NOT.

thinking some Nov calls into this weekend for the government stick save.