President and First Lady Obama have filed and disclosed their 2015 US tax returns. On 2015 income of US$436,065, the Obama’s paid US$97,489 in taxes (the bulk Federal at $81,472) for a tax rate of 22.4%. Charitable contributions were a sizeable $64,000 (15% of their adjusted gross income) which skews the numbers considerably for those ready to skewer their tax accountants (you pay a lot more). The Illinois State Tax rate was recently as high as 5% but sunset back to a 3.75% rate as of Jan. 1, 2015. The Obama’s paid $16,017 in State tax to Illinois (3.7%).

There are many jurisdictions where state tax bite would have been a lot higher. NJ is a timely example, which has the 3rd highest taxes in the US (income taxes, property taxes, estate taxes and inheritance taxes). 40% of the NJ budget is funded by personal income taxes with a full 1/3 collected from the top 1%. The highest personal income tax rate is currently 8.97%. A special 10.75% millionaire bracket has been proposed but Gov. Chris Christie has vetoed repeatedly. Only a small percentage of the 1% have cement shoes, even in NJ, and they have lost a high profile golden goose to Florida for the coming tax year. NJ’s #1 taxpayer, David Tepper (58, has a net worth estimated at $11.4bln), has taken flight after 2 decades, setting up a branch of his Appaloosa fund in South Beach, Miami and listing his condo there as his primary residence. People can vote in many ways in a Democratic society and New Jersey should fully expect more to vote with their feet. Florida has no state income tax or estate tax.

I thought it would be instructive to show what the Obama’s 2015 tax bill would have been in other world jurisdictions.

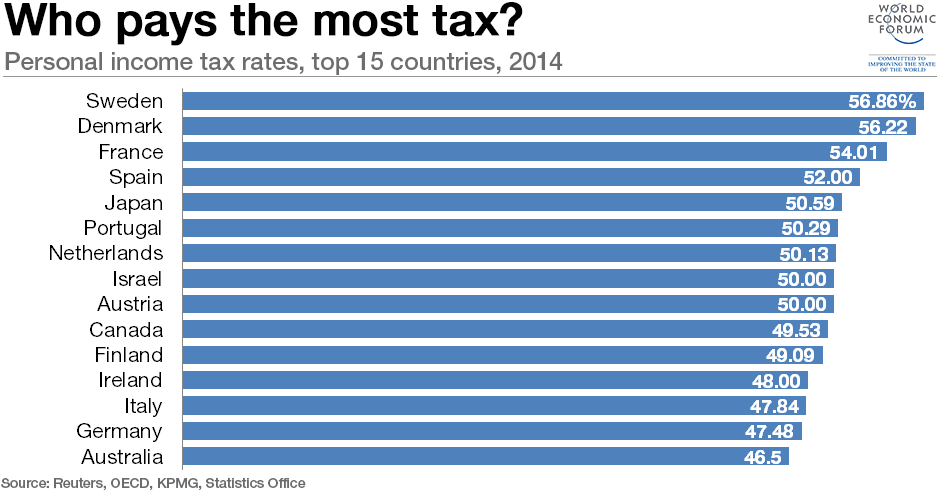

France up is first, Paris of course. Tax rates are very high. For the level of income the Obama’s report on their joint filing, France would extract $185,057 in taxes for a tax rate of 42.4%. Over half of France’s inhabitants pay no income tax. 14% pay 30% for EUR26,792-71,826 band of income and only 1% pay the 45% rate, applicable to income above EUR151,108. There is a 66% credit (up to 20% of income) for charitable giving which greatly reduced the tax liability in the Obama’s case.

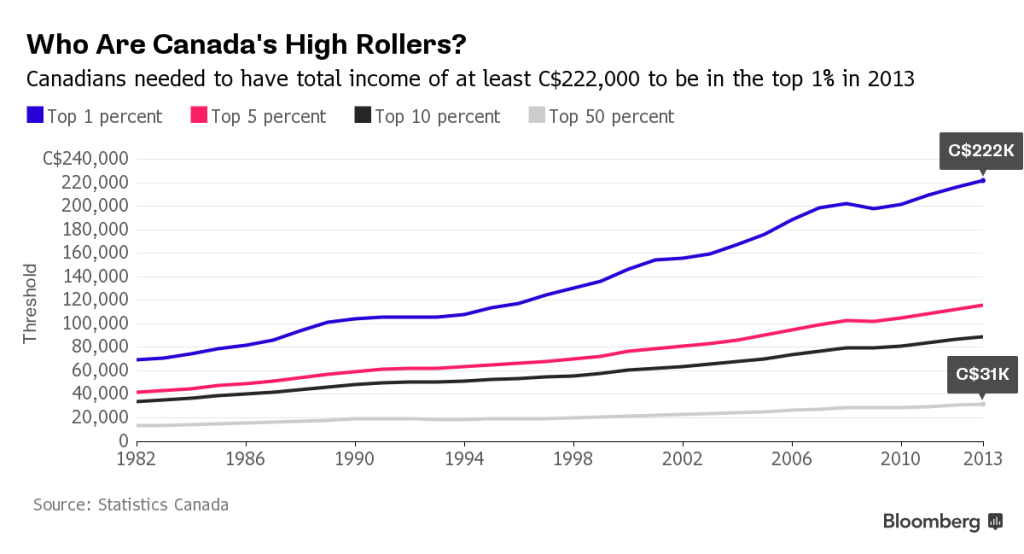

Canada is not far behind, but remember this analysis is for the 2015 tax year. The new Liberal government has raised taxes on the wealthy, defined as those making > C$200,000 (US$155,083) by 4% to 33% (Federal). Provincial taxes are high in Canada as well, with Ontario’s highest rate at 13.16%. Assuming the Obama’s hung their touques in Toronto, the tax bill would be US$165,179, for a tax rate of 37.9%, again tempered by the charitable donation of C$82.560. The top marginal tax rate in Ontario for taxpayers making > $200,000 for the 2016 taxation year is 53.53%.

United Kingdom, sunny London of course. The tax bill would be US$181,470 for a tax rate of 41.6%.

Singapore, Republic of Singapore. With no charitable deduction, the Obama’s tax bill for 2015 would have been US$71,293 or 16.3%, but a generous incentive program was in place for charitable giving in 2015, Singapore’s 50 year Anniversary year. The amount of the qualifying gift is grossed up by a factor of 300% for 2015 donations (normally 250% through 2018) which would have resulted in the Obama’s tax bill being $32,893, for a 7.5% tax rate (lower than NJ State tax for reference).

The US Federal tax code stands at 74,608 pages, by far the most complex of the countries mentioned. The average tax prep cost in 2014 was $273. The cost for all parties, including collection (IRS) calls for simplification of the tax code.

While a progressive tax system on balance makes the most sense globally, for developed economies, there are limits to the tax freight paid by the 1%. It is difficult to determine the exact breaking point, but when it comes, the golden goose can take to the skies for friendlier climes through both legal means (relocation) and via “structuring solutions” mired in the complexity of global tax policy (Mossack Fonseca et al). JCG

Note: The charitable laws of the US and of other nations reflect the notion of territoriality or the restriction of tax relief to those charitable contributions made only to domestic charities.

FX rates used; USD/CAD 1.29, USD/SGD 1.36, GBP/USD 1.42, EUR/USD 1.128.

Comments »