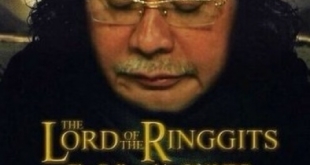

Jack Bogle is 86. He is an absolute legend, founder of Vanguard Investments and #1 proponent of passive index investing. It was disclosed today that Bogle-san personally has a higher weighting in bonds than equities for the first time (53% bonds/47 equities). Let’s take a stab at calculating the duration of Jack’s portfolio. The duration of the US bond market is 8 years, hence the bond component estimate is a modest 4.24 year (0.53 * 8). Equities are a great inflation hedge, primarily because they have a very long duration. For the US stock market, as a whole, is it approximately 50 (price/ dividend ratio, 100/2), contributing 23.50 year of duration to the portfolio, for a 28 duration aggregate. Math geeks can rightly protest this is too simplified, and it is (higher level math and many assumptions are required to fine tune) but the real # is higher, not lower, so simmer down.

This investment mix, assuming Jack is planning for his purposes solely (wait for PART II – Estate Taxes) takes his investment portfolio, from a duration perspective, to his 114th birthday. Not to burst anyone’s bubble, but Japan is the master of the supercentenarian lotto and women make up 87%+ of the 60,000 Japanese >100 years old. The oldest Japanese man presently is Yasutaro Koide (112) who resides in Nagoya, Japan.

Asset allocation has been shown to be more important that security selection over long periods of time. Bonds, as an asset class, are not “easy”, as anyone even brushing up against the high yield component this month can attest, but it is worth the effort. The merit of municipal bonds for US taxpayers can not be downplayed as “It is not what you make, but what you keep.” Power to you Jack Bogle, we are rooting for you! JCG

Note(s):

i) Duration, in bond land, is the 1st derivative of the price/yield relationship (ratio of price/yield). The 2nd derivative, to be profiled in an upcoming post, is convexity (positive convexity is an awesome security feature). Generically, across asset classes, duration can be defined as the elasticity of the security price with respect to changes in the gross rate of return.

ii) If you found this post of interest, follow me on twitter @firehorsecaper as my 11 year old pointed out it is not cool to be following more people than follow me.

Comments »