I have written on miners several times in the past for ibankcoin from the peanut gallery, but from inception no event has been as profound, so glorious, as the “Fathers Day Vein” find by Canada’s Royal Nickel Corp., dba RNC Minerals (RNX.TO, RNKLF otc/pink sheets) at their 100% owned (via sub lease) “Beta Hunt” mine in Western Australia, at Kambalda, 560km (320 miles) from Perth.

RNC Mineral have mined specimen rocks, from a single cut, with visible gold this month from their Beta Hunt mine grading in excess of 2200 g (68.4 oz.)/t (no typo). The largest specimen rock at 95kg. had 69kg. of total gold (quartz making up the bulk of the rest) and required no further processing, being sent directly to the Perth Mint. The scale of this discovery should not be discounted. The nugget sample is the 2nd largest ever mined by man and the grouping of high grade nuggets ranks in the top 10 ever found (107 billion humans have lived on Earth since existence, 7 billion currently present and accounted for). Profile picture with the larger “Fathers Day Vein” specimen rocks features from left to right; SLM Geologist, Lachlan Kenna, Air-leg miner credited with the find Henry Dole, Beta Hunt mine foreman Warren Edwards and Snr. Geologist Zaf Thanos. Happy lads all.

Strike length continues to be refined (2x original now) and an addition 2 km of potential lies ahead. The gold find, from a space basically the size of a large living room, is 24,000 ounces (worth US$29mm, C$38mm). This leads all to think house, football field, airport runway, Newark, NJ., hence the buzz. Given the richness of the find, margins have been estimated at 90%. The specimen stones will likely be sold at auction for a premium as high as 30% to the gold content (15% offered already by yet unnamed museums). The interweb is loaded with coverage on the story as one might expect. In the age of social media issues of continuous disclosure are sure to arise, but the team at RNC Minerals seem up to the task at hand.

Press release related to the “Fathers Day Vein” discovery by RNC Minerals at their Beta Hunt mine is available on their website; http://www.rncminerals.com/2018-09-20-Fathers-Day-Vein-Yields-24-000-Ounces-of-Gold-Worth-38-million There is an informative Webcast of their 11-Sept.-2018 press release which is worthwhile also. For further information: Rob Buchanan, Director, Investor Relations, T: (416) 363-0649, www.rncminerals.com

Note: The other visible metal in the sample is quartz (fly is for scale I assume).

Mining has become expensive, the easy stuff has been done …so we thought. Many jurisdictions are difficult to operate in, subject to government overreach and/or outright nationalization. Spectacular gold grades are largely a thing of the past, trending to 2-3 g/t (5g/t was thought to be economically viable at historic gold prices). . Pretium, $PVG, another Canadian miner, was putting up (modern day) staggering numbers of 14.1 g/t from their Brucejack mine in British Columbia, Canada. Recent Milli Vanilli allegations re: sampling abnormalities have compressed PVG’s market cap aspirations, but with a market cap of $1.6bln Pretium is still a full 10x bigger than lowly junior miner RNC Minerals.

https://ibankcoin.com/firehorsecaper/2016/10/19/pvg-pretium-resources-theres-gold-in-them-thar-hills/#sthash.NM4hjYZG.dpbs

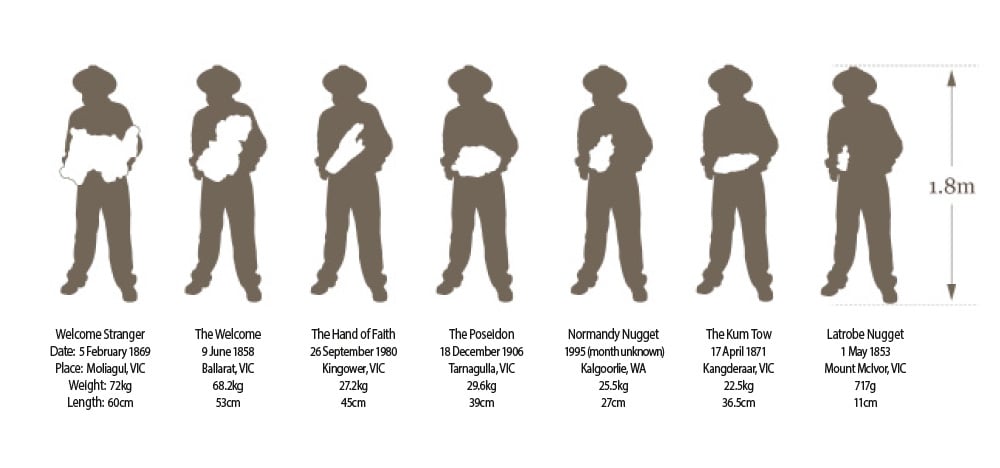

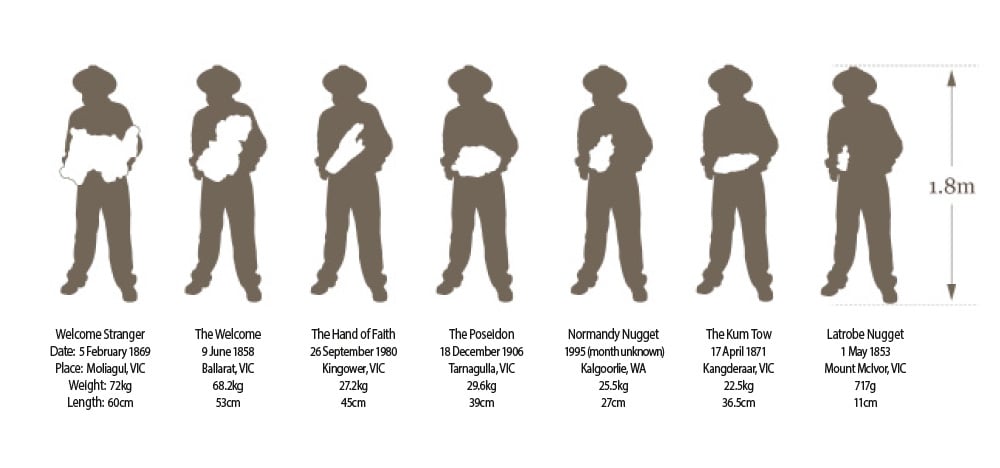

Many of the biggest finds (individual gold nuggets, of all time) have been Australia domiciled:

Top left in the graphic, Welcome Stranger (mined In The Year Of Our Lord 1869) from Australia netted 2520 troy ounces of gold. The biggest nugget of the “Father Day Vein” netted 2440 ounces for a very close 2nd place, but now takes the record as the largest nugget still in existence.

Largest nuggets still existing (others processed for precious coins and deliverable bullion by various mints):

1.) Canaan nugget, Brazil 1983, 60.8kg. (1682 troy ounces).

2.) The Great Triangle, Russia 1842, 36.2kg. gold assay 91% (32.94 kg gold). (Father’s Day Vein 82.5% 95 kg. gross, 78.4 kg gold).

3.) Hand of Faith, Australia 1980, 27.66kg. (largest ever found via metal detector …. a good day), currently housed at the Golden Nugget in Las Vegas, NV, USA.

4.) Normandy nugget, Australia 1990, 25.5kg. (820 oz. gold … 80-90% purity).

5.) The Kum Tow (aka Kum Fow, Rum Ton), Australia 1871, 22.5kg.

6.) Ironstone, “Crown Jewel”, 1992, California, USA 16.4kg.

RNC Valuation:

As with many mining juniors, RNC has has its ups and downs, on balance, more downs of late. As you might expect from their name, Royal Nickel Corp. (dba RNC Minerals) is primarily a nickel miner. Their key asset is their 28% stake (JV with Waterton) in the Dumont Nickel-Cobalt Project in Quebec, Canada. The project contains the world’s biggest reserve of both cobalt and nickel (demand coming largely from the growing electrical vehicle market). The value of Dumont alone was enough to justify the C$0.44 (US$117mm market cap) price once you take insolvency off the table, which is what the Beta Hunt gold find has done. Money was tight and RNC was in the midst of selling “non core” Beta Hunt to fund their portion of the development plan at Dumont (C$1bln total cost). Dumont has a mine life of 33 years and 1.18 billion tonne reserve (proven & probable), containing 3.15mm tonnes of nickel and 126k tonnes of cobalt. The Father Day Vein find of 24,000 oz. of gold at the working Beta Hunt mine in Oz has clearly taken sale off the table (potential suitor likely steamed at the timing). Assuming the current valuation is largely for Dumont (Ni-Co), the Beta Hunt gold call option is hard to value until further exploration work is done to define the potential scope. What we do know is 12mm ounces of gold have come out of the region of which Beta Hunt is a part of. RNC Minerals are the first to explore the Lunnon Basalt at this depth (500 meters), level #15 (of 6 levels total being mined). Gold Fields Limited have rights to the first 200m as I understand it, with RNC mining below that depth threshold.

Eric Sprott, a self-made Canadian billionaire likes the RNC Mineral story, a lot. This week in a regulatory filing Mr. Sprott announced he had purchased 561,000 shares of $RNX.TO on the open market at an average price of C$0.4284, taking his ownership % > 10%. The bulk of Eric’s holding are from a 2016 bough deal financing which came with warrants (9.265mm exercised this week at C$0.43). Current shareholding 40.2mm shares of common. The current float is 390.3mm shares (fully diluted 477mm). Eric does a weekly for Sprott Money and has never seen anything like the specimen stones mined at Beta Hunt.

The majors will be all over developments at Beta Hunt. There has not been a find of this magnitude in a long, long time. RNC Minerals owns 100% of Salt Lake Mining (SLM) who purchased Beta Hunt in 2013 for A$10mm, mining rights secured from Gold Fields Limited ($GFI).

RNX.TO shares went from lower left to upper right all day Friday (yesterday 21-Sept-2018) closing up 31.7% at C$0.56 on 27.99mm share volume. The US dollar RNKLF (oto, pink sheets) closed at $0.4389, up 30.9% on 2.29mm shares.

Conjecture on the potential share price is premature until further mining is undertaken by SLM at Beta Hunt. Any indication of repeat occurence or continuity of the current seam will be well received given the richness of the recent grades. The geography has shown itself to be condusive (gold in quartz touching sediment), but coarse gold finds (>10g/t) typically do not have the consistency of lower grade gold mines. SLM previously had a plan of mining 60,000 ounces of gold per annum from Beta Hunt. How much there Beta Hunt numbers go up will take time to discern, the good news is they will have the money to get on it with a much quicker timetable than their budget previously allowed (114 employees; mgmt, tech srv and operations). While a micro cap at present (<$300mm), this is not a low float stock with almost 400mm shares outstanding. Real movement will only come with real results, but anchor investor like Eric Sprott help to provide a floor pending further clarity. This is a story and a ticker to monitor. In Q4 2010 RNC Minerals stock traded at just over C$2.50, as a point of reference.

Mark Selby, President & CEO of RNC Minerals takes the floor at the Denver Gold Forum Monday next at 4:30pm and you can bet RNC and Beta Hunt will be the belle of the ball. I will be watching developments closely.

Safe trading.

Follow me on Twitter @firehorsecaper

Regards, Caleb Gibbons, CFA

USD/CAD 1.2912

Disclosure: Long RNX.TO from open 21-Sept-2018 at C$0.44. On position sizing, I have a rule of thumb that has served me well in terms of sleeping at night on idiosyncratic single name exposure; never invest more in a single stock that you would pay for a car. I bought 100,000 shares.

Comments »