Note: Now that is a selfie; risk aversion in Europe is low, apparently…more Dom Perignon svp, aviation garcon.

The contrarian in me is keeping an even keel and a steady hand on the wheel, longer of equities than I have been for some time. Europe weighted, mind you (unhedged as to currency, at least for now). The same twitchy feeling that prompted me to go long of gold miners in late November 2015. The key is to let the winners run,which I’ll give myself a B- on (+34% before switching to European equities mid February 2016).

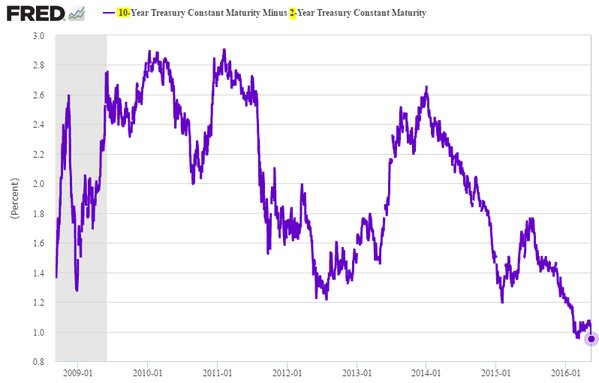

On the bond side, the US remains a global “high yielder” with the 10 year UST at a 1.76% yield. A slowing pace of Treasury Bond issuance, coupled with budget surpluses, should allow rates to remain “contained”. Equity markets do not normally “turn tail” until 18 months after the 1st rate hike by the Fed and unlike former business cycles where the pace of rate hikes was underestimated by Fed Fund futures, most expect a more measured withdrawal from the methadone clinic this time around, with the potential for monetary “throttle steer”, where rates are potentially eased within a longer, flatter tightening cycle. The US 2-10’s curve is clearly flattening, but not by an absurd amount in relation to the modest absolute anchor rate levels in both maturities.

The big boogie men worrying global investors are more ,”in the tails”, than the market is giving them credit for, in my view:

Brexit is far from a coin toss, 70/30 worst case, in favour of the stay camp. From a statistics perspective on a 1-tailed basis (i.e. measuring on the negative outcome tail only, exit the EU), Brexit has a 0.15% “level of significance”. Not to be ignored, but not to be all consuming, West Ham bus incident negative either.

Ditto outcome and math for Trumpanasia, more feared than Zika across the land. Not a likely event that Trump gets beyond the GOP nomination in my view (non-voter, pure armchair view). Hillary looks largely unbeatable, despite the theatrics playing out on your TV.

China. Large, complex, multi-variate. A US$10 trillion dollar economy (2nd largest globally) is far from a 1 trick pony. The US Dollar’s viagra wore off just long enough for the Yuan to regain it’s footing and for the pace of Chinese fx reserve depletion to be curtailed. Time, and time alone, can cure many ills. A 2016 China hard landing is all but off the table.

I see in my crystal ball 2,250 at 2016 year end, with the S&P underperforming other major global indices, save Japan (ex Japan Mothers Index which will outperform). Soros (85), reducing his fund’s equity beta by 37% via S&P puts (on China fears) makes me even more convinced that we rally from here.

Pharma is a strong candidate lead from here in the high beta category. Financials seem destined to lag, still recovering from both gout and the food poisoning inflicted by their governors. JCG

If you enjoy the content at iBankCoin, please follow us on Twitter

JCG, great post as usual.

Quick follow up. When you say you’ve been longer of equities than you’ve been for a while, are you bullish on both U.S. and Europe equities? Thanks for clearing that up!

Bigger position in international equities via RERGX (American Europacific Growth Fund) and ETF IWDA.L. My US exposure is via RLBGX American Balanced Fund, ICSFX Invesco Comstock Fund, PMEGX T.Rowe Price Institutional Mid-Cap & VWNAX Vanguard Windsor II.

In fixed income, mostly “alternative fixed income”, DSL, SLRC, EVV, NLY and PFF. RBS G series prefs got called away at par 6/13/16) yesterday, still own T series.

Biotech ALXN, VRX & ICPT with VRX small and ICPT a large position.

Barron’s are on my band wagon now:

May 24, 2016, 5:39 P.M. ET

No Scaredy–Cats: Dow Jumps 213 Points as Stocks Shrug Off Fed Fears