A betting man would likely place at least even odds on a $20 oil pendulum swing before we hit $50 again, if for no other reason to its’ proximity to spot prices in the low 30’s.

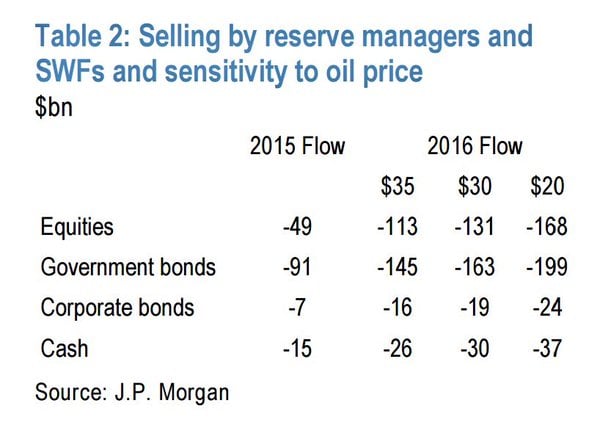

JP Morgan has issued some interesting research, modelling the asset divestitures (by asset class) likely seen from reserve managers and sovereign wealth funds (SWF) on a further downside trajectory in oil, to as low as $20 per barrel. Global FX reserves peaked at just over $12 trillion in August 2014. Reductions from that time have come primarily from China (approx. $700bln) and commodity levered economies. A decent current estimate is $11 trillion. SWF assets stand at $4.5 trillion, with 93% held by the top 10 funds, ranked by size. Half of the top 10 gained their girth via oil riches with the remainder plumped via long held general trade surpluses. If we were to see a $428bln divestiture in 2016 on a move to $20 oil by this approx $15 trillion war chest (2.9% of assets), I would characterize it as a “flesh wound”. Seems low. Check you VaR. Fat tail result observation likely (kurtotic distributions).

The stresses on oil dependent global economies had been well documented and as illustrated in the graph below,most need a snorkel if not a nitrox tank already. 4 of the “fiscally challenged” sovereigns below also have top 10 ranked SWF’s by size.

-Saudi Arabia. SAMA Foreign Holdings. Est. 1952. $762bln (14′), 100 of GDP, 2.6x expenditures, 65.0 x sovereign debt.

-UAE. Abu Dhabi Investment Authority. Est. 1976. $589bln (14′), 147% GDP, 4.8x expenditures, 5.3 x sovereign debt.

-Kuwait. Kuwait Investment Authority. Est. 1953. $548bln (14′), 321% GDP, 6.7X expenditures, 54.0 x sovereign debt.

-Qatar. Qatar Investment Authority. Est 2006. $304bln (14′), 144% GDP, 5.48X expenditures, 6.2X sovereign debt.

Source: Moody’s, IMF, SWFI

The most stressed nations at current oil levels will be in straight jackets at $20bbl oil. As the dominoes of Venezuela, Nigeria and Libya wobble if not fall, it will likely make Arab Spring of 2011 look like a Tragically Hip concert.

Many market pundits point to the fact that lower is oil is positive and will result in an eventual GDP lift for most countries. MSCI World (-6%) has significantly underperformed MSCI EM (-1.8%) over the last 3-4 weeks.

As James Grant recently put it, more eloquently than I might, “Surely, no such thing as a separate and distinct U.S. economy can be said to exist. There is rather the single dollarized and financialized and leveraged worldwide economy. Like it or not, we are all in this together – the Chinese communists, the European socialists, the Japanese statists and we the people.”

The amount of Gas & Oil related debt that will need to be re-structured and that will eventually default clearly ramps at $20 oil. Current default rate estimates are at 7%+ and it is difficult to envision that default rates do not get to the low teens if oil prices languish to $20 bbl from here. The list of global survivors left to pick up the pieces dwindles as well, impacting recovery rates. The public debt markets have been the funding avenue of choice in the latest energy build out cycle and while the Banks will certainly not escape unscathed, there will be enough pain to share with estimated industry debt at $700bln+.

USD denominated debt (non-bank) outside the contiguous states stood at $9.2 tln as at 09/14, +$3tln since 01/10.

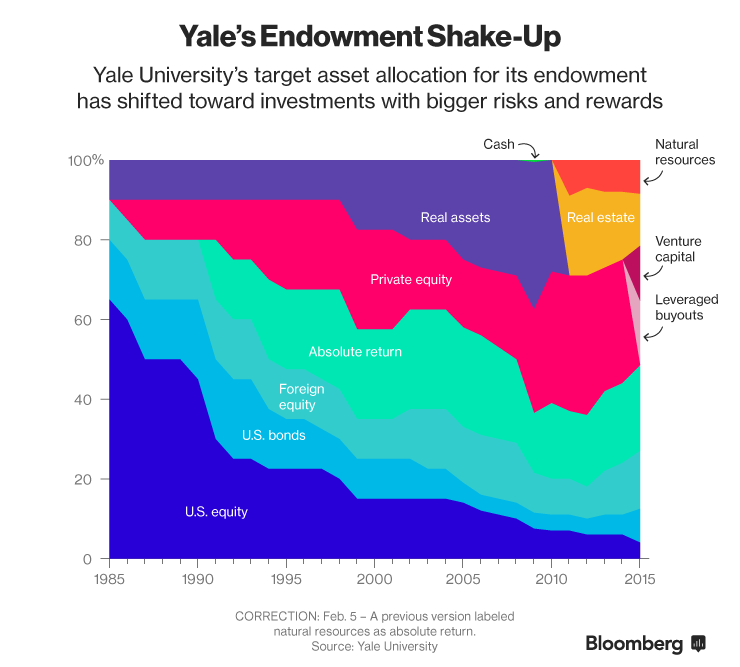

Cupped hands to make up for the reserve manager and SWFs asset divestitures are hard to find as the pension & endowment space revamp their asset allocation, largely away from the public markets in favour of private & specialty areas with higher alpha potential.

Liquidity is waning, and not likely to recover near term. Global regulations, regardless of intent, have had the effect of neutering the profit motive. The former commodity prop groups of the major global banks have largely been thrown to the winds with the most successful finding homes in the successful, albeit less stable trading houses (Mercuria, Vitol, Glencore, Trafigura, Noble, Gunvor, etc.).

Opportunities abound with so many cross currents, but the penalties for being wrong will be increasingly punitive. Asset redemptions, spikes is deficit spending/drawing down former surpluses, spikes in unfunded liabilities, credit downgrades (out of IG), increased civil unrest, increased protectionism and a ballooning global refugee crisis are all issues we will be dealing with in 2016 and beyond. JCG

If you enjoy the content at iBankCoin, please follow us on Twitter

Massive Ugly Bubble has been created in all the commodities caused by Financing Tools. But Bottomline, BoJ gives us emergency QQE then it won’t hit 20 in the short term. If they don’t, then yep 20 here we come.

Awesome research piece, on point to USD/JPY, leverage, regulations.etc;

http://polemics-pains.blogspot.co.uk/2016/02/back-from-skiing-but-markets-are-off.html

Fire, Not Awesome, but a really GOOD and fun to read and I WOULD TOTALLY get drunk in a bar with him. All Very Good Points, but most of this is already known. Here is my take, and if mine is simple or wrong, please point out any mistakes in my analysis. Japan is the Number One Creditor Nation so of course money flows into when China, Europe, etc is at risk. Japan with Abe’s Arrows have been trying to lower the JPY to get Japan out of the Vortex it is in. When Abe gave the world the Massive QQE the JPY fell and the stock market had a Party. But, when China did the same thing in 2009 the money was used to speculate in Copper, Oil, Commodities. The World thought we were growing, I thought Hey we are growing a Massive Bubble of Commodities (My Shanghai Copper Thesis, but that is another story). Now with the over production of Commodities the QQE money had no where to go, Copper, Oil etc started dropping in 2014. So the world didn’t see the pop in Global Economic Data and China Slowed Down Hard (Helped with the speculators in Commodities taking a blood bath). World Panicked and FINALLY went back into JPY for safety. Abenomics is getting killed by this cuz Japan needs Global Growth to Work. Japan is growing old fast and doesn’t like Immigrants to increase internal demand. They need their Export Biz to be strong cuz that is all they have. So rumors went around about an emergency meeting on Friday and a promise to expand QQE if the JPY continued to move up over global Panic. It worked on Friday and USD/JPY is much higher. But here comes the Catch 22 that I thought my New Drinking Pal would address. If JPY is jawboned down, won’t that stop the need for Kuroda to add to QQE? Which in turn would cause our continued slide cuz no QQE is coming? We all saw the yucky Japanese Data that came out and saw that QQE money can’t help trade cuz China is their Major Trading Partner and their Speculator Driven Demand is soooo over. THe Banks in Europe of course are in bad shape cuz they lent to all the speculators that used commodities to secure loans on everything they can think of imho. The Banks being destroyed are just a part of the massive mess that the Central Banks have created. Well maybe the G-20 can come up with something, rofl. BTW nice to see your posts.

Nobody knows the full extent of the JPY carry trade size (the leverage imparted moves like an accordian), but due to the brisk move of last week, a rally of 10 big figures +, many levered players had to sell foreign assets and buy copious amount of JPY in an effort to preserve some capital (live to play another day). The BoJ can singe speculators fingers via intervention (moral suasion/jawboning) for a few big figures move on the crosses but the underlying capital flows dictate in the end. The BoJ is buying everything, it is hard to buy JGBs or even JPY bills except at auction (new issue). Without GFC 2.0 we see a weaker JPY, full stop.

On exports, they are important to Japan. Japan exports $134bln to both China and the USA (18% of exports). Japan imports $150bln in goods from China (accounting for 6.4% of China exports). Japan’s big issue is getting back to energy self sufficiency which they can only do via nuclear power which understandably if coming back on slowly. Nuclear made up 40% of Japan’s power mix prior to the 2011 earthquake/tsunami and energy imports have pushed Japan’s trade balance into deficit.

China, as you note, is near capacity on the debt driven growth metric, $34tln of debt with up to $10tln of it USD denominated (one of the reasons I do not think they want a weaker CNY!). China’s banks are the largest in the world. China commercial bank assets as a % of global GDP is at 41%. The biggest Japan ever got was 27% in 1994. The biggest the USA even got was 33% in 1985 and combined the USA + Japan have 32% at present.

Re: European banks. Yield curve, liquidity concerns and overall price action are signalling all is not well. Concerns over profitability has increased the likelihood of losses as we are late stage in the global credit cycle.

From the horse’s mouth (translations from JPM):

Decoding the Turgid Dialects of the PBOC

After an unusually long silence, the People’s Bank of China (PBOC) Governor Zhou Xiaochuan has finally spoken out in an interview that was released in the midst of the Lunar New Year holiday.[1]

Zhou responded to questions on China’s exchange rate reform, the PBOC’s outlook on the Chinese Yuan (RMB), and the risks confronting the Chinese economy.

The governor’s remarks provide us with a rare opportunity to get an insight into the PBOC’s policymaking. Nothing that Zhou said has changed our views, but they did reaffirm them, namely: (1) the RMB isn’t likely to experience significant devaluation, although a gradual depreciation against the Dollar remains likely, especially if the Dollar strengthens in a disorderly and rapid way; (2) China will do everything possible to prevent competitive depreciation, as it’s against its own strategic interests; (3) China still has the policy tools to arrest capital flight, although that wouldn’t be without collateral damage; (4) the August 11 exchange rate reform and the subsequent moves were poorly timed and ill conceived, and China may have been forced to postpone capital account liberalization, but the PBOC will resist returning to the fixed rate regime; (5) China’s economy remains susceptible to internal vulnerabilities and external shocks, but financial markets may have overreacted (as usual) by mixing up cyclical challenges with self-induced structural adjustments; and (6) public communications will remain a significant weak point for the PBOC (and the government), which in turn makes RMB trading materially more volatile than it would otherwise be.

Our key takeaways and thoughts are as follows:

First, Zhou argued at length that there is no base for a secular depreciation in the RMB. His argument is partly based on China’s substantial current account surplus: the trade surplus in 2015 alone was US$598 billion (out of US$4 trillion trading value). [2] The governor wasn’t wrong, but he inappropriately underplayed the importance of the capital account. The current account, coupled with a large inflow of foreign direct investment, was the key support to the RMB when capital accounts were essentially closed. Zhou’s second argument related to the real effective exchange rate (which is a function of relative inflation): inflation targeting in the US and Japan is 2% and China’s realized inflation is 1.4%. The governor’s argument is of course flawed. Inflation as measured by Personal Consumption Expenditures (PCE) in the US is also 1.4% and core inflation for Japan is only 0.8%, not to mention that China’s inflation target is 3%! In our view, the case for a secular RMB/USD depreciation is indeed weak, but cyclically, short-term pressure RMB/USD is still on the downside. Zhou did point out that RMB has moderately appreciated against a trade weighted basket, a point often overlooked by the markets.

Second, the governor made no direct assessment of the PBOC’s exchange rate reform on August 11, but he did indicate that additional policy moves would depend on “market windows”. To us, that is as clear an indication as any that the PBOC has learned a costly lesson for not having paid adequate attention – if not respect – to market sentiment. It suggests that additional capital account liberalization is likely to have been put on the back burner until the global financial market calms down and sentiment towards China becomes more conducive.

Three, Zhou addressed concerns about depleting foreign exchange reserves. His take is largely consistent with the one we detailed in our previous report[3]. According to Zhou, currency translation and investment losses totaled US$121 billion vs. US$29 billion in capital outflow in 2H2014. This then became US$83 billion and US$66 billion in 1H2015 and US$88 billion and US$276 billion in 2H2015, respectively. Zhou argued that the unwinding carry trades and switches from offshore to onshore funding are largely behind us, and that Chinese companies’ overseas M&A activities, which are encouraged by the government, cannot be carelessly labeled as capital flight. We made the same arguments in our report. That’s not to say capital flight isn’t a material risk. While Zhou dismissed any possibility of capital control, he did admit the need to tighten illegal and illicit capital outflow through better regulations and more strict enforcement. We agree with his thoughtful differentiations between capital outflow and capital flight and we vigorously oppose sensational statements populated by pundits and analysts. Emerging market analysts and traders should be careful when they apply their experience from Latin America, and Asia’s 1997.

Fourth, the governor was candid about the obstacles to the PBOC providing “forward guidance”. These include limitations on technical know-how, data collection/forecasting, and competing views even within the PBOC (read: the PBOC is far from being independent). We find these remarks refreshing. They also suggest that a monetary policy evolution is likely to be a lengthy one. The reformers within the government have to be patient (as admitted by Zhou himself). So, additional policy moves would likely be incremental and gradual, and they would likely err on the conservative side during the remainder of Zhou’s tenure.

Fifth, Zhou, like all other Chinese officials, seems to subscribe to a conspiracy theory. In the interview, he suggested that speculators’ negative views on RMB and China are nothing more than “talking their books”. The delta exhibited in FX markets since August has little to do with China’s fundamentals, but is merely the result of speculative shorts. We find the mentality disturbing for three reasons: (1) it underplays – wrongly in our view – the cyclical and structural risks confronting China; (2) it assumes FX markets should be rational and that China’s plan to open up its capital account was appropriate; and (3) it pits the Chinese government against capital markets, which is hardly a winning proposition.

Sixth, the governor also commented on China’s growth outlook. He cited the high savings rate as a source for continued investment growth. We agree. Rebalancing between investing and consumption is a valid argument, but China simply cannot consume to prosperity. The real issue is how to balance planned investment by the state and investment by the private sector. Another growth factor the governor cited is China’s rising new comparative advantages in global export markets. He is right. China recently overtook Japan and Korea as Asia’s largest IT exporter, a fact rarely known to the markets. According to a recent study by McKinsey, which is based on 20,000 listed companies and 31 industries; China’s innovation capability is considerably higher than previously believed. In certain areas, China is already in the leadership position. [4] However, our concern is whether productivity growth is adequate to offset growth drags from “old China”, such as property.

Seventh, Zhou reiterated a view that has been argued by other senior leaders: relative to other markets, China’s growth – at approximately 6.5% – isn’t low, and it adequately accommodates labor market demand. [5] For example, the governor pointed out that in 2009 and 2010, China’s GDP as a share of the global economies was less than 10%, but China’s contribution to global growth exceeded 50%.[6] He believes a 25% level is more realistic and justified. The argument is valid, especially for the foreign exchange market (which trades on comparative value), but the officials fail to appreciate the fact that capital markets trade on the rate of change relative to itself. The fact that growth has decelerated does matter. The governor also stresses the fact that self-induced structural adjustments have been a drag to growth and he believes growth is likely to be more sustainable and robust if China successfully addresses supply impediments. We are sympathetic to this view. Unfortunately, the markets have largely missed the point.