100 BSV = $13,500

When 1 BSV = $13,500

Your $13,500 will be worth $1,350,000

Worst case you lose $13,500.

Comments »100 BSV = $13,500

When 1 BSV = $13,500

Your $13,500 will be worth $1,350,000

Worst case you lose $13,500.

Comments »Treasury Secretary Mnuchin talked about Crypto today:

BTC is so fucked. pic.twitter.com/rfGDqfzqUX

— Elon Moist [CEO of Twetch] (@coinyeezy) July 15, 2019

Remember how I have been saying BSV is honest money? BSV fits within the law. Most of Crypto is a pipedream for anarchists who didn’t have good fathers.

BTC is relying on a non existent Lightning Network which runs afoul of KYC and AML. BTC can’t scale and now it will soon be illegal.

For me, Mnuchin’s comments were bullish for BSV.

BSV scales ON-CHAIN, legally.

Comments »BSV is trading at ~$130. This looks like strong support on charts. BSV has fallen 50% from recent highs while BTC has fallen 25%.

I have been pounding out blogs talking about the fundamentals of BSV. Fundamentals is about what to buy. BSV is the only crypto anyone should buy because Crypto is a Ponzi.

Technical analysis is about when to buy.

At $130 BSV is a buy.

I expect $130 to offer price support. If 130 breaks we’ll have psychological support at $100 and, worst case IMHO, $50. BSV could fall another 50% or more. Long term, this doesn’t matter. BTFD now and continue all the way down. If you can’t stomach that don’t do it. Wait till trend reverses and follow the herd. As a confirmed crypto degenerate I am only telling you what I’m doing.

BTC is trading 70:1 to BSV. If you own BTC and are not hedging your holding at this ratio there’s no reason for you read my posts. You have made your decisions. You’re no longer processing information. You’re a HODLer. I have no time for that.

This is my call: BSV is a 10x from here within 12 months.

Comments »Simply put, time is limited for Crypto. I expect another bear swoon maybe as soon as this Summer. The counter to this is Bitfinex and Tether will pump BTC in one last glorious exit pump, dumping at a peak on retail noobs conditioned to HODL. This will be the last hurrah.

Bitfinex implicated in a 850M fraud on April 24.

800M tether printed since April 24. This is fine.

— Coinspeak (@coinspeak_io) July 13, 2019

Regardless of timing, there will be a massive cleansing of Crypto.

I called this BTC ponzi pump as it happened:

BTC is the Lehman Brothers of crypto.

— Coinspeak (@coinspeak_io) June 24, 2019

Don't forget, this BTC pump got started because of an April Fool's joke.

BTC jumped 21% in one hour to break $5k. Fuel to that fire: 300 million in fresh Tether.

This is fine.https://t.co/5EG5bPzd5G

— Coinspeak (@coinspeak_io) June 26, 2019

I wasn’t the only one:

BTC is the Fyre Festival of crypto.

— Warboat (@warboat1) June 26, 2019

This tweet was near the current BTC top:

Current day chart.

Could run quite a bit more, but don't get fooled. This will come back to earth hard. pic.twitter.com/owQlCOKLBy

— Coinspeak (@coinspeak_io) June 26, 2019

This call on BSV paid off well if you took it at $57. Within weeks it hit $240+ and is now sitting around $160.

I don't see how the BSV news could get much worse and support did not break. If you were looking for a moment to add this seems like it.

BCHBSV and BTCBSV ratios also at ATH. pic.twitter.com/xsAmzZBdkJ

— Coinspeak (@coinspeak_io) April 17, 2019

So how does this end? All the shitcoins, including BTC, with their broken economic models, experimental blockchains and “second layer” solutions will fail. This may take a year or more but it will happen.

Only one coin will survive.

Comments »Technology has transformed the human experience over the past 150 years. Medicine can now prevent and treat many previously incurable diseases. We can traverse the planet in hours instead of years. One farmer can feed a small town. Cars did not exist when my Great Grandmother was born.

Technology moves fast.

One area that we have not transformed is breaking our reliance on centrally managed fiat currencies. Our boom bust cycle that has existed since money was invented continues to this day. Every fiat currency in history has failed.

As the saying goes, “On a long enough timeline….”

We are now entering a new phase. Similar to how advances in medicine, transportation and technology altered our day to day life we are about to see a shift in how we value information and exchange goods.

Information is the new money.

Money has these characteristics:

The characteristics of money are durability, portability, divisibility, uniformity, limited supply, and acceptability.

When comparing the USD (the world’s reserve currency) to Bitcoin the USD is inferior in all areas except for acceptability (at this time). The world just hasn’t caught on yet. When it does, Bitcoin will beat the USD there too.

We are on the verge of a new era, distinct from every currency of the past.

No currency in history has been backed by Proof of Work. This makes Bitcoin the most reliable, resilient and fair money mankind has produced.

Very simply, Proof of Work creates honest money. We know for the next 100+ years how Bitcoin, via POW, will be issued and secured. This process is set in stone.

Proof of Work is fundamentally different than Fiat. Proof of Work is competitive. Miners are rewarded for securing the Bitcoin network. No work, no reward. Every Bitcoin is a product of Proof of Work providing cryptographic proof of it’s validity.

Fiat money is a currency without intrinsic value that has been established as money, often by government regulation. Fiat money does not have use value, and has value only because a government maintains its value, or because parties engaging in exchange agree on its value. – Wikipedia

Stablecoins, eg Libra, are pegged to fiat. Fiat is a promise. Therefore, Libra is a promise about a promise! The world has been built on promises created by governments proclaiming their currency as means of exchange. Throughout history governments have broken their promises around Fiat. Fiat can be manipulated. It is subject to the presiding government’s challenges. Never in history has fiat survived the waxing and waning of the politicians. Example: as of the 70’s the US dollar is not backed by gold. Only more promises. Fiat is inferior to POW. Fiat, as a promise and as history has shown, is eventually broken.

POW is a fair playing field. No politician can manipulate Bitcoin. Money has always been power. In Bitcoin, information is power. This enables competition without boundaries. Even with unreliable internet anyone can compete in the Bitcoin Economy. I can sell my goods online for pennies from anywhere in a Bitcoin Economy.

The Bitcoin Economy will revolutionize information sharing and exchange of value.

Proof of Work is a breakthrough in how money is created. There is no promise, no peg to break in PoW. There is no dilution via centralized policy. Proof of Work replaces fiat with honest money. POW does not care about politics. POW is truth.

Bitcoin enables commerce at a microtransaction level. The Long Tail theory shows that microtransactions can generate a larger impact on the world economy than the Internet. Microtransactions in volume will dwarf current economic numbers.

Fiat currencies ultimately settle in USD, the king of Fiat, as USD is the world’s reserve currency. The problem is the USD is not honest money. There’s no peg to anything, only an empty promise. Bankers print with the Fed’s approval. Pegging the world’s currencies to the US Dollar is tying your lifeboat to the Titanic.

The world’s economies are living on borrowed time.

Stablecoins are lipstick on a pig (USD).We must dig deep. We can do better. This is a critical turning point for the world economy.

Bitcoin is truth.

Bitcoin is honest money. Every satoshi is always accounted for at all times. When Bitcoin is the standard

slush funds, mismanagement and crony capitalism will die.Triple ledger accounting is another Satoshi breakthrough.https://t.co/v46wq2uIyQ

— Coinspeak (@coinspeak_io) July 5, 2019

Stablecoins perpetuate a fiat system built on a promise. Bitcoin is a NOT a promise. Stablecoins are the gateway to a new century of serfdom.

The Bitcoin Whitepaper is a masterpiece. Maybe the greatest human achievement in the past 100 years.You don’t mess with a masterpiece. If that sounds like hyperbole you haven’t seen what Bitcon enables yet.

The Bitcoin Economy exposes corruption, lies and crime. Anyone who champions against Bitcoin has a stake in hiding something. To be clear, Bitcoin does not care what you do, but if you do something illegal Bitcoin is not your friend.

We are in the very earliest stages of Bitcoin. 10 years is nothing. It’s important to begin researching Bitcoin now. I’ve been at this for years and I have startling revelations almost daily.

This will take time. Start now.

This post first appeared on Coinspeak.io

Comments »There is a new app powered by Bitcoin SV. It’s called Twetch. This early stage app has the potential to be a Twitter killer.

To use Twetch you must have a moneybutton.com wallet linked. Once on Twetch every action has a microtransaction fee in BSV associated. This small fee pays for putting the information on the BSV blockchain and rewards the content producer. Content producers monetizing via microtransactions is an unsolved problem on today’s Internet. BSV changes the game.

Similar to Twetch, there is Bitstagram, a Bitcoin SV powered version of Instagram. When someone likes your post on Twetch or Bitstagram you, the content provider, get paid.

For writing articles there are BSV powered sites yours.org and https://www.bitpaste.app/. Goodbye Medium and other paid blogging sites. Writers can now blog direct to the blockchain and be paid in BSV.

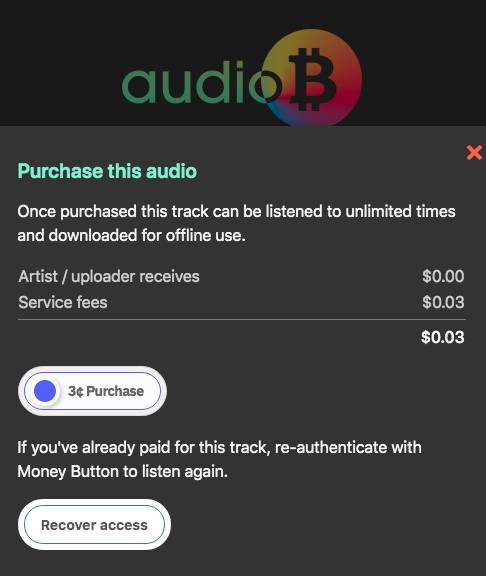

Now, imagine this for music. There is going to be a tidal wave of migration to BSV for artists sick of large record companies owning their music catalog. There is already a site available: https://www.audiob.app/ Sample screenshot below of a micro 3 cent transaction for a music file. You can’t do this anywhere else!

EDIT: Forgot to add https://streamanity.com/ as the BSV powered pay by time viewed replacement for YouTube.

These products are in early phase development. In the future I could see these platforms being customizable for content producers (and consumers). All censorship free, immutable and monetized. This a new economy, one that will dwarf the Internet explosion.

This will shift the game of social media owning your data and you being the product for advertisers, bots and phishing scams. Now you own the data and your puppy pictures pay you instead of Zuck.

There is a noticeable shift in BSV. Another development this week is a relatively unknown Crypto holder went to the Florida courtroom for the Kleiman vs Craig Wright hearing and reported about it on Twitter. At first he was anti BSV, but as he heard more he began to shift and the BTC army attacked him.

Holy shit @PeterMcCormack put my tweeter into hate filled overdrive.

For the record, not paid.

Just looking to educate future high school graduates on crypto focusing around bitcoin.

Not a reporter

— 22nd Century Crypto (@thatcryptoguyyy) July 3, 2019

This person’s tweets are now a public litmus test for what it is like for someone with a bit of notoriety to go against the tide of BTC towards BSV.

While all of these apps are early stage they point to a very exciting future for BSV. Social media is about to be shook.

People are waking up.

This post first appeared on Coinspeak.io

Comments »Bitcoin is a simple concept, peer to peer electronic cash, but deceptively difficult to describe.

In 2010 Satoshi himself (AKA Craig Wright) said:

“Sorry to be a wet blanket. Writing a description for this thing for general audiences is bloody hard. There’s nothing to relate it to.”

I have found the easiest way to explain Bitcoin is for someone to experience it. Going into a long explanation is less effective than having a person use Bitcoin. Explaining Bitcoin is a bit like describing how to balance on a bicycle. It pales in comparison to having a person actually ride a bike.

Bitcoin has come a long way since it’s release in 2009 but it’s still a mystery to most people. One of the recent and more significant developments to reduce this mystery has been the creation of user friendly wallets. The BSV wallet leaders are Handcash, RelayX, SimplyCash and Paymail (Paymail is part of moneybutton.com).

These wallets allow one person to send BSV to another person anywhere, instantly, with near zero fees by just knowing the other person’s wallet handle. You get to choose your handle when you create a new wallet.

For purposes of illustration consider the two versions of what I can share to get paid in BSV.

Handcash handle: coinspeak

or

BSV address: 1KPxVWD9tKuTBnk7qzCFZTRJbyJqUhjUTV

Which one do you think is easier to remember, put on a business card, or share with someone over the phone?

This is a big step forward in usability.

Once you use Bitcoin with a user friendly wallet the potential of Bitcoin becomes undeniable.

Since it’s easier for you to experience the power of Bitcoin than it is for me to explain it via more blogs, I am going to give away $5 in BSV to the first 20 people who post their Handcash handle (Android only) or SimplyCash handle (Android and IOS) in the comments below. Download either app and post your handle (and whether it’s Handcash or SimplyCash) and I will send you BSV. Have a friend download a wallet and send them a $1. Spread the virus.

Then you will experience the power of:

DO NOT FORGET TO BACKUP YOUR WALLET or you can lose your money.

I request that only new BSV users post their handles below. If you already have BSV feel free to ping any handles below with additional BSV.

You are on your way to experiencing Bitcoin. Warning: there’s no going back.

EDIT: This is not a feasible exercise on BTC. The current transaction fees on BTC are ~$3.50. To send $5 in BTC would cost $8.50. On BSV fees are less than a penny.

Comments »

Tomorrow the FATF releases new rules for exchanges around KYC and AML.

This could be a heavy burden on Crypto. From this article:

Bloomberg reports that the FATF rules are expected to require firms ranging from major spot exchanges such as Coinbase to asset managers like Fidelity Investments to gather data on all clients initiating transactions worth over $1,000 or 1,000 euros.

Big Brother wants to know everything. If they can’t just get the data directly off Google and FB’s servers then they will enact new laws. Even when your money is yours it’s only by the grace of the US Federal Government. ‘Murica!

Sarcasm aside, this will send many exchanges and coins running for cover. However, keeping to the theme of Honest Money BSV actually complies with these rules (as far as we know). BSV is publicly verifiable but also private, but not anonymous. I can’t look at your balance but you could disclose it to me and I can confirm it.

Imagine governments run on honest hard money. I don’t think the US fears Bitcoin as a new digital currency as much as they fear this may mean that their books and budgets would be transparent and easily audited. No more overruns, lost trillions or bribes. Honest money is honest government.

This post first appeared on Coinspeak.io

Comments »I am visiting Puerto Rico this month. My primary reason for visiting is to scout the island as my potential new home and tax shelter.

Puerto Rico is the only place in the entire world that a US citizen can live and be free from capital gains tax. Puerto Rico is a US territory so Puerto Ricans are US citizens. However, they can’t vote in national elections. No taxation without representation so….if you are a PR citizen you pay no cap gains. Nomad Capitalist has a long and slightly negative assessment of the pros/cons of moving to PR for this tax shelter.

They call Puerto Rico the Island of Enchantment. It’s beautiful here. Old San Juan is like living in Old Europe. The streets look like this:

The women look like this (PR has the third highest number of Miss Universe winners, incredible for small island):

It’s not all positive though. Some Puerto Ricans are upset that the US government has been dictating life on PR for decades not to mention the poor FEMA response after Hurricane Maria.

Due to the unique tax laws for Puerto Rican residents many US citizens have fled to PR. There is a very large crypto community here. A few years ago there was some publicity about Brock Pierce, EOS investor, creating a new Crypto based incubator / society. That seems to have died down but I can tell you in a few weeks here I have met more Crypto people in a small area than my travels through many large cities in different countries.

Boom bust shill Harry Dent and precious metals shill Peter Schiff live in Puerto Rico. In fact, I had the opportunity to speak one one for 20 minutes with Harry Dent at a recent crypto meetup here in San Juan. That kind of chance meeting seems unique to Puerto Rico.

I am looking at potential housing today.

This post first appeared on Coinspeak.io

Comments »FB released their whitepaper on Libra coin today. The opinions on it are flying around the web.

Leaked Libra Assoc. meeting with the Fed. pic.twitter.com/06zMxqxznM

— Ti Kawamoto⚡? (@TiKawamoto) June 18, 2019

My brief takeaways:

Libra won’t go live until sometime in 2020. So it’s all a temperature check and FUD as FB algos crunch how to adjust their propaganda. Part of the paper says that as the tech matures that Libra coin will be further decentralized. Do you believe they will build this and then turn over any part of control? Never. This is a classic shell game.

FB users will not care what Libra is or bother to understand “blockchain”. They can barely manage their own messages. To the average FB user they will see they can now pay for their pizza inside FB. That will be useful. Now, imagine trying to secure the average FB users funds in an online wallet. There is going to need to be a serious breakthrough in usability and trust for Libra to be safe for anything other than pizza money.

Speaking of trust, what level of funds would you put into custodial ownership under FB? Pizza money? Car payments? Rent? Savings? I don’t see how FB breaks through from petty cash to replacing significant payment systems. The same can be said of Bitcoin. However, with Bitcoin you retain privacy and have no 3rd party risk.

FB will have 2B users to start. If all the early adopters deposit $20 USD Libra will probably be a top market cap coin. But that is relatively meaningless and could fade quickly. FB coin faces a different regulatory challenge than Bitcoin but I think in the end Bitcoin may have an easier time overcoming hurdles due to it being truly decentralized.

In the end I’m left with the boys from Silicon Valley do not understand Bitcoin. Bitcoin is an economic system expertly blended and balanced to provide a new global ledger. This ledger is immutable and can provide honest money for the world. I have been emphasizing “honest money” the past few posts. FB has zero chance of ever being a custodian of honest money

There is only one Bitcoin. The rest are just glorified databases and spreadsheets.

This post first appeared on Coinspeak.io

Comments »