Learn to be indifferent to what makes no difference.

-Marcus Aurelius

In this post we will take a look at how to identify noise vs signal in Crypto.

A signal has credibility while noise begs for attention. Signals whisper to the tribe while noise promotes itself. A signal will cause you to take initiatives while noise will want you to join the cause.

An easy way to identify signal vs noise is signal requires you to think. Signal has substance. Signal is challenging. Signal isn’t easy.

Noise is like junk food. Noise is designed to trigger a dopamine response. Noise is emotional. Noise is simple. Noise is repetitive.

Crypto is noise. BSV is signal.

Put another way….

BitCoin is not Crypto.

Crypto is not BitCoin.

— Coinspeak ??? (@coinspeak_io) October 16, 2019

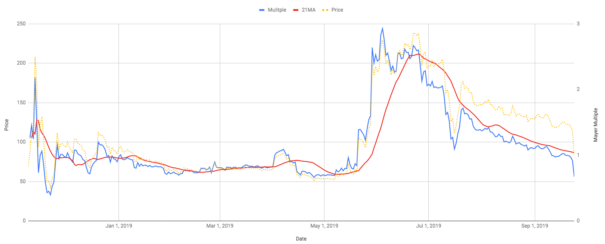

In 2009 there was only Bitcoin. Since then over 2,000 coins were released and Crypto peaked at a market cap just under 1 Trillion dollars. Today the market cap for all of Crypto is less than 250B. The classic market bubble and correction.

After a bubble pops the only survivors are those that prove themselves economically viable.

The true market cap of all "crypto currencies" equals the market cap of BSV.

The rest is a Ponzi scheme.

— Coinspeak ??? (@coinspeak_io) October 20, 2019

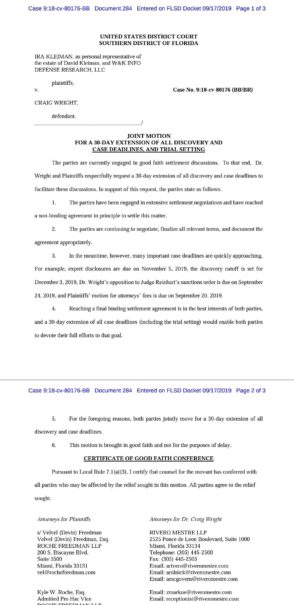

Keep your eye on what emerges over the next year. Noise will kill your portfolio. Sometimes popular well known personalities show they built their following broadcasting noise. Here is an example this week:

Tone Vays charges $2,400 an hour. Ok, fair play if you can get it. But then he says:

I honestly don't know ANY facts because i never bothered to look at them as it should have been beyond obvious from the start that is not Satoshi

— Tone Vays [Bali – Financial Summit] (@ToneVays) October 13, 2019

Tone Vays charges $2,400/hour and then states “I honestly don’t know ANY facts because I never bothered”. This is a noise maker in an echo chamber. He has 193,000 followers on Twitter and is teaching others how to invest.

Here’s a LITERAL noise maker. A Craig Wright heckler from this week’s CC Forum.

Farmer Craig, Pumpkin Man Craig, go back to your farm, your pumpkins, and your tomatoes, and grow a superfarm. pic.twitter.com/t8w3jBOC9E

— Graeme Moore (@MooreGrams) October 16, 2019

This screeching attack is an example of the current conversation in BSV/BTC. I am exhausted engaging with the anti-BSV crowd. It’s no longer a debate it’s wrestling a pig. You both get dirty but the pig likes it.

Enter the Hopium Dealers

There is no shortage of hopium dealers dishing out forecasts of six figure BTC. Many of these “analysts” have 50k+ followers on Twitter. Take a moment to see if these Nostradamus wannabes ever address the fundamentals behind their charts. You’ll see it’s speculation based on new money entering or the halvening causing a doubling of their HODL stash. It’s noise and many fall for it.

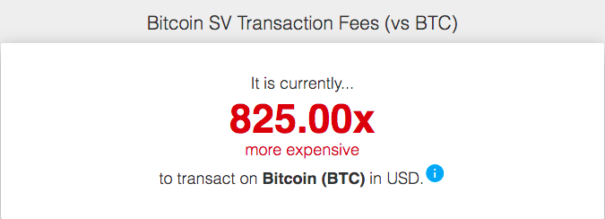

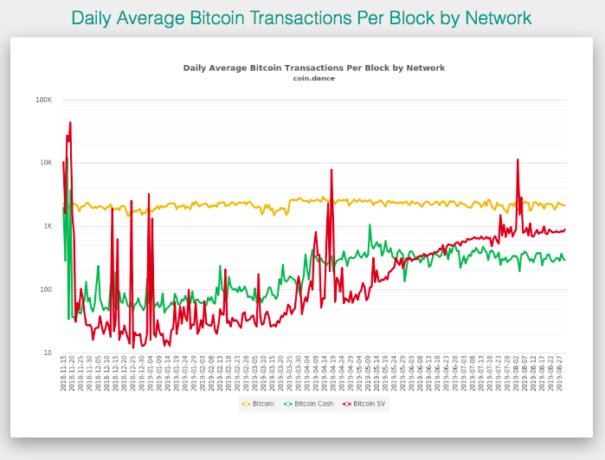

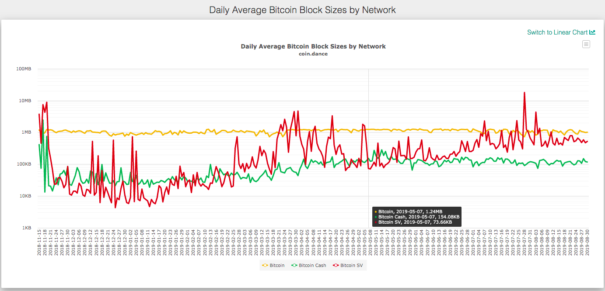

Meanwhile, the signal is that BTC has been a zombie coin for over a year. You wouldn’t know this from the talking heads on CNBC but you have to remember, CNBC makes money by amplifying noise.

Also be wary of BSV noisemakers. There are many of them.

The most valuable thing I learned in Crypto is I don’t know anything. Early in my Bitcoin journey I believed that Nick Szabo was the father of Bitcoin. It was only once I realized I knew nothing I could research for truth. It wasn’t easy letting go of what I “knew”.

“In the beginner’s mind there are many possibilities, in the expert’s mind there are few.”

-Shunryu Suzuki

Most self identified crypto traders are stuck in their Szabo/Lightning/altcoin phase. They stop learning. They dig in. They identify with a camp and relentlessly attack anyone who disagrees. It’s primal tribalism via the Internet broadcast on Twitter 24/7.

If you aren’t with us, you’re against us.

The majority of Crypto investors are disconnected from reality. Scaling matters. Economics matter. Business matters. Law matters. Governments matter. The Bitcoin Whitepaper matters. This is signal.

Twitter polls don’t matter. This is noise.

In the past year I’ve learned more about Bitcoin than I had in the previous five years. It is crucial that you filter noise. If you can’t filter noise then you’ll start believing noise IS signal. You’ll stop learning just like Tone Vays. You’ll fall behind. You’ll get rekt.

What you know can be dangerous if it keeps you from learning. I’m not ashamed that I had it wrong regarding Szabo. I hadn’t learned to filter noise. What’s shameful is to shut down your brain and live for attacking people that disagree with your view. Seek and value truth above all else, including your ego.

The noise will eventually fade in crypto and only signal will be left. That signal is BSV.

What I consider to be truth now may change in the future. That’s OK. It’s called learning.

I will endeavor to have my future content focus on signal.

Comments »