There is nothing quite like opening up the brokerage account window on your computer to see one of your positions down over 5%. The frantic keystrokes in the Firefox search window, banging out the characters: “earnings calendar” only to see that I did not obtain erroneous information…**whew**.

So what the hell happened to CLMT?

Evidently the company is wont to dilute the supply of their stock (via offering more shares) to buy more things. I cannot say that I blame them…though as a shareholder, in this merely for a trade (not an investment), I find their tactics to be a bit unsavory this hideous “spring” morning.

As I mentioned last night, I have been motivated to buy more shares by what I am seeing in a number of stocks.

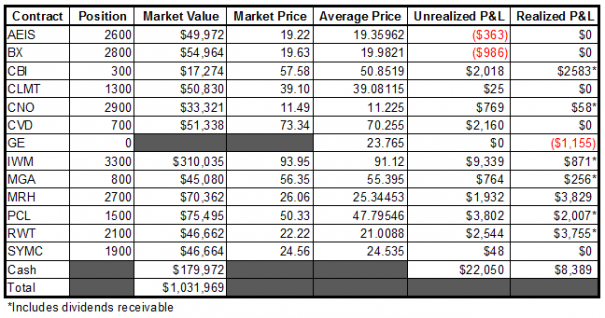

In this vein, I added to BX late in the day, and really really wanted to pull the trigger on a double of my CNO position, but decided to set free my languishing GE position instead. I still like the intermediate to long term prospects of GE and will certainly keep it on watch, but there is just too much sideways churning (with nothing to show for it) at this point to warrant a 5% asset allocation.

So where do we stand? I believe that the market is currently correcting through time, allowing many individual names to set up (this is the action that I am seeing in a lot of “leading” stocks). I do not think that we see a swift move lower from here. If we do get a big move to the downside, the scenario I see transpiring is the following: there will be a breakout which lures a bunch of people into the market as it makes new highs, only to have those late-comers summoned to the city square for swift penis removal.

I am positioned in advance of this move and will look to take profits on any substantial move higher in my stocks.