In Friday’s update, I spoke of being timid in the face of deploying cash into new positions.

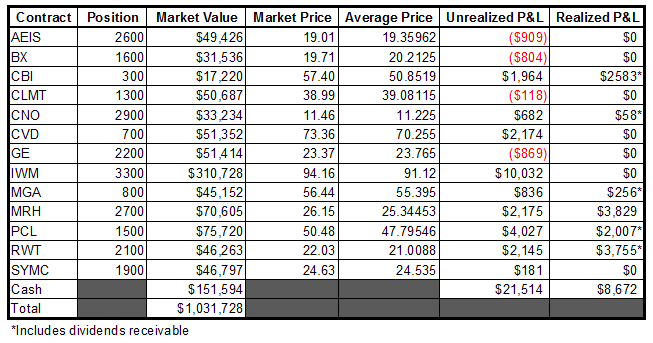

Hours (if not minutes) later, I changed my mind and started adding to my AEIS and CLMT positions. Both of those companies were originally breakout buys, but in this market, I feel like any retreat to the 20 day is screaming “BUY ME NOW”, so I obliged, effectively doubling my stake in both names.

After scaling profits in RWT a couple of weeks ago, I mentioned that I was looking to buy back if there was a pullback that interested me…well, that opportunity came on Friday afternoon. My purchase in the stock brings my position to slightly greater than it originally was, but this time (obviously) with a decent buffer of profits already in my satchel. I’m looking for much higher prices from here and an opportunity to repeat the process.

Lastly, I decided to start a position in SYMC. I thought about buying on the break above 23 a few weeks ago, but felt like it was already getting extended and decided to hold off for a better setup. Well, after two weeks of sideways trading, I figured “now this is a better setup” and pulled the trigger on a starter.

This is another of these “thin air” trades that I have been making recently. With a push above 25, there is very little in the way of resistance all the way to all-time highs (made in 2004) around 34. I will become much more skeptical about this position on a break below the 20 day. Keep your risk low and your profit potential high.

If this Costanza rally off of the cordial news out of Cyprus continues (and at this hour, it appears to be fading), with my cash levels now below 15%, I am looking at pushing back through all-time highs.

-EM