Greetings to my tens of readers, we have reached an interesting point in matters regarding the stock exchange. I was waiting for many of the stocks I am interested in buying to “pull back” or “consolidate”. I am seeing evidence of this happening in a number of different names that I hold in high regard.

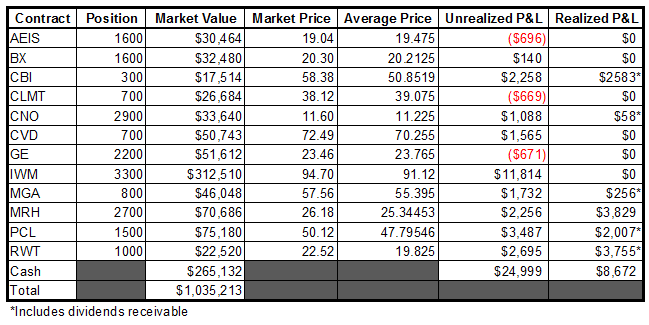

Throughout this year I have been patiently picking my spots, chipping away with modest, but steady gains. Now I find myself in the opportune position of having 25% cash and several interesting places to invest said cash.

Granted, I would not be at all surprised if I get sucked into being 100% invested here and have things turn south on me…quickly. Since 2009, I have often found that the best “looking” opportunities often turn to dust (and worse) when I try to execute them with real money. Therefore, yes, I am a little eery here about going for it…but fortune favors the bold, no?

It’s been a while, so why not provide some notes on my positions?

AEIS has retreated to the 20 day. Since this rally has started, the 20 day has acted as support for pretty much everything in an “uptrend”. If we are to continue higher, I would be remiss if I neglected this opportunity to add here. I will be watching this one very quietly…waiting to pounce.

BX is another that has come in a bit and has been found nuzzling up to the 9 day EMA as support since Monday. I’m tempted here, but I’m also aware that the 20 day is about 80 cents lower from here, so since I already have a position that is treading water here I might as well wait and see what transpires before allocating additional funds.

I gave you CBI as a gift in the high 40’s. I’m still kicking myself for not reloading after earnings. Big winner.

I thought I was given a premium buying opportunity in CLMT when I bought shares last week…now it has (like AEIS) retreated to just below the 20 day. What concerns me is the moving average now appears to be acting as resistance more than support. I am interested in adding to the position here, but I do want to see how it handles the aforementioned resistance before making any decisions.

CNO is “basing”. I’m not a huge fan on trading breakouts, but if that is your thing, a strong move over 11.7 could see this one really start to fly. I am seeing a volume void on this one up to 17.5, so there is room to run once it breaks free.

CVD has been busy “honey badgering” this week after breaking above the recent 6 week base. I’m seeing a volume void into the low 80’s and will be looking to add on a pullback.

The GE daily chart looks like shit. Lots of gaps that have been faded, resulting in black candles…which is really unappealing to my delicate ocular sensibilities. Due to the relatively low beta of this stock, the starter that I bought constitutes about 5% of my assets, if this nonsense continues I’ll be looking to free up some cashola via selling some or all of this laggard.

IWM is an incredible place to put a percentage of your portfolio when things are going good.

I gave you some analysis on MGA back in late January in the low 50’s. It broke higher yesterday and has a date with an all-time high at 62.20 in the coming weeks.

MRH recorded the highest close since September…2005 yesterday. This is a MASSIVE volume void people. Yes, I know this stock seems boring, but there is little in the way of resistance until 29. There is also a huge gap from 2005 between 28 and 30. Runner potential here.

PCL closed over 50 for the first time since 2008. I still like this one for the dividend and the opportunity to get back to an all-time high around 56.

RWT has retreated. I have sizable realized gains in the name, and as I have mentioned in the past, I am looking to add shares when an opportunity arises. This one is on Defcon 3 watch, though I also wouldn’t be surprised if this was the start of a lengthier base. Still lots of clean air above in the volume void.

-EM

One Response to “Portfolio 03/20/13”

Sooz

‘tens of readers’..said the humble man.

very glad to be one of tens.