Greetings people of the interwebs. My “work-night-earlier bed time” routine is helping my well-being, but is killing me here with generating content (after 10 PM is the only uninterrupted time I have in my day to sit down and write, so that sucks).

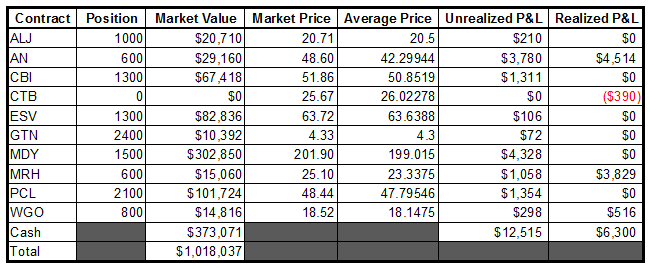

On to the portfolio (which reached new highs on Friday…yeah yeah, I know, along with everyone else):

- On Friday, I opened positions in ALJ and GTN. I had been watching ALJ for a while and was waiting to see how things sorted out following the most recent surge to new 52 week highs. The stock sold off pretty violently last Tuesday (down over 4% intraday), but then rallied to close the day almost break even. That told me all I needed to know about this stock and I was looking forward to an opportunity to purchase some shares. Obviously that opportunity came on Friday.

- GTN is more of a lotto ticket than anything…the stock seems overextended and has put in a few volatile sessions recently, but it has also entered the void where overextended can lead to diabolically overextended in short order. Using an ATR position sizing strategy with this one has put me in a small position with an enormously large buffer between the current price and my ‘stop’.

- AN continues to calmly sort itself out right below all-time highs. As long as the stock continues to trade in this post-earnings range, I will remain bullish and will be looking to add shares on a ‘meaningful’ break of 49. What this means is I want to see the stock close over 49.

- CBI acted quite ungentlemanly on Friday, but then again with “Chicago” in the title of the company, I guess unsavory behavior is probably to be expected. No offense to my good readers in Chicagoland, but your city appears to be devolving…quickly. Earnings for CBI are one week from today, Monday, 2/18. As you know I will be liquidating most of this position prior.

- Similar to ALJ (except that I had already started a position, and they are both energy stocks) I added to ESV on strength on Friday. My initial purchase was on the breakout…which didn’t stick. So I waited and really liked what I saw on the pullback, then I didn’t, then I did, then I decided to buy more. Earnings for this company are also on Monday, 2/18.

- MRH reacted well post earnings, but my rules state that I am not to hold a large position into earnings…so even if MRH had gotten killed I would have been “winning even when it appears I was losing very badly”. With my strategy, there is absolutely no edge nor benefit to holding a full position (even relatively) through earnings. Unless you really have a significant edge with earnings plays, I believe that the wins and losses will usually balance with the real loss taking place in one’s psyche and well-being. I don’t need to deal with that noise, so I’ll sit back with some popped corns and comfortably watch the fireworks with a greatly reduced position.

- PCL is my second largest position, and it making me a little nervous. Any significant breakdown out of this current range will be a huge red flag and will lead me to unload at least a portion of my position. We are well into the void, so I’m interested to see what happens here.

- In the past, I would gravitate toward the kind of bottoming pattern that WGO made last week…so I really shouldn’t be too concerned about this stock. The lines are drawn, if it breaks below 18 (and looks like it will close there), I am going to liquidate everything. If not, my perspective on this stock has changed slightly from pessimistic to looking for a break to new 52 week highs. The risk reward is clearly in my favor, and I should be adding to this position, but what I end up doing has yet to be seen.

-EM

Comments are closed.