Since my promotion at the turn of the year, I have treated this opportunity as one grande experiment. A chance to share my thoughts, practically unfiltered with a sizable audience.

Naturally the focus of my material would need to be geared toward the stock market, but I felt like most blogs that talk about stocks are kind of derivative and mundane. During the Great iBC Election of 2012, I had a bunch of ideas darting around in my head for what I wanted to do with my blog should I be elected (those plans were unfortunately put on ice for a few weeks).

I knew that I wanted to run a model portfolio with complete transparency. I don’t give a rat’s behind if it is egregiously self-indulgent, I can’t tell you how valuable the experience has been. Yes, the market is going up every single day and any mammal with a pulse can make money, so my paltry return is nothing to write home about.

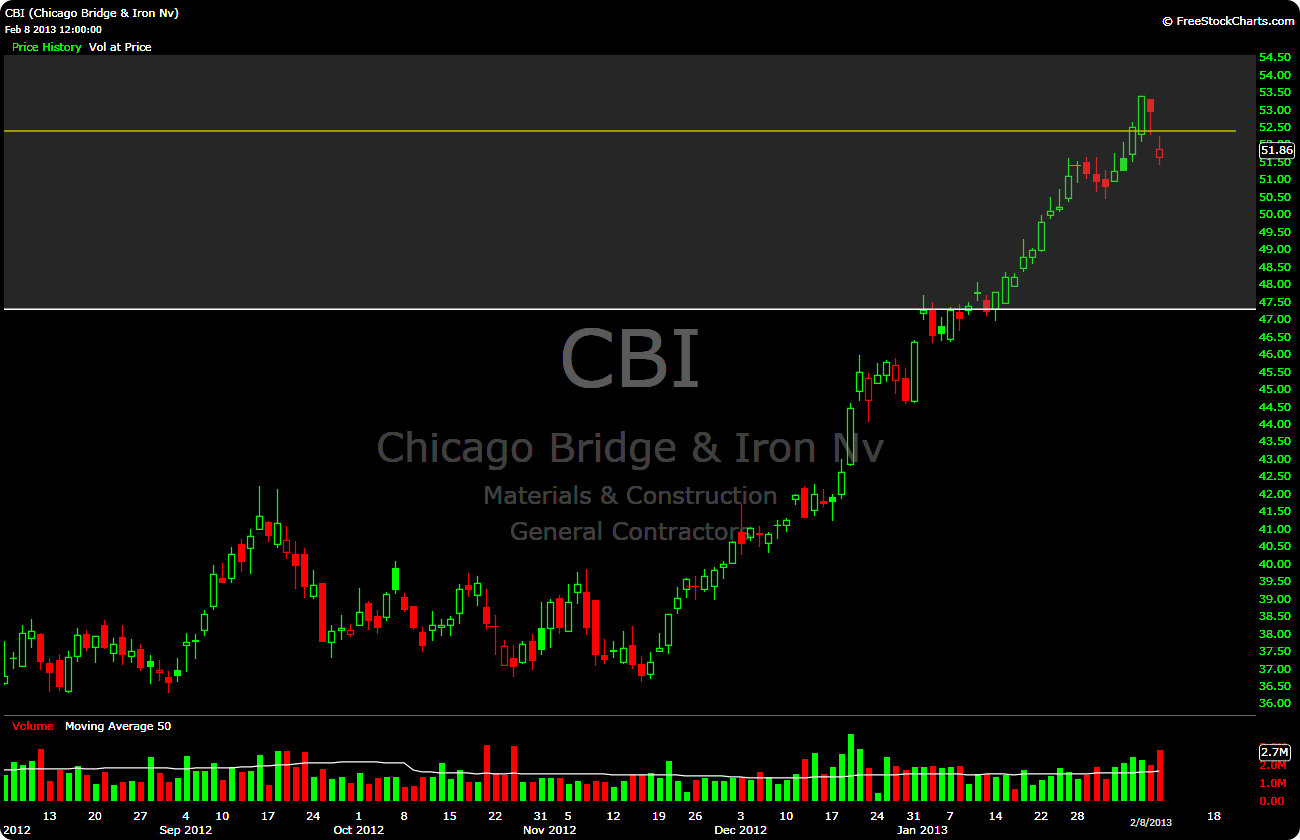

NEVERTHELESS, the experience of sitting down and making sure I have all of my “ducks in a row” prior to and during a the course of a trade is very empowering. Even when these stocks behave like jackasses (see: CBI, Friday 2/8) I’m completely in control of the trade(s). I’d rather be grinding out slow-but-steady gains and feeling in control than hitting a few home runs and just flying all over the damn map (see: 2012, all).

The whole volume pocket, watchlist, “Top 10” list thing has been completely organic. I had never even used “Price by Volume” on my charts prior to mid-December, but once I started delving, I knew that this was something I wanted to explore.

No matter what those godforsaken (!!) Google statistics say, this blog has provided me with an incredible venue to explore my thoughts and document my behavior/performance. As always, I appreciate your readership and contributions…thanks for giving me a few minutes of your day, I really do appreciate that.

I realize that these Top 10 lists probably seem a bit esoteric, but I promise you, the process is really quite simple. What we are measuring here is the price of a stock as it relates to various “locales” within a volume pocket.

If you recall, I mentioned the other day how I am interested in trading 70% of the pocket (thus placing a 15% buffer on the top and bottom of the pocket). I take that 70% and divide it into 4 equal segments. These are the “watch prices”. The stocks in my watchlist are sorted (i.e., ranked) by the percentage difference between the close and watch price.

Again, nothing groundbreaking here.

Our goal here is to monitor these stocks as they enter these areas of historically low volume, and to profit from the hypothesized supply/demand imbalance. Through repeated exposure to the same stocks on this list, we can form a heightened understanding of how they behave. When the time comes to trade the stock, we can be prepared.

This IS the “tall grass” of the stock trading world. I may wait years for some of these stocks to enter the volume pocket(s) I have identified, but when they do, I will be waiting.

One final note, I am only going to post daily charts on these updates from now on. Weekly charts will be kept up-to-date (no more than 1 week old) in the deep south of the interwebs: chartpin.

Okokok, enough words, on with the list:

(Ticker, watch price)

10. DEPO, 7.00

9. MDP, 38.10

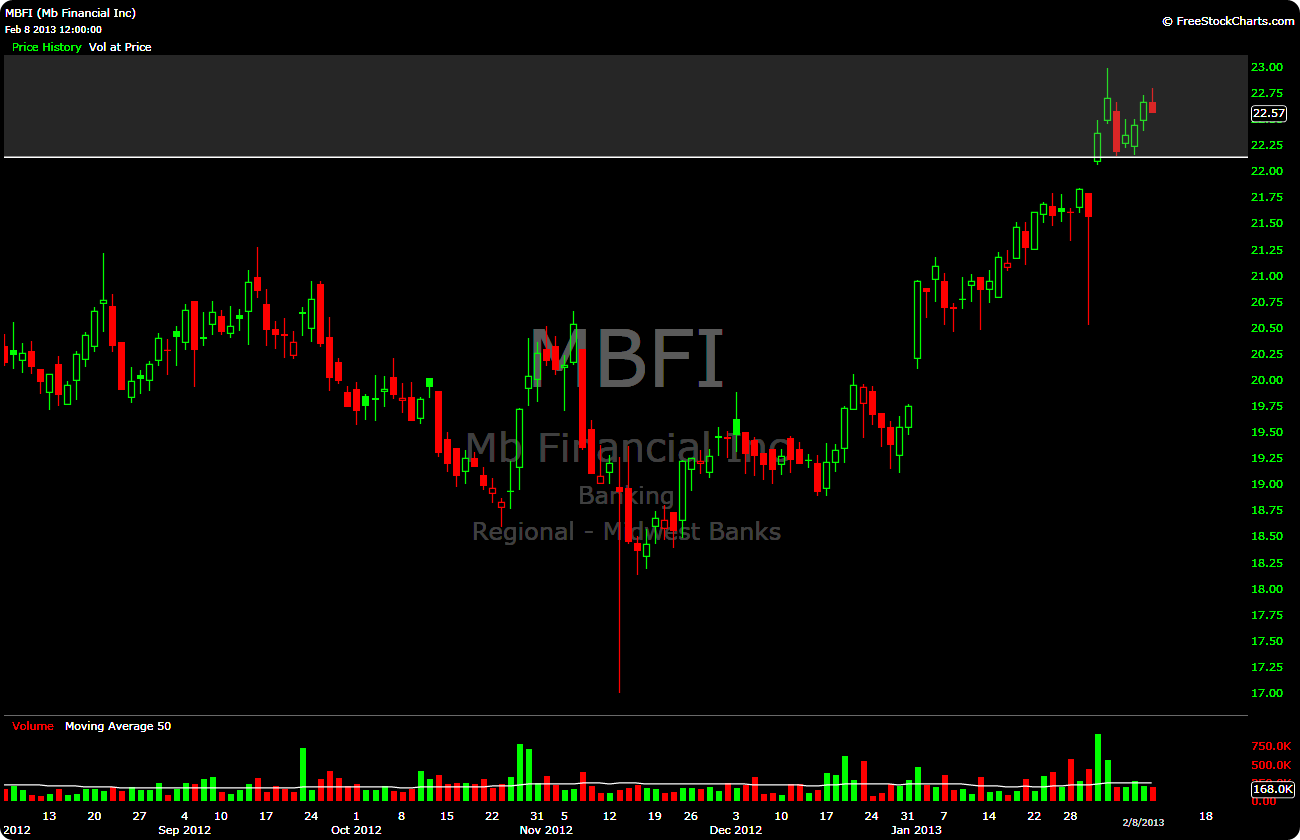

8. MBFI, 23.40

7. GDOT, 14.80

6. ALJ, 21.20

5. MGA, 54.20

4. CBI, 52.40

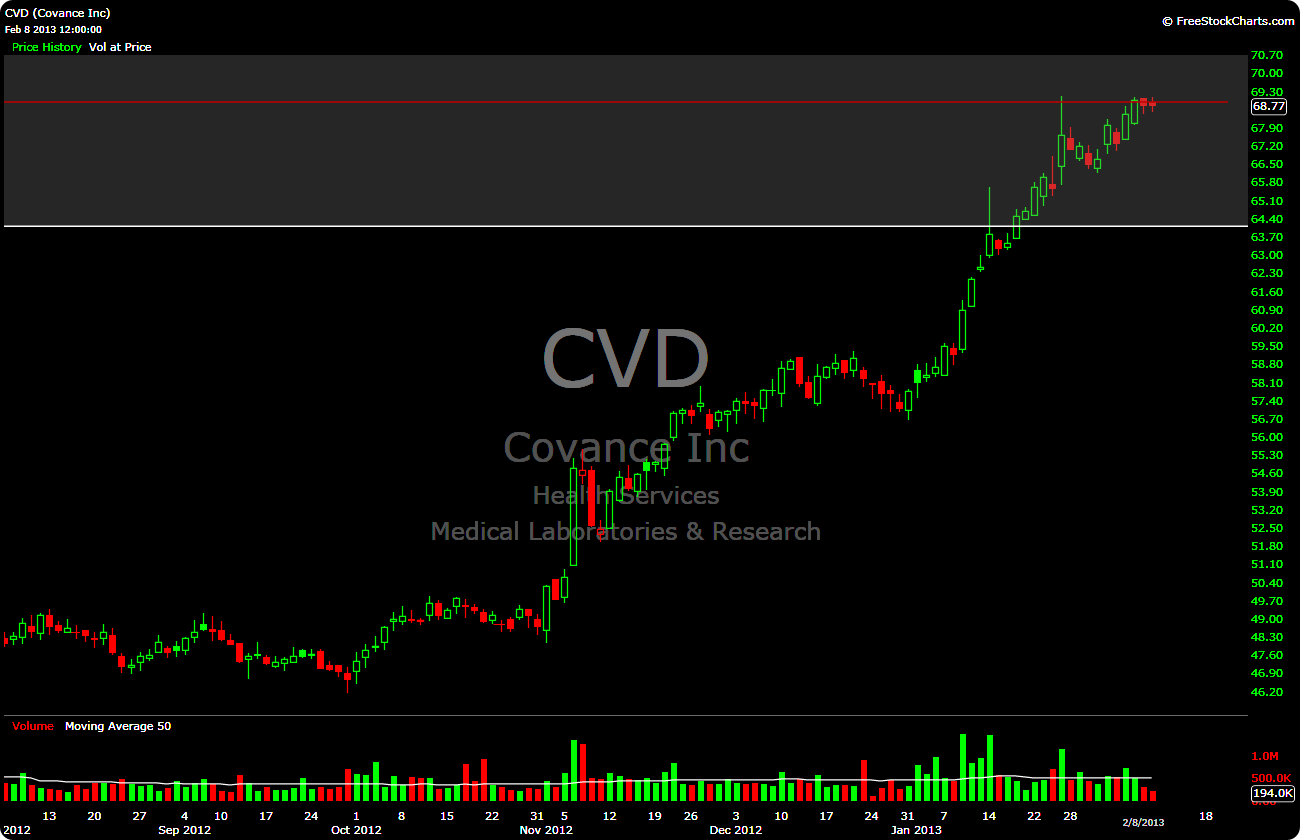

3. CVD, 68.90

2. RWT, 19.40

1. GTN, 4.10

-EM

2 Responses to “Weekly Top 10”

Marc David

I think everybody who spends the time to make a good blog post (best effort) deserves some comment from somebody. Just saying.

elizamae

Thanks Marc.