A few quick notes this morning:

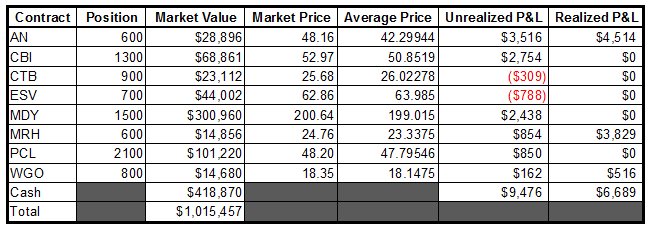

- I would not be at all surprised to see AN trade in the range between 47 and 49 for an extended period of time. This stock has had a monster run since late December and is stalling right at previous highs. I have a small position here that is sitting on a nice profit, so I don’t have a problem waiting for this to sort itself out before making any additional decisions. Now, having said that, I would likely cash out my winnings if the stock failed to hold 47. There are better and higher probability places for my cash at that point. This stock reached my “target” so it’s all gravy at this point anyway.

- I should learn that the Stock Market Gods do not appreciate when I boast about my research being sound and leading to a profitable trade. Without fail, every single time I mention a stock, and how well it is doing based on the information I was able to gather, in short order, it inevitably gets ripped. Lo and BEHOLD, CBI was slashed by over a buck at certain points yesterday, causing pressure to build behind my tired eyes. It did close strong, so that was an encouraging sign.

- Maybe if I stop talking about CTB, it will do something; therefore consider this my last mention of this stock until it breaks above 27 or I sell out.

- ESV is the story of a stock that looked like an excellent buy 3 days ago, to looking like dog dung after Wednesday, only to setup what appears to be an even more favorable buying opportunity yesterday. I really like where this one is, and as long as it is not knifing lower (see Wednesday’s trade for a good example) I will be looking to add shares, perhaps as early as this morning. I like the support from the 20 day MA…I will use that as my guide as I monitor the stock.

- Owning MDY is why I enjoy having a significant exposure to broad market indicies (via ETF’s) in my portfolio. It gives me a chance to roll with the tide, so to speak. My relative strength algorithm puts me into the index that is performing the best (typically…January was certainly an outlier). Right now mid cap stocks continue to slightly outperform small caps (both of which are bullish signs, IMO).

- Turns out that I “fat fingered” my sale of MRH late in the day yesterday, selling 81.25% of my stake instead of the intended 75%. Nice work there slick. I sold at 24.81 from 23.34, thus locking in a modest gain of 6.2%. Even though the percentage gain was minor, since the stock lacks volatility, my position sizing methods put me into a pretty sizable stake (dollar-wise). Nevertheless, there are few feelings that approach the level of satisfaction as taking a nice profit on a well-reasoned trade.

- I do not like how PCL behaved yesterday. My antennae are now up and I will be monitoring this stock to see how it deals with trading around 48.

- I’m waiting for a pop in WGO to unload some (if not all) of my shares. This is formerly one of my favorite picks, but there is no doubt that 20 is providing some pretty significant resistance. You have to love when a stock respects those nice round numbers.

-EM

Comments are closed.