I would like to speak about the “watch level” prices that I highlight, previously in my watchlist updates and now in the “Top 10” posts that I have been producing in recent weeks.

When I first started on my analysis of volume pockets, one thing that really intrigued me was the ability to gauge the size of a potential move. In an ideal world, if everything breaks as planned, then a price target can be set at the top of the volume void. With the extremes of the volume pocket as our guide we can safely approximate the boundaries of the range in which we want to trade, thus we now have a baseline (bottom of the void) and a target (top of the void).

After years of reading, observation and experience I have come to find that the “easy money” (relative term) is made in the middle of a lengthy bull (or bear…but on a much shorter time frame) move. In other words, your probability for winning improves dramatically when you catch the ‘meat’ of a move versus trying call a top and/or a bottom.

Once the momentum is underway, my goal is to hitch on to that train and let it take me where it wants to go, which hopefully is in the direction I am speculating. I have my risk parameters in place, I know that the stock is already moving in the direction that I want it to move in and I have an edge based on the fact that a supply/demand imbalance exists in the form of a lack of historical volume.

Ok, so back to the idea of catching the bulk of the move and how that relates to my “watch prices”. I am interested in catching 70% of the move through the volume pocket. This means that I place a 15% buffer on the bottom of the volume pocket and a 15% buffer on the top of the pocket.

With the remaining 70% I set up my “watch prices”. Ideally, I want to build a position throughout the 70%, nibbling on bits here and there, having a full boat by the time we reach the top buffer level. I break down the 70% region into 4 equally spaced buy zones. This is what the “watch prices” signify. Keep in mind that this doesn’t automatically mean that I’m going to buy the stock once these prices are hit. In theory, one could do that and it probably would work just fine, but after using this method for a bit, I feel like I can control risk better through being more subjective with where I start a position and/or add shares.

The essence of this is (in theory) to build a position throughout the void.

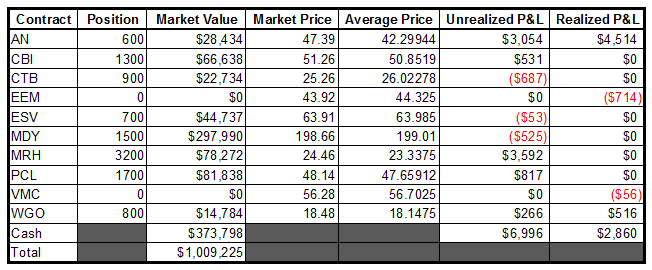

As for my holdings:

- AN has come in a bit since making an all-time high Friday on the gap higher. I’m looking for more consolidation here and will probably add shares at some point TBD.

- CBI has the look of a stock that wants to march higher but is being held back by a sluggish general market. With a broad market rally, I see this moving through 52.5 with ease.

- CTB looks to be slowly rolling over. This will likely be liquidated shortly.

- ESV is tightening up quite nicely. As I monitor these stocks I continue to come across stocks that have spent 1-2 days marching higher only to pull back and consolidate in a calm and orderly fashion. From a risk/reward standpoint, I feel like this is a better time to buy.

- MRH is another stock that continues to defy the selloff in the broad market. 24 has acted as support for 2 weeks now, I’m looking for this to break much higher. Unfortunately (for me trying to build a position), earnings are on Thursday after the close. Therefore similar to how I traded AN, I will be liquidating 75% of my position prior to that time.

- Yesterday I documented my desire to add more PCL based on how The PPT has handled the stock since the rally (in this name) started in November. I held off due to the cascading of the market into the close, but this does look like a good place to add a bit. Since I already bought a large chunk last week, if I do go through with it, the add will be small. Additionally, this stock typically goes ex-div the second or third week in February (and pays 0.42 quarterly), so we have that to look forward to.

- WGO appears to have hit a snag and is being closely monitored for liquidation. I do not at all like how it broke down yesterday.

-EM

3 Responses to “Portfolio 02/04/13; A Word about “Watch Prices””

Grinder

Hey Eliza, caught your readership post the other day and thought I would let you know that you’ve found another appreciative member.

Nice post above. The cool thing is how the basic ideas can apply to any type of trading timeframe, while serving as a good, conservative guide for beginning and intermediate traders.

I just joined the PPT so hopefully I’ll catch you in the forums if your blog doesn’t get a contract extension. Happy trading this week.

elizamae

Thanks for commenting and reading. Feel free to ask questions, I’ll be more than happy to oblige when I can.

With a name like “Grinder” my guess is that you are either a hockey player or a fan of sandwiches?

Grinder

Heh – no, former winning poker player turned trader. Not a big hockey person (do watch the Stanley & Olympics though), but do love sandwiches.

I’ve had decent success on my own but having the resources here is great, and should bring it up another notch. Poker helps with the money management/emotional side of the equation, which gives you a leg up getting into the markets.

That said, just having constant exposures to ideas like the above (even when they are familiar) is always a plus. As you well know, writing them out yourself help keeps the mind sharp.

Sorry for the ramble, back to the desk. Catch you soon.