This evening I had to manage an extended bout with a very fussy four month old (which may or may not have subsided), so I’m not feeling particularly enthused nor inspired (I apologize in advance) to write a lengthy narrative, so lets get right to my thoughts about this portfolio of stocks:

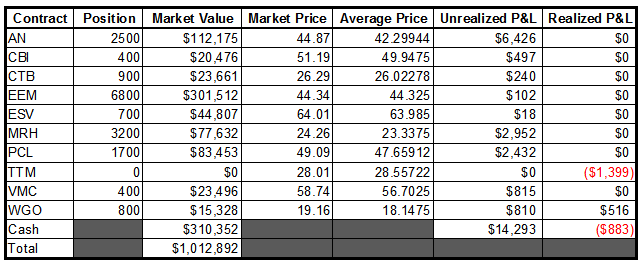

- The strength that AN continually shows late in the day is remarkable. No matter how bad things look, you can never count this stock out on a day-to-day basis. I can’t tell you how many times I will have written off the stock for the day only to be pleasantly surprised when I see what the closing print was. This is pure conjecture, but I think that strong closes are a bullish development. Nevertheless, I will be selling 75% of this position near the close tomorrow in preparation for earnings on Thursday (1/31) morning.

- CBI is a little overdue for a correction. I will welcome a retreat, seeing that I would like to add to this position.

- My leash with CTB has never been shorter. With each passing day I think: “there are probably much better places to put this capital”.

- It was nice of EEM to bring itself (barely) back above my cost…

- I started a new position in ESV late this afternoon, purchasing a 25% percent stake in this company and in the process giving my portfolio some energy exposure. The last time ESV printed in the 64’s was in September 2008. I may have been a little early with this one, but I have been watching this closely for a couple of weeks now and really like the looks of the break above the most recent range.

- The resistance that was present in MRH since late October at 24 now seems to have turned into support. This development has me feeling good about my position. Granted, this isn’t going to win any awards for “most exciting stock”…but I’m ok with that.

- I wanted to scale into PCL based on certain prices being met. Well, today that price was met; therefore I doubled my position. I am looking at it now, and I don’t really know what to make of that candle printed today. This has been a pretty easy trade so far, but I don’t like when stocks that were behaving predictably (even if that predictability was in the form of relentlessly moving higher) start to show signs of chaos (similar to what happened to TTM as week or so ago).

- I came very close to adding to VMC at the close today, but decided to hold off. My strategy will be simple: if it shows strength, I will most likely add.

- WGO is continues to confuse me. I still think it goes higher, but there is clearly some agreement on price between 19 and 20 (which is not what we want). This being my smallest position, I am not overly concerned at this point. That said, I will not hesitate to cut and run should I start to see signs of it breaking down.

All in all, one of my better days this year, mostly thanks to the portion of my portfolio that has been holding me back: EEM. I’m also down to 31% cashola.

-EM

Comments are closed.