Every single day, there goes EEM up to no good, trickling lower, continuously trying my patience.

The grande (sic) irony with this whole charade is that I developed this system which led me to pump 30% of my assets into this ETF as a way to help a percentage of my portfolio “keep pace” with the market as a whole. It provides me with a mindless chunk of broad market exposure (set it and forget it) while still allowing for the majority of my assets to be put to work via more speculative stock picking.

Well, needless to say, the month of January has been akin to a cruel joke.

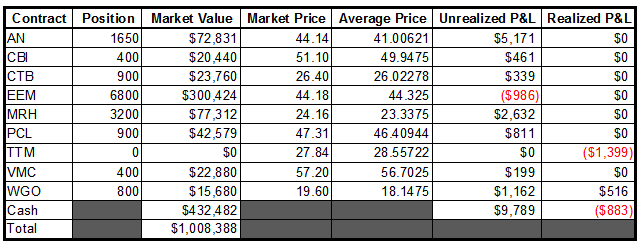

The percentage of assets that I have devoted to stock picking has done well enough, but I’m continuously being held back by this God forsaken EEM. I watch the top ranked ETF’s in my system (IWM and MDY) continuously march higher. I did not want to do the math, but I had to, and my results would look MUCH different had my 30% been placed in either of those two funds. Alas, it’s pointless to think about “what could have been”, and I eagerly await the start of February and I can rotate my money from this dog into an ETF that will immediately start drifting down/sideways throughout the month of February.

Not that I’m becoming cynical or anything…

Some portfolio notes:

- AN continues to consolidate. I would deem this recent price action to be “healthy” following a +15% run. I’m still very interested in adding on a break of this most recent range.

- CTB just has the feel of a stock that is going to break in one direction, trap everyone ( by going long/short on the break) then immediately reverse. In these patterns that consolidate for longer and longer (and gain more attention), it’s like the “smart money” waits for the “dumb money” to show their hand then they immediately put them in their place. Now I’m rambling.

- While waiting for MRH to erupt much like CBI and PCL, I noticed that it ran into a bit of a snag on Friday.

- Suffice it to say that PCL received it’s own bit of “comeuppance” on Friday as well.

- VMC continues to consolidate. Exhibiting patience in the face of a stock that was erupting higher on Tuesday (I had just started a position on Friday and didn’t feel comfortable adding one day after my initial buy in) was a positive development. As long as the range of prices remains subdued in this pullback, I’ll be looking to add.

- WGO has struggled with 20 on several occasions. My experience with this stock has been well documented…aside from my (albeit small) financial stake in this company, I’m genuinely interested to see what happens here around 20.

-EM

2 Responses to “Portfolio 01/25/13; Bellyache Edition”

Tpain

Look at the GE chart. I found it after reading Chess’ post. Beautiful volume pocket on the monthly from 23 to 35.

elizamae

You are correct, thanks for pointing that out. I have added it to my watchlist. There are potentially many more out there to discover, as I currently have only 588 stocks in my “database”.

Thanks again.