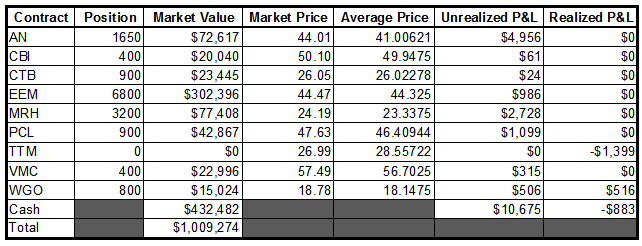

When I log into my brokerage account, I feel like the exact same events take place every day in the premarket. Like clockwork, EEM is down a few points and TTM is acting maniacally. So imagine my excitement this morning when my broker’s desktop client pops up with EEM moderately lower and TTM getting annihilated.

My basis in TTM was just above 28.5, so when I see it bouncing around nearly a dollar lower (on, at that point, no news), I start to become a bit agitated.

As a rule, I really really don’t like placing trades in amateur hour (9:30 – 10:30). Traditionally, even if a stock (like TTM) is sharply lower, I want to wait and see what happens versus immediately running for the exit.

That said, part of my “new leaf” here in 2013 is to not get attached to positions. If the stop price is hit, assess the situation, but don’t hesitate to sell and move on to the next trade.

In 2012, for the first time in my career I had a really difficult time adhering to this rule. What became clear to me was that the problem lied in my instrument of choice. I was using options…and the thought was “hell, they are almost to zero, I might as well hold on to them to see if they come back.”

Terrible decision. Wrong. It never happens. You always lose in that scenario.

I had myself positioned for incredible winship on at least 5 different occasions last year, and lost HORRIBLY every time because I became too greedy and would repeatedly oversize my positions to try and “get back”. Each time I would have recovered all of my losses AND MORE, but just continued to make the wrong call.

Finally, I came to realize that options were just too sophisticated an instrument for me to trade profitably.

Anyway, my labored point is this: TTM finished the day nearly a dollar lower than from where I sold out at 27.78…if I had hesitated, I would have come close to doubling my loss. The Price by Volume research that went into this trade was a bit substandard, so I plan on reviewing it in the coming days to see what happened.

More notes:

- Oh AN. I am buying more shares of this stock one way or another VERY soon. I’m still looking to get back to those highs. Earnings 1/31 (note to self).

- CTB bounced off of the 20 day again. Need to see this clear 26.75 with some oomph to consider adding shares. Hell, I have been **this** close to liquidating this thing on several occasions. It’s basically dead money at this point. Like a lot of what’s happening in a few of the stocks that I own.

- Speaking of deadbeat securities: EEM. February 1st can’t get here soon enough so I can roll this money over into IWM or MDY.

- Nice action in MRH today. Remember, this stock is at 5+ year highs with a lot of low volume nodes ahead. I don’t really see the logic in an insurer going parabolic, but if this stock catches some momentum, there is not much to stand in it’s way.

- PCL doesn’t doesn’t deviate much from it’s upward trajectory. I would imagine that this will correct through price or time in the near future.

- Nice to see that VMC may give me a chance to add some shares via not erupting directly to 65.

- I sold half of my WGO position late in the session. The pattern went from “looks great” to “taking too long to do something” pretty much overnight. I felt like today was the key day, and it just couldn’t get going at all. I still have my original 800 shares and will give them a little more breathing room to the downside before making any final decisions.

-EM