This evening I would like to take a moment to talk about position sizing.

When I mention transactions, usually I will make reference to it being an “X%” position. A “100% position”, means that at the current cost basis, my max pain risk point would be at a loss of 1% of total account equity. So if all of my 8 positions were full positions and they all knifed lower at the same time, I would stand to take roughly an 8% hit.

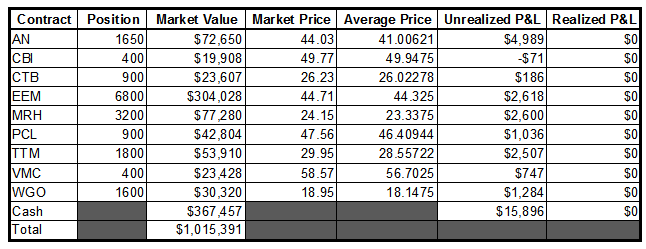

At present, none of my current holdings represent more than a 50% position (MRH, WGO); therefore my current risk is much lower than 8%.

How do I determine the size of a position you ask?

Simple, I use Woodshedder’s ATR system (part 1 part 2….do yourself a favor and reserve 30 minutes to go read and digest those).

I have tossed in a few of my own ingredients, but the basic recipe he presents is fantastic. The premise is to tailor your position size to the recent volatility in the stock (as measured by ATR, aka. Average True Range).

Using the formula from part 2 of Wood’s post, I use an ATR (5), ATR (25), and the 13 week simple moving average. Of those three, whatever is calculated to give me the “stop” farthest from the current price will be my “absolute last stop”. I then base my position size off of “the amount of money I’m willing to lose on the trade”.

In the sample portfolio I am running here, that amount is 0.25% of account equity (right now = $2538.48) (aka a “25% position).

Confused? Good. Go read Woodshedder’s posts…it will become clear(er).

Now, some thoughts on the portfolio:

- Aside from representatives from AN coming to my place of work and providing me with my own office again, the company could not be doing more to interest me right now. The only thing I’m overly concerned about is earnings on January 31. I will be reducing to a 25% position MAX prior to the event. If things continue to develop in this manner I’m tempted to add on the pullback here vs. waiting for the breakout.

- I was not going to let CBI get away from me, so I opened a 25% position earlier in the day…pretty much top-ticking the thing. Oh well, this one is well into the void and I wasn’t going to sit around and watch as it slithers higher without me. My stop is around 43, so I’m going to give it some room to sort itself out if it wants to pullback a bit.

- CTB continues to frustrate, and quite frankly, bore me, but I suppose the potential for a breakout increases every day it sits in this range.

- EEM is like a hemorrhoid right now. I see IWM and MDY marching higher regularly while EEM just wallows in the 44’s…it’s getting painful. Since this represents such a large part of my assets, the underperformance of this ETF in January has really been a drag on my portfolio. As time goes on, I am inclined to think that the poor showing by emerging markets in 2013 is a result of the ‘rotation’ that chess has been talking about, moreso than a red flag.

- MRH finally broke 24…I doubled my position just before the close today. Today’s close was the highest closing price for this stock since the week of October 7…2005! We are in the void ladies and gents…lets see what happens.

- PCL is unrelentingly moving higher.

- TTM was a real drag on performance today. I have expressed caution in this name since the chaotic behavior started last week. I came very close to liquidating half of my position this afternoon but decided to wait and see what happens should the stock test the 20 day around 29.35.

- VMC took off today and I missed it. I saw it going, hell, I even wrote a post about it, but it just kept going…and I was not going to chase (I bought CBI instead).

- WGO is going to blast off. In my manic pullback buying days, this was one of my absolute favorite looking formations (which, in 2012 meant that it’s probably going to meander lower and grind your account balance into dust…not that I have any experience with that sort of thing.)

-EM