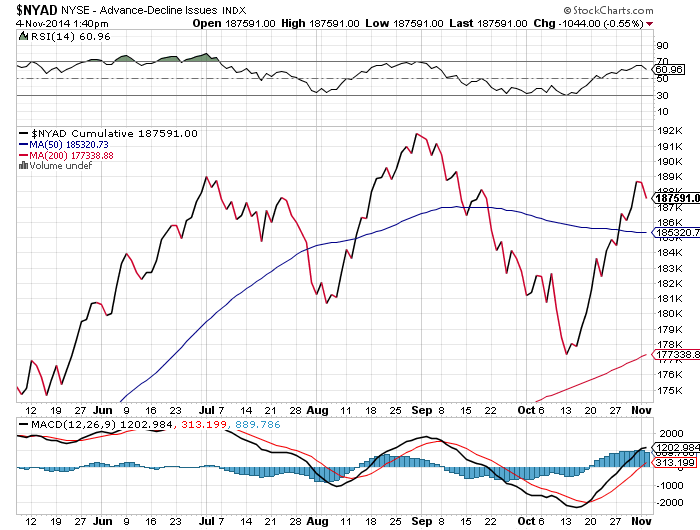

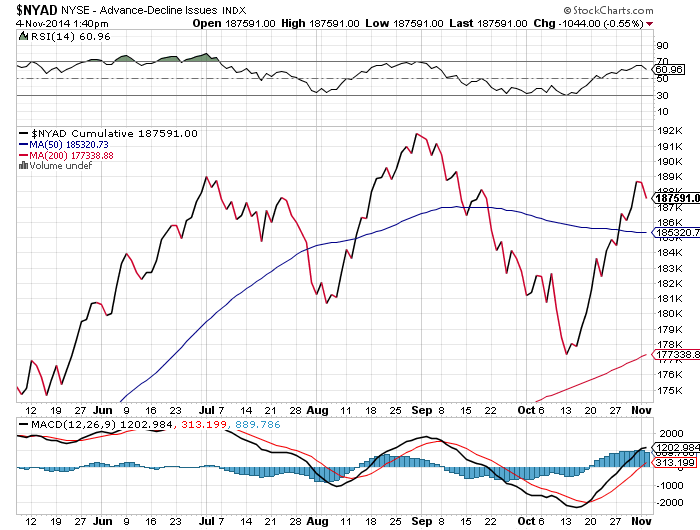

The New York Stock Exchange Advance / Decline Line, or NYAD, diverged from the Nasdaq and S&P 500 on those two indices’ recent push to fresh higher.

For reference, the NYAD captures the net difference between advancing and declining issues, or a type of breadth measure. It is usually compared to a major index, where a divergence from that average would be an early indication of a possible trend reversal.

As you can see, below, on the cumulative line, NYAD made a lower high of late. Also note the potential for a head and shoulders top formation.

While it’s true that bears need downside follow-through to confirm this divergences, as usual, it is also true that market participation has been weak underneath the surface.

In particular, the leading issues continue to lag–Usually a sign to adhere to caution.

_______________________________________________________________

Comments »