A few years ago, I took a trip out to Los Angeles and found myself sitting in the best poker game I have ever seen, to this day. I was playing $100/$200 limit Texas Hold ‘Em at the Commerce Casino. To a person, the table was full of players not just playing every single hand they were dealt, but raising and re-raising with them on every single betting round. Needless to say, they were playing very “loose,” and very aggressive. In a full game (9-10 players) of limit Texas Hold ’em, very few starting hands show a large enough profit over the long run to justify playing very many of them. You should be folding most of the hands that you are dealt before seeing the first three community cards. The correct strategy is to be “tight” by only playing the best starting hands (pocket aces, KK, QQ, JJ, TT, Ace King suited, etc.) yet also very aggressive when you are finally dealt them. Generally speaking, you want to be patient and then raise and re raise with big pairs, and big suited hands. Of course, you will play other hands, but only in select situations.

For the first few hours that I sat at the table, I felt like it was correct to fold every single hand that I was dealt. When the game you are sitting in is very aggressive, you should be playing even tighter than usual, as the variance–or volatility–of the size of the pots and your own price swings are exacerbated. Beyond that strategy, however, I was so-called “card dead,” as I was consistently looking down at hands like 2-8 off suit. Because of how loose all of the other players were, it made absolutely no sense to try to bluff them with my horrendous cards, since they would not be folding.

Naturally, the players around me were oblivious to my absence from participation, as they were either drunk or in some euphoric state of degenerate gambling nirvana. At the risk of stereotyping, in poker you want to sit at tables with women and men wearing flashy jewelry. You want to sit in games where people are boisterous, emotional and loud. If they are drinking alcohol and/or have been playing for hours or days on end, all the better. You want to play with people who are having fun gambling, without too much regard for the math involved.

About two and half hours into my playing session, I looked down at the Ace of spades and the Ace of clubs. I raised and got raised three more times to cap the betting action before we even saw the “flop” (first three community cards). No one folded. It was all nine of us in the pot for $3600 before the we even saw the flop! The flop came down 2-2-7, all of different suits. Understand that this one of, if not the, very best flops you can see when you are holding A-A in a wild game. I raised and re raised my hand until the betting action was capped. No one folded. The next card was a 6. I bet, a middle aged Asian gentleman raised me and, surprisingly, everyone else folded. I re raised, as I could beat many hands in this situation. However, he kept raising me back until I just called. The last card was a 3. There were no flush possibilities on the board. I bet, and he raised again. So, I just called. The Asian man turned over 4-5 for an unlikely straight, which he had caught perfectly on the fourth and fifth cards.

As he raked in the massive pot, he gave me a playful smile and screamed “maximum boom-boom!” in a thick Chinese accent, while pointing to my second-place pocket aces. He had been screaming that little phrase after each big pot he won. I said “nice hand, sir,” while my stomach did a few somersaults.

I took a break and walked away from the table for a minute to collect my thoughts. Should I leave the game? Well, I ran through a checklist of questions that I ask myself when considering whether to pick up my chips and leave.

How well was I playing?

I was playing very well, and I was not tired nor making emotional decisions.

How good was the game in terms of potential profitability?

It was a great game with loose and careless players playing very poorly despite their aggression.

Before I asked myself any other questions, I knew I had to return to the game, so long as I did not surpass my stop loss. I noticed several of the regular, winning players were on the waiting list and looking eager to get into the game. Indeed, it was a great game.

A few more hours went by, and I was losing about $2,700. Normally, if I lost my initial buy-in ($5,000), I would get up and leave, as a stop-loss. The casino would always be open, and I could come back the next day and start fresh. A few of the crazy players were getting lucky, including Mr. Maximum Boom-Boom, and many of them were simply passing their money back and forth to each other with each crazy hand.

I wish I could give you a rousing finale to the story. But, there wasn’t. I got dealt a few more quality starting hands and lost the hands, along with my buy-in. I could have easily bought back into the game for another $5,000, but I knew I would be digging myself a deeper hole in the face of a wild game, with wild swings. So, I stood up and I left the game. The next few days on my trip I gradually won back the money I had lost. The games were tougher and not as juicy, so it was a slow grind trying to win. It truly was an elevator down, stairs back up type of situation.

Despite the fact that I knew I was playing my cards in a way that was profitable over the long term, that night I had to respect the fact that short term luck can have a surprisingly heavy influence on any one poker game.

As much as I wanted to take the otherwise pleasant and funny Asian man’s money, to let my ego get involved would likely have been a costly mistake given the short term luck he was having, compared to mine. It also occurred to me how ironic his little catch phrase was, as without any kind of stop-loss, you are destined to experience a maximum boom boom, in terms of your downside risk. Just as in the stock market, your poker losses can mount up very quickly.

Despite the money that I lost, walking away from that juicy, stellar game remains one of the best decisions that I have made and am proud of. Of course, I could have gone on winning streak and won tons of money that night. But, that misses the point.

As a serious stock trader, and a serious poker player, you are constantly trying to fight and minimize the luck that is involved, not embrace it. Luck is the ephemeral friend of amateurs. If you find yourself in exceptionally volatile situations, of course you can gamble it up all you want. But that’s not the risk/reward profile you should be looking for as a serious trader.

———————————————————————————-

In the current stock market in which we reside, many traders are disrespecting the short term luck involved. Perhaps buying falling knives right now like $RIG, $BP and $APC will show a huge profit over the long run. However, what usually happens is traders try to precisely time an inflection point, only to lose a quick 20% and sell out of their positions. They sell out of both frustration of quickly losing money, and fear that their doomed stock will soon go to $0.

My point is that you always need to have an exit strategy in mind for any position that you take. Even if you do not place a specific stop loss, you should mentally have a price target in mind where you are explicitly prepared to admit that you are wrong and have made a mistake. Note that this applies to long term investors as well, even if they had previously averaged down in a position. At some point, you will be wrong. Limiting further downside risk is an ever present issue in the stock market, if you want to live to fight another day.

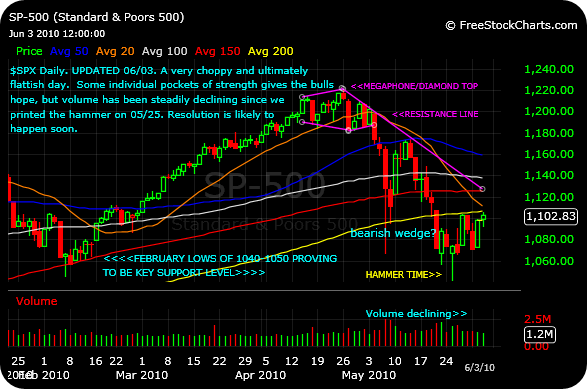

Take, for example, the bulls who bought last Thursday’s 3% rally. We have now closed below where we were before that day started. Are they going to admit they were wrong if we keep seeing more selling? Each and every rally attempt we are seeing is being met with distribution. I am going to respect that fact and, despite any oversold conditions, will sit in cash for now until I see a better environment to trade.

Comments »