I have had more money behind the short bond thesis since August 29th, inside the 12631 Trading Service and profiled in my Weekly Strategy Session, than at any point prior to that.

But the thesis continues to be the same; that rates on the 10-year put in a multi-decade low back in the summer 2012.

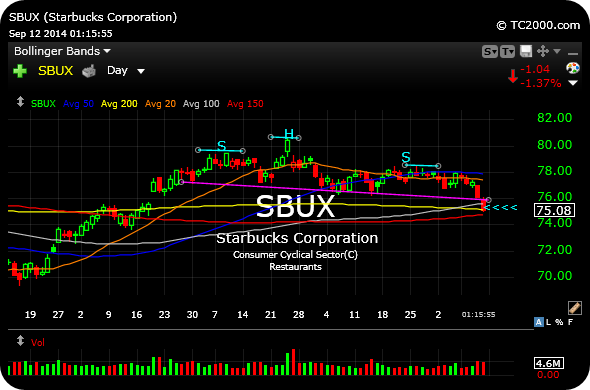

As evidence, consider the TNX weekly chart, below. The TNX is the CBOE 10-Year Treasury Yield Index.

Note the falling wedge pattern resolving higher this week, after several quarters of consolidation. I am playing for higher rates in the coming months, well over 3%–Perhaps up to 3.7%. A move back over $118.41 on TLT would negate my thesis.

Over the weekend, consider joining those services for more actionable, inter-market analysis.

In addition, I would be remiss not to implore you to consider attending the first annual iBankCoin Investors Conference in Las Vegas, Nevada, this November 8th. Although I will not be able to attend, you can be sure the keynote presentation given by The Option Addict, as well as two respected guest speakers, will be value-added to your process as a trader. Having met OA and his wife over the summer, I can assure you he is a true professional and a class act. Please click here for more details about attending.

Have a great weekend!

____________________________________________________________

Comments »