The Japanese Yen currency typically trades inversely to global risk assets, with the “carry trade” still perceived to be ubiquitous.

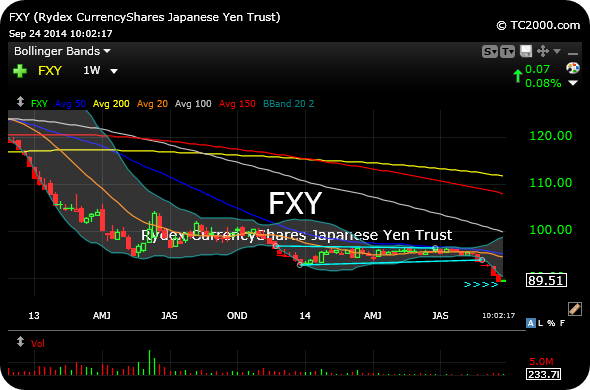

As you can see on the weekly chart for the Yen ETF, below, Abenomics has resulted in the persistently weak Yen for quite some time, not coincidentally with the S&P hitting one new all-time high after the next.

Still, the Yen is quite oversold on weekly and monthly timeframes. I am watching it for an upside reversal in the coming days, with the potential for a tradable rally. A move over $89.70 on this ETF would have my interest.

Elsewhere, the small caps weakness is out in full force this morning off what was an opening bounce.

What are you trading this morning?

________________________________________________________

Comments »