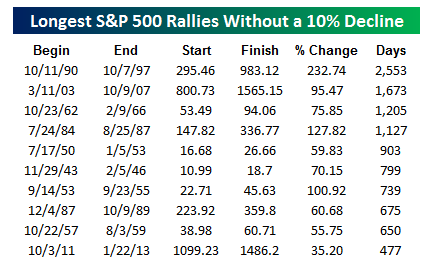

The above chart, courtesy of Ryan Detrick a while back on Stocktwits, puts the often-reference S&P 500 Index rally into historical context.

I often reference, in my video market recaps, the length of the current rally with no 10% correction. The current rally ranks about in the midpoint of the above-rallies.

If you enjoy the content at iBankCoin, please follow us on Twitter

SHORT EXEL. LOOK AT WHAT HAPPENED THIS WEEK. TICKING TIME BOMB

$2.00 TARGET $$$$$$$

These are the setups I wait VERY patiently for throughout the year. Pump job on “buyout rumor” on Tuesday followed by massive volume dump the following day. Unable to rally along with market now. Pinned to the mat. EXEL is headed much lower SHORT TERM. Very short @ $3.78

You’re welcome (in advance)

quit trolling

In 2007 when the market finally gave us that 10% pullback that everybody jumped on as a buying opportunity, it was a head fake. Market rallied back to old highs and on Halloween gave up the ghost…

Careful out there.

indeed. the successful bears don’t short the break….they short into the retrace.

interesting that all of those rallies end Aug/Sept/Oct or in Jan/Feb.

“Trolling”?? OK.

Kick yourself in two weeks or sooner. Charts are screaming here on EXEL. Path of least resistance is down. Short in a big way here.